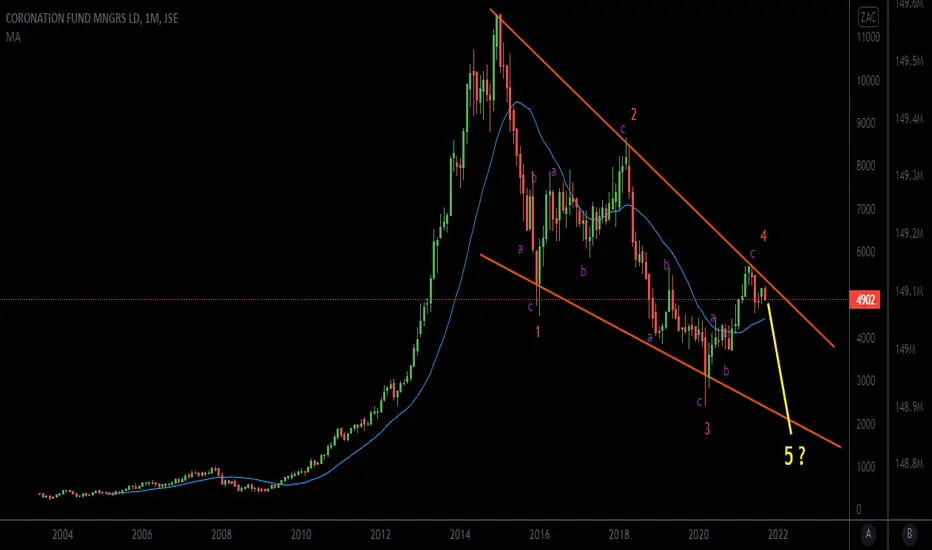

Time for a relook at the Monthly chart of Coronation Fund Managers Ltd, after I identified what looks like a falling wedge about two months ago. A guru in the financial world described $JSECML as a good proxy for SA Inc some time ago, but while the SA TOP 40 for example has not made much headway over the past 5 - 6 years, this counter has undeniably been in reverse over that time, being responsible for some serious losses for long term investors.

I will not boast about any Elliott Wave capabilities, but I managed to find four waves so far, with three sub waves each, so currently the falling wedge looks pretty much like those from the textbooks to me, and I find it difficult to see why a fifth wave down could not be a distinct possibility. I have been unashamedly bearish for almost a year already, and have this week expressed that a significant world wide correction is in my view now right in front of us. If Coronation has now indeed started with Wave 5 down, a drop to the lower line of the wedge, or even beneath it with a typical over throw that often accompanies a wedge, this means that the price could go from the current R49-02 to below R20, which would be a fall of at least 60%.

I will not boast about any Elliott Wave capabilities, but I managed to find four waves so far, with three sub waves each, so currently the falling wedge looks pretty much like those from the textbooks to me, and I find it difficult to see why a fifth wave down could not be a distinct possibility. I have been unashamedly bearish for almost a year already, and have this week expressed that a significant world wide correction is in my view now right in front of us. If Coronation has now indeed started with Wave 5 down, a drop to the lower line of the wedge, or even beneath it with a typical over throw that often accompanies a wedge, this means that the price could go from the current R49-02 to below R20, which would be a fall of at least 60%.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.