Long

CNXM a top gainer, rising +73.75%. Expect Uptrend continuation

CNX Midstream Partners LP - Unit (CNXM, $10.51) was one of top quarterly gainers, jumping +73.75% to $10.51 per share. Tickeron A.I.dvisor analyzed 39 stocks in the Oil & Gas Pipelines Industry over the last three months, and discovered that 30 of them (77.78%) charted an Uptrend while 9 of them (22.22%) trended down. Tickeron A.I.dvisor found 242 similar cases when CNXM's price jumped over 15% within three months. In 163 out of those 242 cases, CNXM's price went up during the following month. Based on these historical data, Tickeron A.I. thinks the odds of an Uptrend continuation for CNXM are 67%.

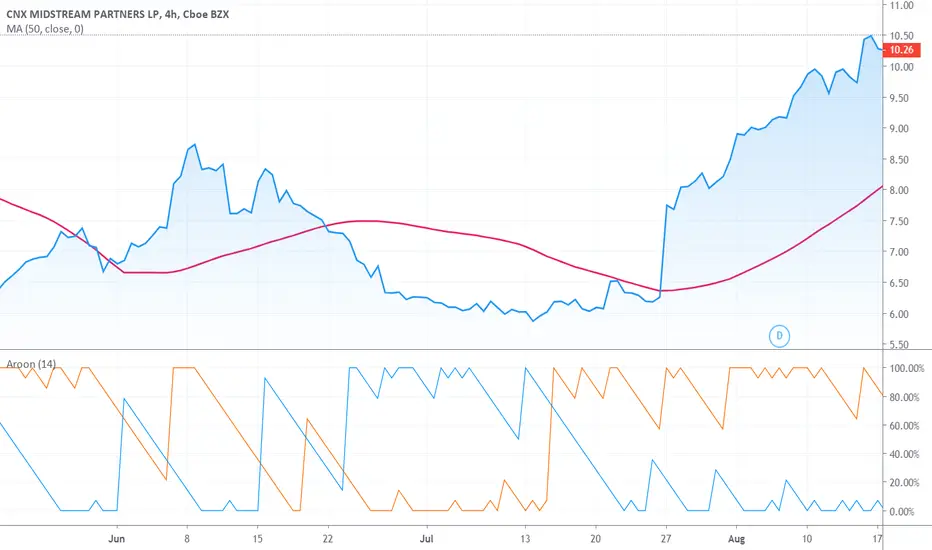

Current price $10.27 crossed the resistance line at $8.30 and is trading between $10.54 support and $8.30 resistance lines. Throughout the month of 07/14/20 - 08/13/20, the price experienced a +70% Uptrend. During the week of 08/06/20 - 08/13/20, the stock enjoyed a +9% Uptrend growth.

The price moved above its 50-day Moving Average, which indicates a change from a Downtrend to an Uptrend. Tickeron AI shows that in 36 of 54 similar backtested cases where CNXM's price crossed above its 50-day Moving Average, its price rose further within the subsequent month. The odds of a continued Uptrend are 67%.

The 10-day Moving Average for this ticker crossed above its 50-day Moving Average on July 31, 2020, which can be construed as a buy signal, indicating that the trend is shifting higher. Tickeron AI shows that in 11 of 16 similar cases where CNXM's 10-day Moving Average crossed above its 50-day Moving Average, the price rose further within the following month. The odds of a continued Uptrend are 69%.

The Aroon Indicator entered an Uptrend today. Tickeron AI shows that in 141 of 225 similar cases where CNXM Aroon's Indicator entered an Uptrend, the price rose further within the following month. The odds of a continued Uptrend are 63%.

Current price $10.27 crossed the resistance line at $8.30 and is trading between $10.54 support and $8.30 resistance lines. Throughout the month of 07/14/20 - 08/13/20, the price experienced a +70% Uptrend. During the week of 08/06/20 - 08/13/20, the stock enjoyed a +9% Uptrend growth.

The price moved above its 50-day Moving Average, which indicates a change from a Downtrend to an Uptrend. Tickeron AI shows that in 36 of 54 similar backtested cases where CNXM's price crossed above its 50-day Moving Average, its price rose further within the subsequent month. The odds of a continued Uptrend are 67%.

The 10-day Moving Average for this ticker crossed above its 50-day Moving Average on July 31, 2020, which can be construed as a buy signal, indicating that the trend is shifting higher. Tickeron AI shows that in 11 of 16 similar cases where CNXM's 10-day Moving Average crossed above its 50-day Moving Average, the price rose further within the following month. The odds of a continued Uptrend are 69%.

The Aroon Indicator entered an Uptrend today. Tickeron AI shows that in 141 of 225 similar cases where CNXM Aroon's Indicator entered an Uptrend, the price rose further within the following month. The odds of a continued Uptrend are 63%.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.