Algos enjoy jacking Price, they are exceptional at moving Offsides to Out of Balance.

Friday was an excellent example of their ability to fool, confound, and RANGE.

Price, as it has all week, sold off into the Afternoon Session, Lunch was the Pivot time.

__________________________________________________________________________

The Thursday Afternoon "Simulated Pit Close" @ 2:30 PM EST was 66.17.

The Magnet was set.

Friday's close - just over.

Open Outcry may be long gone, but Rules used remain Rules. As do the .55 and .85 Price

Pivots going back many decades. These levels were used by Floor traders to establish

over and under for Price movements IntraDay.

___________________________________________________________________________

Opening Gap was destined to be filled as it was @ the Prior Pit Close by a few Ticks, all

one had to do was hold their nose (as we did taking a whacking @ 50% Level only to 2X

down at the Fr of the .618) until the Lunch Sell began.

The Gap took its sweet time to fill - BUT - Every Retrwcement was SOLD, HFTs were extremely

active.

The SELL was very clear - patience as the Fill dipped in and moved lower.

End of Day Profit taking took care of the Close over 66.17 / 66.06

_____________________________________________________________________________

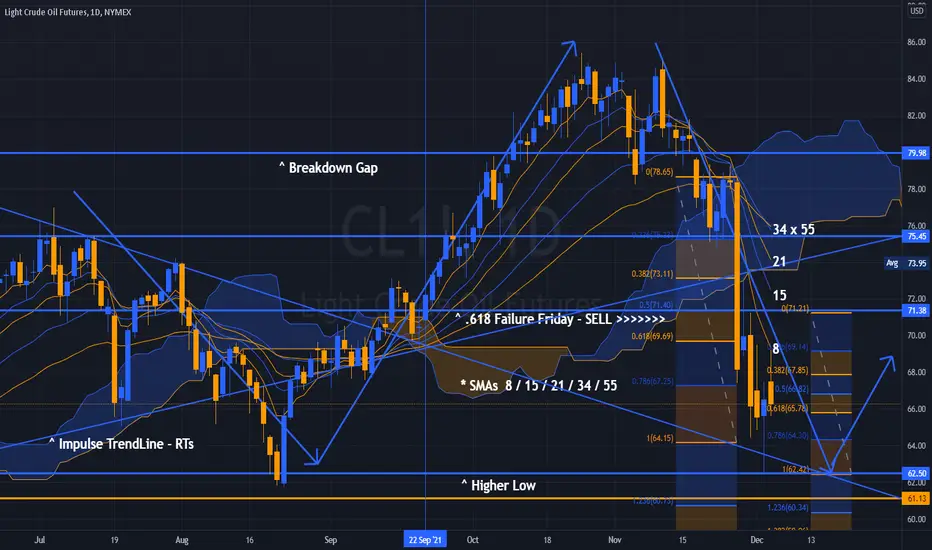

Thursday's Price movement failed to recover the . 618 Level, Friday spooked Sellers by

pretending to run it.

We see the "head and shoulders" pattern setting up and Traders are anxious to "Catch the Low"

for the reversal... assuming this pattern will compete.... regardless of the Fill, to them it

appears we have a 3X Bottom with a Higher High.

They will be chasing Price all over the Range this week... it is all but assured. Hoping to build

a position for the "Move back to 72-76"

______________________________________________________________________________

The chart has a well-defined Impulse Trend Line for Retracements.

The problem is the above - what the Majority Expects in Downtrends... has broken more Traders

over time than I care to remember, having watched a number of them Buy to the Bottom.

Relenting is not something that comes easily to Oil Traders, they "Average Down" forgetting CL

will simply continue to Power Down when in Trend.

Simply look at the Weekly / Monthly Charts... Absolute Carnage. These charts are damaged.

Crude Oil will end up going much lower - barring a WAR.

The potential for regional Conflict has never been Higher.

SO there's that - but it's Winter... and again that is not the TIme as these will be Ground Wars

to secure "things" - Bread Baskets, People, Movements, Materials.

_________________________________________________________________________________

What is crystal clear is this:

There is a Global RollUp of Energy, the United States went from being the World Leader in

production due to short turn Shale ramp-ups... to a Dependent due to Klaus Schwab's Cult

of Green Eggs and Ham.

Ideally, in a RollUp, you want to buy on the cheap... by Bankrupting an entire Industry so

you may pick up the pieces on the Down Low.

Production has already been hit in within the US - simply look at Rigs below 500.

__________________________________________________________________________________

Oil is essential, it is not going away anytime soon, it is however being used as part of a larger schema

to Wreck Things.

We are at a pivotal Juncture into the end of the Year.

Volumes will begin to abate as will Liquidity.

The $10 Drop occurred on a Friday, usually very low participation for Crude Oil.

Didn't quite Pan out that way.

Extreme caution is warranted in Crude as it will follow the Equity Complex around the Board this week.

It may end up leading again, we'll know more as the Week progresses.

Guess wrong, you'll be smoked.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.