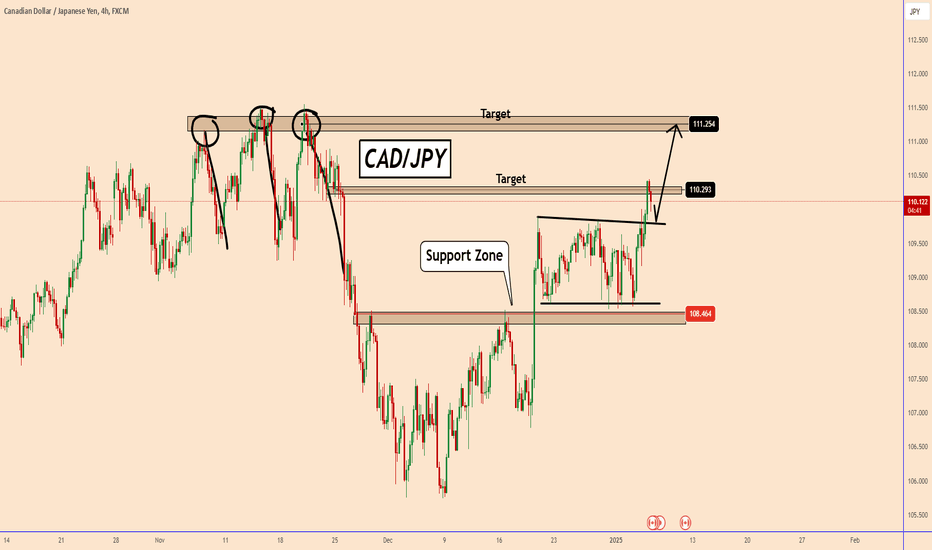

CADJPY Expected to Rise as BOJ Doesn't Support JPY

Yesterday, the Bank of Japan (BOJ) decided to keep the interest rate unchanged at its latest meeting, showing hesitation about future rate hikes. The market's initial reaction was to trade against the JPY, resulting in a devaluation of at least +200 pips across most of its pairs.

Japan's core inflation accelerated in November due to rising food and fuel costs, which is putting pressure on the central bank to raise interest rates. However, this is only speculation, and no decision has been made.

Given the BOJ's stance, CADJPY may rise further from the current zone.

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Yesterday, the Bank of Japan (BOJ) decided to keep the interest rate unchanged at its latest meeting, showing hesitation about future rate hikes. The market's initial reaction was to trade against the JPY, resulting in a devaluation of at least +200 pips across most of its pairs.

Japan's core inflation accelerated in November due to rising food and fuel costs, which is putting pressure on the central bank to raise interest rates. However, this is only speculation, and no decision has been made.

Given the BOJ's stance, CADJPY may rise further from the current zone.

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Trade active

CADJPY: Bullish pattern is Still Intact

From our previous analysis, CADJPY rose almost +60 points showing a slight upward momentum.

The current situation is not so clear in all JPY pairs. The BOJ said it was ready to raise rates and during the last meeting, they did not raise rates. However, their Finance Minister threatens to intervene in the Forex Market. The market seems to not react at all to their comments as they have lied several times and nothing happened.

The chances are that the price may continue to rise further during the coming days.

✅MY Free Signals

t.me/TradingPuzzles

✅Personal Telegram

t.me/KlejdiCuni

✅YouTube

youtube.com/@TradingPuzzles

✅MY Recommended Broker is TRADE NATION

🔸bit.ly/49VySJF

t.me/TradingPuzzles

✅Personal Telegram

t.me/KlejdiCuni

✅YouTube

youtube.com/@TradingPuzzles

✅MY Recommended Broker is TRADE NATION

🔸bit.ly/49VySJF

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅MY Free Signals

t.me/TradingPuzzles

✅Personal Telegram

t.me/KlejdiCuni

✅YouTube

youtube.com/@TradingPuzzles

✅MY Recommended Broker is TRADE NATION

🔸bit.ly/49VySJF

t.me/TradingPuzzles

✅Personal Telegram

t.me/KlejdiCuni

✅YouTube

youtube.com/@TradingPuzzles

✅MY Recommended Broker is TRADE NATION

🔸bit.ly/49VySJF

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.