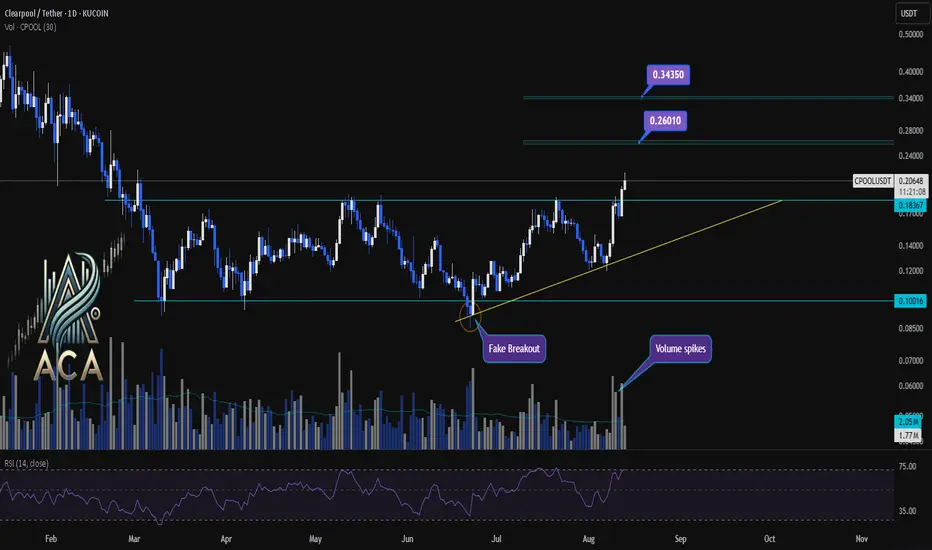

CPOOLUSDT Daily Chart Analysis | Momentum Surge & Key Targets

🔍 Let’s dive into the CPOOL/USDT 1D chart and break down the latest price action that’s catching attention, with an eye on bullish setups and critical zones.

⏳ Daily Overview

The chart shows a dynamic breakout above the accumulation box (range), with price riding a clear yellow trendline and volume spiking hard — classic momentum signals. RSI is entering the overbought zone, which confirms surging buying interest and the possibility for rapid moves.

🔺 Long Setup:

- The breakout from the range box suggests accumulation and fresh interest. Immediate upside looks at the mid-range target of $0.26010.

- Next, if momentum holds, price could rally towards $0.34350, which lines up with the risk-reward (RR1) from the box.

- Sustained momentum and continued volume spikes could unlock even higher targets beyond these levels.

📊 Key Highlights:

- Yellow trendline supports the move, tracking bullish sentiment.

- Volume spikes show real participation — this isn’t a low-liquidity fakeout.

- RSI entering the overbought zone is a momentum engine, but keep an eye out for possible pullbacks or cooling periods as price tests higher levels.

- Fake breakout earlier in the range now confirmed by the strong candle and volume surge.

🚨 Conclusion:

Momentum is accelerating. If buyers stay in control above current support, price could climb to the mid-box target of $0.26010, with $0.34350 as the next bullish destination. This setup favors longs as long as volume and trendline support remain intact. Aggressive momentum could push price even further — time to watch those critical resistance levels.

🔍 Let’s dive into the CPOOL/USDT 1D chart and break down the latest price action that’s catching attention, with an eye on bullish setups and critical zones.

⏳ Daily Overview

The chart shows a dynamic breakout above the accumulation box (range), with price riding a clear yellow trendline and volume spiking hard — classic momentum signals. RSI is entering the overbought zone, which confirms surging buying interest and the possibility for rapid moves.

🔺 Long Setup:

- The breakout from the range box suggests accumulation and fresh interest. Immediate upside looks at the mid-range target of $0.26010.

- Next, if momentum holds, price could rally towards $0.34350, which lines up with the risk-reward (RR1) from the box.

- Sustained momentum and continued volume spikes could unlock even higher targets beyond these levels.

📊 Key Highlights:

- Yellow trendline supports the move, tracking bullish sentiment.

- Volume spikes show real participation — this isn’t a low-liquidity fakeout.

- RSI entering the overbought zone is a momentum engine, but keep an eye out for possible pullbacks or cooling periods as price tests higher levels.

- Fake breakout earlier in the range now confirmed by the strong candle and volume surge.

🚨 Conclusion:

Momentum is accelerating. If buyers stay in control above current support, price could climb to the mid-box target of $0.26010, with $0.34350 as the next bullish destination. This setup favors longs as long as volume and trendline support remain intact. Aggressive momentum could push price even further — time to watch those critical resistance levels.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.