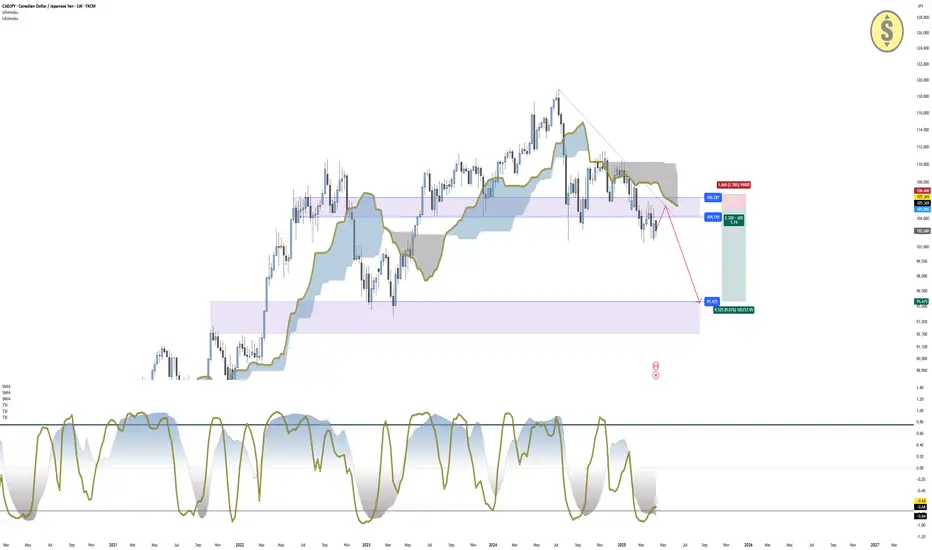

CAD/JPY is currently trading at 102.68, showing signs of rejection from the 106.00–104.00 resistance zone, which aligns with a bearish Ichimoku cloud (Span A at 105.36, Span B at 108.70). Price remains below the cloud, reinforcing the downtrend bias.

The market has not broken above previous swing highs, confirming that bearish structure is intact. The current move appears to be a retest of broken support turned resistance, now acting as a supply zone.

Both Trend Strength Index (TSI) indicators support downside momentum:

TSI(10): -0.68

TSI(20): -0.84

These values reflect persistent bearish pressure, though not yet fully oversold, leaving room for further downside before reversal signals arise.

The suggested plan is to wait for a retracement back into 104–106, offering better risk-to-reward entries for short positions, with a target at the next support near 96.43, where historical demand has previously stepped in.

Trade Setup Summary:

Entry Zone: 106.00 – 104.00 (resistance + cloud)

Stop Loss: Above 106.28 (recent structure)

Target: 96.43 (key support zone)

Bias: Bearish while below 106.00

As long as price holds below the cloud and fails to break previous highs, the downtrend remains valid.

The Canadian dollar remains tied to oil performance and BoC expectations, while the Japanese yen continues to trade weakly due to the Bank of Japan’s ultra-loose policy. However, CAD/JPY has shown technical exhaustion after a long bullish cycle, and unless oil regains momentum or the BoC shifts more hawkishly, the yen may regain some strength, particularly during risk-off periods. This environment supports short setups in CAD/JPY under technical confluence.

Disclaimer: This content is for educational and informational purposes only. It does not represent financial advice or a recommendation to buy or sell any financial instrument. Trading involves risk, and you should only trade with money you can afford to lose.

The market has not broken above previous swing highs, confirming that bearish structure is intact. The current move appears to be a retest of broken support turned resistance, now acting as a supply zone.

Both Trend Strength Index (TSI) indicators support downside momentum:

TSI(10): -0.68

TSI(20): -0.84

These values reflect persistent bearish pressure, though not yet fully oversold, leaving room for further downside before reversal signals arise.

The suggested plan is to wait for a retracement back into 104–106, offering better risk-to-reward entries for short positions, with a target at the next support near 96.43, where historical demand has previously stepped in.

Trade Setup Summary:

Entry Zone: 106.00 – 104.00 (resistance + cloud)

Stop Loss: Above 106.28 (recent structure)

Target: 96.43 (key support zone)

Bias: Bearish while below 106.00

As long as price holds below the cloud and fails to break previous highs, the downtrend remains valid.

The Canadian dollar remains tied to oil performance and BoC expectations, while the Japanese yen continues to trade weakly due to the Bank of Japan’s ultra-loose policy. However, CAD/JPY has shown technical exhaustion after a long bullish cycle, and unless oil regains momentum or the BoC shifts more hawkishly, the yen may regain some strength, particularly during risk-off periods. This environment supports short setups in CAD/JPY under technical confluence.

Disclaimer: This content is for educational and informational purposes only. It does not represent financial advice or a recommendation to buy or sell any financial instrument. Trading involves risk, and you should only trade with money you can afford to lose.

Trade forex, indices, stocks and metals with up to US$100.000 in company's funding.

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Trade forex, indices, stocks and metals with up to US$100.000 in company's funding.

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.