Pros

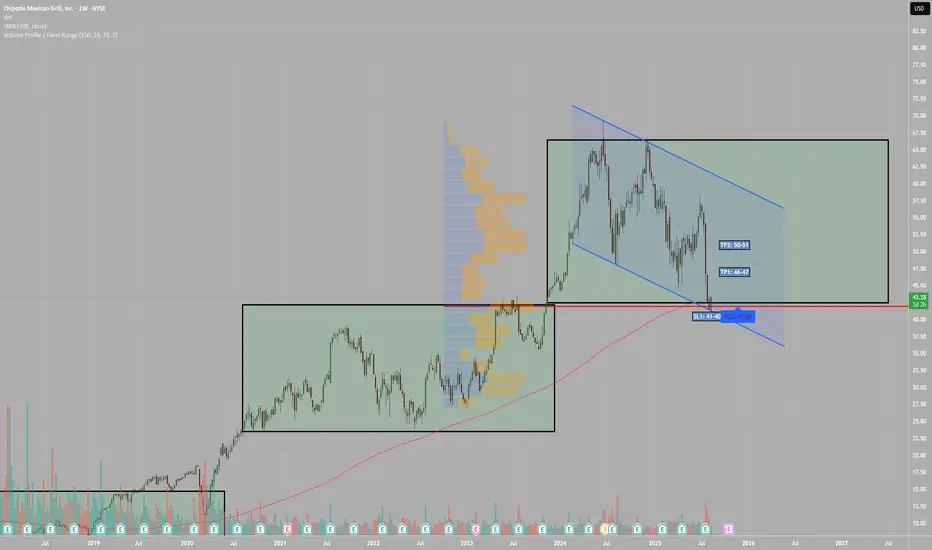

-Major pullback from highs: -40% from ATH.

-Technical confluence at support: Top of 2020–2024 range, weekly 200MA, and weekly volume POC.

-Gap magnet above: July 22 gap to $50.76 (+21% from here) with intermediate target $45–47 (+8–9%).

-Strong fundamentals: YOY revenue and gross profit growth consistently +20–30%.

-Brand moat: Loyal customer base, pricing power, consistent product quality.

-Innovation: Ongoing AI & robotics investment in meal prep. Supports margin expansion over time.

-Post-split price appeal: Lower nominal price post 50:1 split may draw in retail on recovery.

Risks

-Valuation still stretched: P/E of 38 even after a large correction. Leaves room for further multiple compression.

-Macro headwinds: If consumer spending slows, fast-casual dining could see softer traffic.

-Gap risk to the downside: A decisive break below $40 could trigger selling toward $35–37.

-High expectations baked in: Growth slowdown could cause outsized downside.

Entry Zone: Current levels ($43–44)

Targets:

-TP1 (Conservative): $46–47 → +8–9%

-TP2 (Aggressive): $50–51 → +18–21% (gap-fill / daily POC target)

Stop Loss:

-$41–40 → Below key support confluence (old range top, weekly 200MA).

-Close below $40 = setup invalidated.

Timeframe:

-Swing trade → Expectation of move playing out over several weeks to a few months.

Notes:

-Trim partial position at TP1 to lock gains, let rest ride toward TP2.

-If price fails to reclaim $44 within the next few sessions, reassess — could indicate sellers still in control.

-P/E still high. Not a value play.

-Major pullback from highs: -40% from ATH.

-Technical confluence at support: Top of 2020–2024 range, weekly 200MA, and weekly volume POC.

-Gap magnet above: July 22 gap to $50.76 (+21% from here) with intermediate target $45–47 (+8–9%).

-Strong fundamentals: YOY revenue and gross profit growth consistently +20–30%.

-Brand moat: Loyal customer base, pricing power, consistent product quality.

-Innovation: Ongoing AI & robotics investment in meal prep. Supports margin expansion over time.

-Post-split price appeal: Lower nominal price post 50:1 split may draw in retail on recovery.

Risks

-Valuation still stretched: P/E of 38 even after a large correction. Leaves room for further multiple compression.

-Macro headwinds: If consumer spending slows, fast-casual dining could see softer traffic.

-Gap risk to the downside: A decisive break below $40 could trigger selling toward $35–37.

-High expectations baked in: Growth slowdown could cause outsized downside.

Entry Zone: Current levels ($43–44)

Targets:

-TP1 (Conservative): $46–47 → +8–9%

-TP2 (Aggressive): $50–51 → +18–21% (gap-fill / daily POC target)

Stop Loss:

-$41–40 → Below key support confluence (old range top, weekly 200MA).

-Close below $40 = setup invalidated.

Timeframe:

-Swing trade → Expectation of move playing out over several weeks to a few months.

Notes:

-Trim partial position at TP1 to lock gains, let rest ride toward TP2.

-If price fails to reclaim $44 within the next few sessions, reassess — could indicate sellers still in control.

-P/E still high. Not a value play.

Trade active

First entry: $43.24 Aug 13thSecond entry: $42.56 Aug 12th

Average cost per share: $42.88

Rejected 43.60 Aug 13th and Today Aug 15th on the opening push. Held on the 43.20 pullback at 10AM. I am still bullish, I want to see it get above that 43.60 and hold today. Then next good sign is getting above $44. I want it to reclaim $44 within a few sessions as stated on original post. Today would be great to accomplish that

Note

$44 accomplished at EOD. Good sign. I sold 1/4 of my position for reducing risk. sold 1/4 at $43.92. Holding 3/4 of position Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.