⚠️ CNC EARNINGS TRADE IDEA – JULY 25, 2025 ⚠️

💊 Healthcare Pressure + Missed Guidance = Bearish Setup for AMC

⸻

📉 Sentiment Snapshot:

• 🚨 Last quarter: Broke 100% beat streak

• 📉 Thin margins + rising medical costs

• 💬 Analyst bias: Neutral to Negative

• 🧮 Fundamentals Score: 4/10

⸻

📊 Technical Breakdown:

• 📍 Price: $26.76 (below 50DMA of $48.12)

• 📉 RSI: 32.4 = Oversold but still trending down

• 🛑 Testing 52W Low @ $26.25

• 🔻 Volume = 2.67x Avg → Heavy Distribution

⸻

🧠 Options Flow Insight:

• 🛡️ Heavy institutional put activity @ $28

• ⚠️ Weak call interest = bearish skew

• 📉 IV crush possible post-earnings

• Options Score: 6/10

⸻

🧬 MACRO CONTEXT:

• Rising sector costs crushing providers

• VIX < 15 = complacent market, sharp reactions possible

⸻

✅ TRADE IDEA:

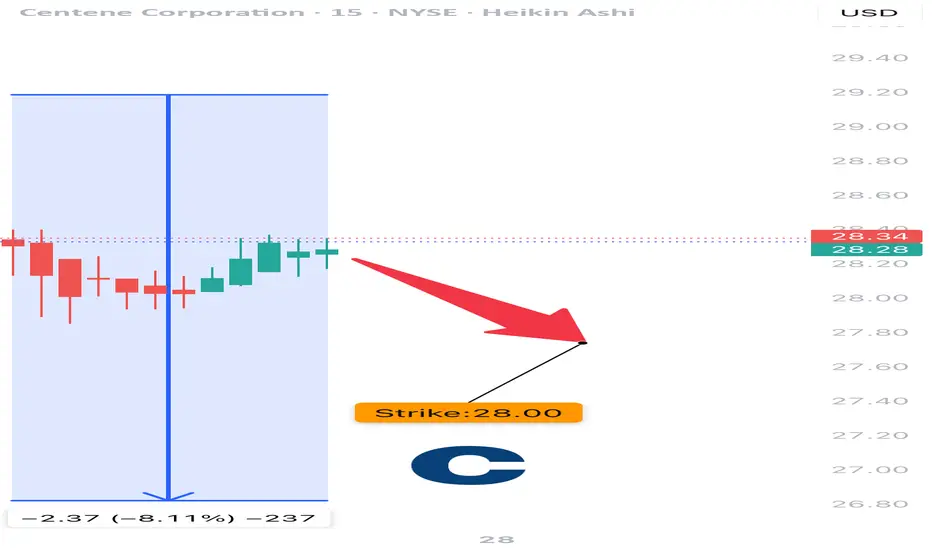

🎯 CNC $28 PUT (0DTE)

💵 Entry: $0.20

🎯 Profit Target: $0.60 (3x 💥)

🛑 Stop Loss: $0.10

📅 Expiry: Today (July 25, 2025)

📈 Confidence: 70%

⏰ Entry Timing: Before earnings (AMC)

📆 Close trade within 2 hours post-earnings

⸻

📍 RISK REMINDER:

• Theta decay will be brutal if flat

• Watch for volatility and potential IV crush

• Ideal exit zone = stock retests $26 support

⸻

💡 Weak guide = collapse risk.

👍 Like & repost if you’re tracking CNC puts tonight!

#CNC #EarningsPlay #PutOptions #HealthcareStocks #OptionsTrading #0DTE #EarningsTrade #TradingView #SPX #GammaRisk

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.