Hello awesome traders! 👑✨

I hope you’ve had an amazing weekend and are ready to kick in the trading week like a pro. Let’s dive straight into the CHFJPY chart — and it’s shaping up to be a high-probability opportunity to start the week strong.

🧠 Setup Breakdown:

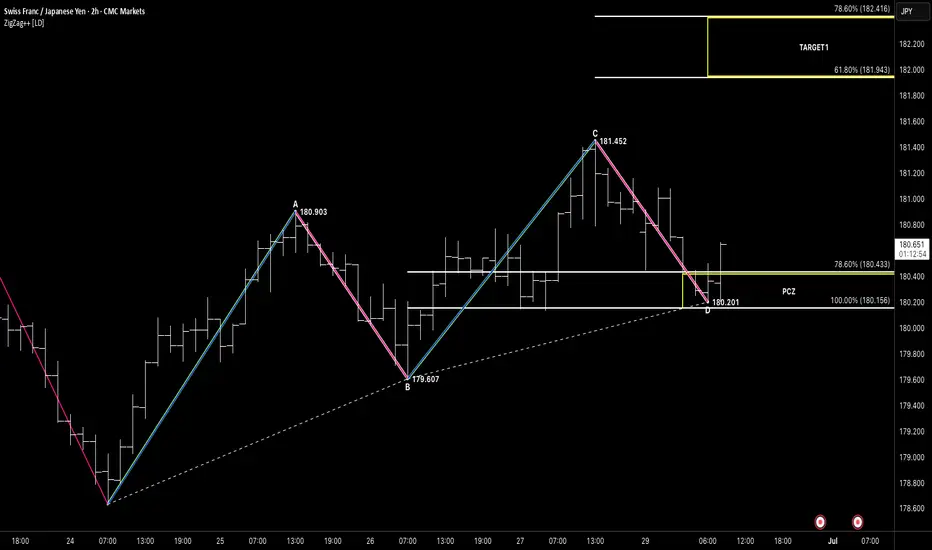

Price has formed a clean 121 bullish reversal — a classic pattern built on symmetry, structure, and timing. What makes this one stand out is how both the AB and CD legs mirror each other not just in price, but also in time, giving us a powerful edge.

We’re seeing:

✅ Symmetric correction

✅ PRZ zone rejection

✅ Impulsive breakout confirmation

Price tapped the Potential Completion Zone (PCZ) — confluence of 78.6% and 100% fibs — and immediately rejected with conviction.

🎯 Targets in Sight:

TP1: Already being approached – targeting the 61.8%–78.6% Fibonacci zone

TP2: Final objective lies near the 127.2%–161.8% extension

Structure says: "Let the trend unfold, manage the trade, and let it breathe."

Risk is clearly defined below the D point, and price has now confirmed strength above the breakout level (EL).

💡 What’s Next?

If price continues to respect structure and momentum holds, we’re tracking toward both target zones. The 121 is one of the cleanest reversal setups, and this one ticks the boxes:

🔹 Symmetry

🔹 PRZ rejection

🔹 Impulse confirmation

🔹 Defined risk

🔹 Measured targets

Let’s keep it simple: pattern → PRZ → trigger → continuation.

Wishing everyone a profitable week ahead — stay focused, manage risk like a sniper, and remember…

📊 Trade chart patterns like the pros do.

📈 Let structure lead, not emotions.

I hope you’ve had an amazing weekend and are ready to kick in the trading week like a pro. Let’s dive straight into the CHFJPY chart — and it’s shaping up to be a high-probability opportunity to start the week strong.

🧠 Setup Breakdown:

Price has formed a clean 121 bullish reversal — a classic pattern built on symmetry, structure, and timing. What makes this one stand out is how both the AB and CD legs mirror each other not just in price, but also in time, giving us a powerful edge.

We’re seeing:

✅ Symmetric correction

✅ PRZ zone rejection

✅ Impulsive breakout confirmation

Price tapped the Potential Completion Zone (PCZ) — confluence of 78.6% and 100% fibs — and immediately rejected with conviction.

🎯 Targets in Sight:

TP1: Already being approached – targeting the 61.8%–78.6% Fibonacci zone

TP2: Final objective lies near the 127.2%–161.8% extension

Structure says: "Let the trend unfold, manage the trade, and let it breathe."

Risk is clearly defined below the D point, and price has now confirmed strength above the breakout level (EL).

💡 What’s Next?

If price continues to respect structure and momentum holds, we’re tracking toward both target zones. The 121 is one of the cleanest reversal setups, and this one ticks the boxes:

🔹 Symmetry

🔹 PRZ rejection

🔹 Impulse confirmation

🔹 Defined risk

🔹 Measured targets

Let’s keep it simple: pattern → PRZ → trigger → continuation.

Wishing everyone a profitable week ahead — stay focused, manage risk like a sniper, and remember…

📊 Trade chart patterns like the pros do.

📈 Let structure lead, not emotions.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.