Copper 360 describes its business as follows, "The Copper 360 business is focused on (a) processing historical mined copper rock dumps through a process of environmental clean-up, and (b) mining surface and shallow copper resources." The company has acquired (through SHIP) an extensive database from companies such as American Mining Conglomerate Newmont and Global Gold Company Gold Fields who worked the district before.

In its results for the year to 31st August 2023, the company reported a loss of R4.9 million compared with a loss of R31.6 million in the previous period. The company said, "Our loss has narrowed as production ramps up and capital expenditure comes to an end. The post-period acquisition of Nama Copper Resources Proprietary Limited ("Nama Copper") further ensures we remain on track to deliver significantly improved production with a major reduction in execution build and delivery risk. The 2025 FY will see the Company target EBITDA in excess of R650 million together with major resource upgrades to improve mining flexibility and growth."

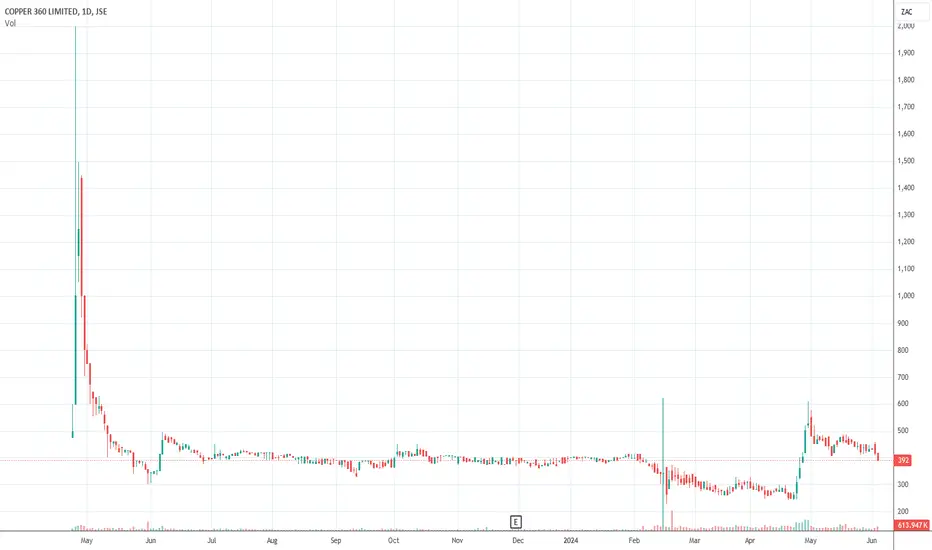

On 21st December 2023, the company announced that it had raised a total of R274 million to fund the Nama copper acquisition and production growth at Rietberg mine. The share listed on 12th April 2023, closing at 500c. Since then, it has drifted down to 371c, which does not bode well. We suggest that this is a risky commodity operation and that you should wait for the share price to at least settle down before investigating further.

On 19th February 2023, the company announced that it had raised just less than R100 million by selling shares. On 27th March 2024, the company announced that it had signed a memorandum of understanding with Far West Gold Recoveries. The CEO said, "Copper 360 estimates that there are approximately 50 to 60 million tonnes of dump material with grades varying between 0.18% and 1.5% copper in the dumps with the potential to contain 450,000 tonnes of copper metal in situ."

On 16th May 2024, the company announced that Shirley Hayes had been appointed as executive chairperson with immediate effect. On 24th April 2024, the company reported that it had produced 136 tons of copper concentrate from the Northern Cape and that the grade was more than 30%.

In a trading statement for the year to 29th February 2024, the company estimated that it would make a headline loss of between 10.5c and 12c per share compared with a loss of 0.27c in the previous period. Technically, the share has been moving sideways and downwards since it listed in April 2023. It is a risky commodity share and very volatile.

Overall, Copper 360 presents a high-risk, high-reward scenario typical of commodity shares. Investors should be cautious and consider the volatility and risk factors before making any investment decisions. The company's plans for growth and production improvement are promising, but it remains to be seen if they can deliver on these targets.

In its results for the year to 31st August 2023, the company reported a loss of R4.9 million compared with a loss of R31.6 million in the previous period. The company said, "Our loss has narrowed as production ramps up and capital expenditure comes to an end. The post-period acquisition of Nama Copper Resources Proprietary Limited ("Nama Copper") further ensures we remain on track to deliver significantly improved production with a major reduction in execution build and delivery risk. The 2025 FY will see the Company target EBITDA in excess of R650 million together with major resource upgrades to improve mining flexibility and growth."

On 21st December 2023, the company announced that it had raised a total of R274 million to fund the Nama copper acquisition and production growth at Rietberg mine. The share listed on 12th April 2023, closing at 500c. Since then, it has drifted down to 371c, which does not bode well. We suggest that this is a risky commodity operation and that you should wait for the share price to at least settle down before investigating further.

On 19th February 2023, the company announced that it had raised just less than R100 million by selling shares. On 27th March 2024, the company announced that it had signed a memorandum of understanding with Far West Gold Recoveries. The CEO said, "Copper 360 estimates that there are approximately 50 to 60 million tonnes of dump material with grades varying between 0.18% and 1.5% copper in the dumps with the potential to contain 450,000 tonnes of copper metal in situ."

On 16th May 2024, the company announced that Shirley Hayes had been appointed as executive chairperson with immediate effect. On 24th April 2024, the company reported that it had produced 136 tons of copper concentrate from the Northern Cape and that the grade was more than 30%.

In a trading statement for the year to 29th February 2024, the company estimated that it would make a headline loss of between 10.5c and 12c per share compared with a loss of 0.27c in the previous period. Technically, the share has been moving sideways and downwards since it listed in April 2023. It is a risky commodity share and very volatile.

Overall, Copper 360 presents a high-risk, high-reward scenario typical of commodity shares. Investors should be cautious and consider the volatility and risk factors before making any investment decisions. The company's plans for growth and production improvement are promising, but it remains to be seen if they can deliver on these targets.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.