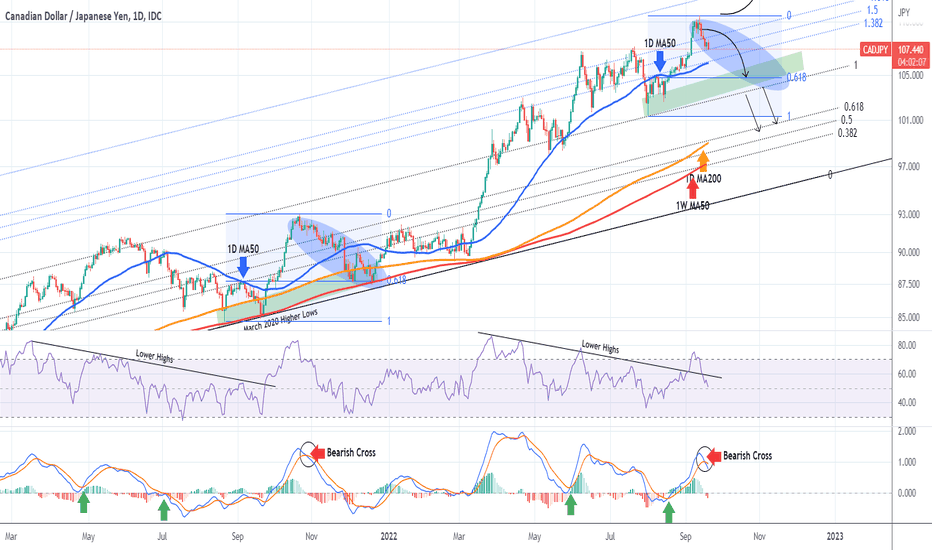

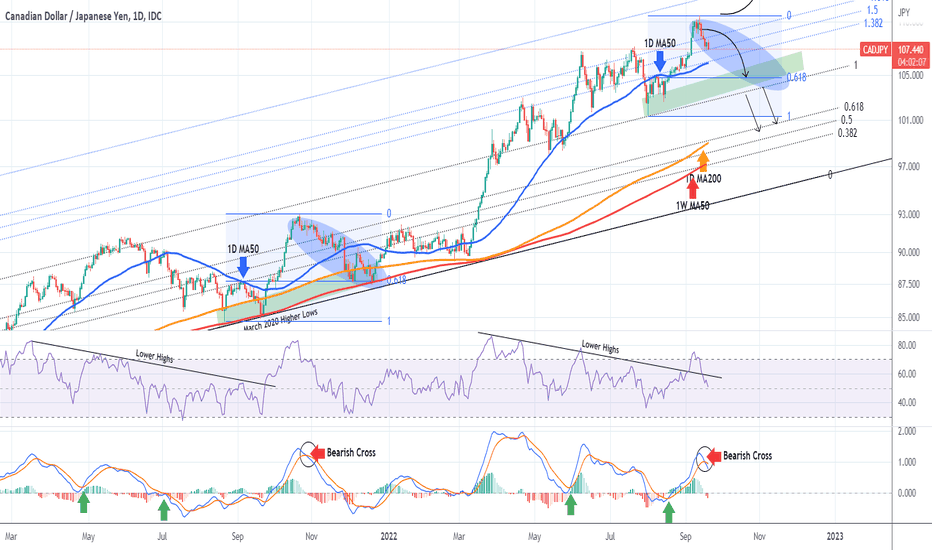

The CADJPY pair continues to follow our trading plan presented on September 20, as it repeats the fractal of late 2021 - early 2022:

As you see, the MACD Bearish Cross was the correct sell signal we needed and the price hit the 0.618 Fibonacci target and rebounded. Right now it appears that the price has entered a consolidation phase similar to the post January 20 MACD Bearish Cross. As long as the Green Support Zone holds, we should expect within a 5 week horizon a break above the September High, targeting the 2.0 Fibonacci extension.

A break below the Zone though, shouldn't stop on the 1D MA200 (orange trend-line) but instead target the 1W MA50 (red trend-line) for the first time since December 20 2021. An additional bullish confirmation would be a break of the RSI above its own Lower Highs trend-line, which in more than a year has delivered very strong and rapid rallies.

-------------------------------------------------------------------------------

** Please LIKE 👍, SUBSCRIBE ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support me, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

You may also TELL ME 🙋♀️🙋♂️ in the comments section which symbol you want me to analyze next and on which time-frame. The one with the most posts will be published tomorrow! 👏🎁

-------------------------------------------------------------------------------

👇 👇 👇 👇 👇 👇

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

As you see, the MACD Bearish Cross was the correct sell signal we needed and the price hit the 0.618 Fibonacci target and rebounded. Right now it appears that the price has entered a consolidation phase similar to the post January 20 MACD Bearish Cross. As long as the Green Support Zone holds, we should expect within a 5 week horizon a break above the September High, targeting the 2.0 Fibonacci extension.

A break below the Zone though, shouldn't stop on the 1D MA200 (orange trend-line) but instead target the 1W MA50 (red trend-line) for the first time since December 20 2021. An additional bullish confirmation would be a break of the RSI above its own Lower Highs trend-line, which in more than a year has delivered very strong and rapid rallies.

-------------------------------------------------------------------------------

** Please LIKE 👍, SUBSCRIBE ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support me, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

You may also TELL ME 🙋♀️🙋♂️ in the comments section which symbol you want me to analyze next and on which time-frame. The one with the most posts will be published tomorrow! 👏🎁

-------------------------------------------------------------------------------

👇 👇 👇 👇 👇 👇

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.