Hello awesome traders! I hope you're having a great trading week so far. This week is a bit shorter due to the U.S. Independence Day — with partial closures Thursday and a full close on Friday. But as always, we keep doing what we do best: identifying high-probability patterns, managing our risk, and pulling pips out of the market.

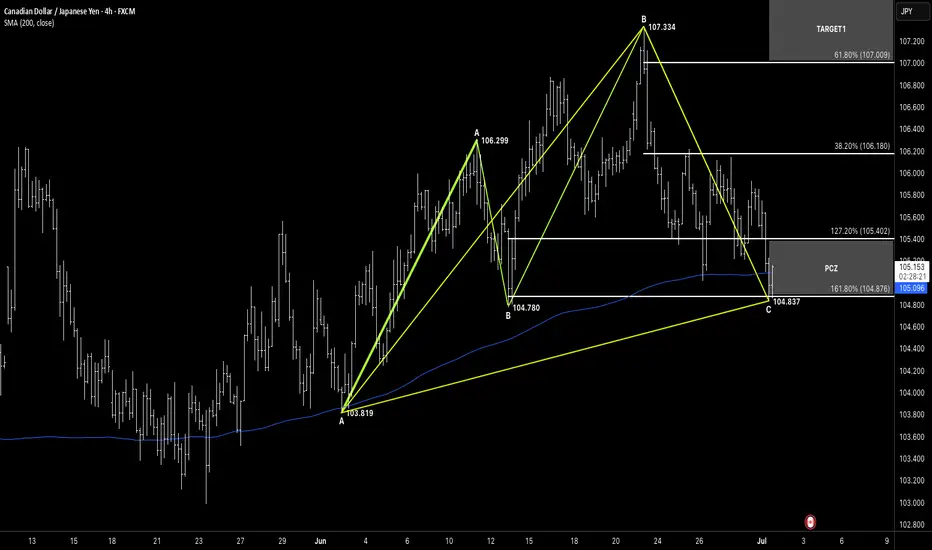

Let’s break down this solid technical opportunity shaping up on CADJPY (4H) – presenting a bullish ABC structure into PCZ with clean symmetry and mapped targets.

Pattern Overview:

Pattern Type: ABC Bullish

Asset: CADJPY

Timeframe: 4H

Trade Type: Long – Bullish impulse expected from confirmed completion at PCZ

Key Levels:

A Point: 103.819 – Major swing low off the 200 EMA

B Point: 107.334 – Recent swing high, strong resistance reversal

C Point: 104.837 – Completion zone aligning with fib extension confluence

Entry Level (EL): 105.100–105.200 – Price now entering PCZ with reversal structure

Stop Level (ST): Below 104.780 – Invalidation if structure fails

Target 1 Zone: 107.000–107.600 – Key retracement and 78.6% cluster

PCZ (Potential Completion Zone): 127.2–161.8% BC extension @ 105.402–104.876

Fibonacci Extensions & Key Ratios:

BC 127.2%: 105.402 – First PRZ alert

BC 161.8%: 104.876 – Extended completion zone

AB=CD (Symmetry): Confirmed with nearly equal projection

38.2%–78.6% Retracement: 106.180–107.600 – Major resistance for profit-taking

Price Action & Setup:

Strong downside correction from B (107.334) to C (104.837) completed with confluence at PCZ.

Price is reacting near the 200 EMA and forming a minor reversal wick.

ABCD symmetry leg confirms with C leg near equal length projection from A–B.

If bullish momentum confirms, a move back toward the retracement zones is expected.

Market Sentiment:

Market testing the PCZ zone with wicks forming — early buyers showing presence.

200 EMA support coincides with D-leg completion, a common bounce area in structure trades.

No major USD flows this week due to holiday impact — JPY and CAD flows dominate.

Next Potential Movement:

Reversal confirmation from PCZ could send price up into:

Target 1: 107.000 (61.8% retracement of BC)

Target 2: 107.600 (78.6% extension and previous structure resistance)

Invalidation below 104.780 (break of C low)

Risk Management:

Entry: 105.100–105.200 on confirmation signal (bullish engulfing / hammer / breakout)

Stop Loss: Below 104.780 (below structure + fib invalidation)

Targets: 107.000 and 107.600

Risk Profile: Tight invalidation, high reward-to-risk structure

Conclusion:

CADJPY is offering a clean ABC Bullish structure, completing right at the fib confluence and 200 EMA zone.

With a solid base at the PCZ and mapped target levels ahead, this setup aligns well with structured traders looking to enter on confirmation.

Stay patient, stay disciplined, and trust your patterns.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.