Current geopolitical tensions between Israel and Iran have precipitated significant volatility in global oil markets. This study analyzes the immediate and medium-term impacts of the conflict on oil prices utilizing the Advanced Petroleum Market Model (APMM), a multifactorial fundamental analysis framework. The analysis reveals that both robust supply fundamentals and geopolitical risk premiums are currently supporting oil prices at elevated levels.

1. Introduction

Global energy markets are experiencing upward pressure from escalating tensions between Israel and Iran. Israeli military actions against Iranian targets have triggered immediate oil price responses, with Brent crude rising up to 10% and reaching the highest levels since January 2024 (Al Jazeera, 2024). The Strait of Hormuz, through which approximately 20% of global oil trade flows, remains central to geopolitical risk pricing in oil markets (CNBC, 2024).

2. Current APMM Market Assessment

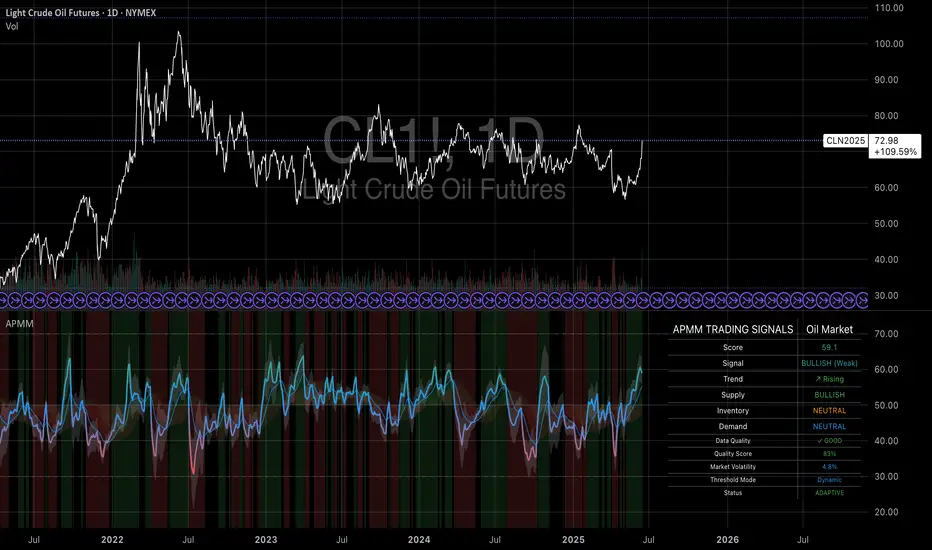

The Advanced Petroleum Market Model currently indicates a Bullish (Weak) regime with a composite score of 69.1 and a rising trend. Supply indicators are bullish, inventory and demand are neutral. The model's adaptive status shows it is successfully adjusting to current market conditions.

3. Market and Model-Based Scenario Analysis

- Brent Crude: 5-7% increase to over $87/barrel

- WTI Crude: 6% daily gain

- Geopolitical Risk Premium: $8-12/barrel (Goldman Sachs, 2024)

The APMM's current reading suggests oil markets are in a "Fundamental Support Regime" reinforced by geopolitical risk premiums. Geopolitical uncertainty is inherently bullish for oil prices as it increases supply disruption risks and drives precautionary demand.

Scenario Probabilities

- Base Scenario (65%): Bullish (Weak) regime persists, prices stabilize at $75-85/barrel

- Escalation (25%): Strong Bullish regime, prices at $85-95/barrel

- Extreme (10%): Extreme Bullish regime, prices above $100/barrel

4. Long-term and Policy Implications

- Diversification: Importers seek alternatives to Middle Eastern oil

- Strategic Reserves: Governments reconsider reserve strategies

- Energy Transition: Geopolitical risks strengthen investments in renewables

5. Conclusion

Despite robust supply, oil prices are supported by both fundamentals and persistent geopolitical risk premiums. The APMM reflects this environment with a Bullish (Weak) signal and rising trend. Geopolitical uncertainty remains a key bullish factor for oil markets.

References

Al Jazeera. (2024). Oil prices spike as Israel strikes Iran amid Middle East tensions.

Armstrong Economics. (2024). Oil Prices & the Israel-Iran Crisis - A Historical Perspective.

BBC. (2024). Israel Iran: What could conflict mean for oil and gas prices?

Chen, S., Liu, P., & Wang, J. (2024). Uncertainty about interest rates and crude oil prices. Financial Innovation, 10(1), 1-28.

CNBC. (2024). Oil prices could spike to $95 if Iran-Israel conflict escalates, Goldman Sachs warns.

Goldman Sachs. (2024). Commodities Research: Middle East Risk Premium in Oil Markets.

Al-Shboul, M., & Alqaralleh, H. (2025). Dynamic Effects of Economic Uncertainties and Geopolitical Risks on Saudi Stock Market Returns. Journal of Risk and Financial Management, 18(1), 12.

1. Introduction

Global energy markets are experiencing upward pressure from escalating tensions between Israel and Iran. Israeli military actions against Iranian targets have triggered immediate oil price responses, with Brent crude rising up to 10% and reaching the highest levels since January 2024 (Al Jazeera, 2024). The Strait of Hormuz, through which approximately 20% of global oil trade flows, remains central to geopolitical risk pricing in oil markets (CNBC, 2024).

2. Current APMM Market Assessment

The Advanced Petroleum Market Model currently indicates a Bullish (Weak) regime with a composite score of 69.1 and a rising trend. Supply indicators are bullish, inventory and demand are neutral. The model's adaptive status shows it is successfully adjusting to current market conditions.

3. Market and Model-Based Scenario Analysis

- Brent Crude: 5-7% increase to over $87/barrel

- WTI Crude: 6% daily gain

- Geopolitical Risk Premium: $8-12/barrel (Goldman Sachs, 2024)

The APMM's current reading suggests oil markets are in a "Fundamental Support Regime" reinforced by geopolitical risk premiums. Geopolitical uncertainty is inherently bullish for oil prices as it increases supply disruption risks and drives precautionary demand.

Scenario Probabilities

- Base Scenario (65%): Bullish (Weak) regime persists, prices stabilize at $75-85/barrel

- Escalation (25%): Strong Bullish regime, prices at $85-95/barrel

- Extreme (10%): Extreme Bullish regime, prices above $100/barrel

4. Long-term and Policy Implications

- Diversification: Importers seek alternatives to Middle Eastern oil

- Strategic Reserves: Governments reconsider reserve strategies

- Energy Transition: Geopolitical risks strengthen investments in renewables

5. Conclusion

Despite robust supply, oil prices are supported by both fundamentals and persistent geopolitical risk premiums. The APMM reflects this environment with a Bullish (Weak) signal and rising trend. Geopolitical uncertainty remains a key bullish factor for oil markets.

References

Al Jazeera. (2024). Oil prices spike as Israel strikes Iran amid Middle East tensions.

Armstrong Economics. (2024). Oil Prices & the Israel-Iran Crisis - A Historical Perspective.

BBC. (2024). Israel Iran: What could conflict mean for oil and gas prices?

Chen, S., Liu, P., & Wang, J. (2024). Uncertainty about interest rates and crude oil prices. Financial Innovation, 10(1), 1-28.

CNBC. (2024). Oil prices could spike to $95 if Iran-Israel conflict escalates, Goldman Sachs warns.

Goldman Sachs. (2024). Commodities Research: Middle East Risk Premium in Oil Markets.

Al-Shboul, M., & Alqaralleh, H. (2025). Dynamic Effects of Economic Uncertainties and Geopolitical Risks on Saudi Stock Market Returns. Journal of Risk and Financial Management, 18(1), 12.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.