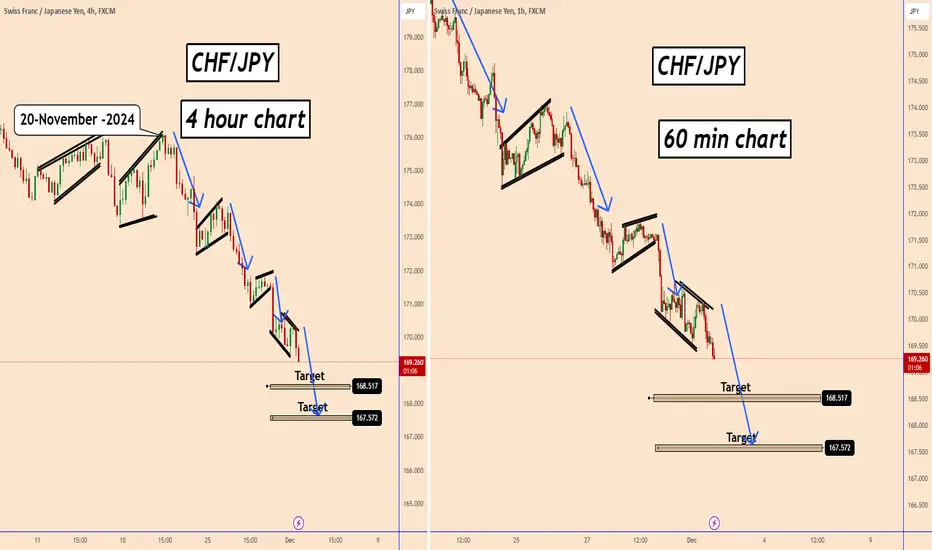

CHFJPY in a Clear Bearish Trend

Since November 20, 2024, CHFJPY has begun a clear bearish wave, dropping nearly 700 pips in just two weeks.

Last week, the Bank of Japan (BOJ) reported higher inflation data. With this increase in inflation, it is likely that the BOJ will keep its promise to hike rates on December 19th.

In simple terms, the market is anticipating a rate hike from the BOJ at this meeting, which is why JPY continues to strengthen.

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Since November 20, 2024, CHFJPY has begun a clear bearish wave, dropping nearly 700 pips in just two weeks.

Last week, the Bank of Japan (BOJ) reported higher inflation data. With this increase in inflation, it is likely that the BOJ will keep its promise to hike rates on December 19th.

In simple terms, the market is anticipating a rate hike from the BOJ at this meeting, which is why JPY continues to strengthen.

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

✅MY Free Signals

t.me/TradingPuzzles

✅Personal Telegram

t.me/KlejdiCuni

✅YouTube

youtube.com/@TradingPuzzles

t.me/TradingPuzzles

✅Personal Telegram

t.me/KlejdiCuni

✅YouTube

youtube.com/@TradingPuzzles

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅MY Free Signals

t.me/TradingPuzzles

✅Personal Telegram

t.me/KlejdiCuni

✅YouTube

youtube.com/@TradingPuzzles

t.me/TradingPuzzles

✅Personal Telegram

t.me/KlejdiCuni

✅YouTube

youtube.com/@TradingPuzzles

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.