WaverVanir International LLC · CRM Weekly Outlook · Published June 28 2025

Ticker: CRM | Chart: Weekly

🔹 Catalyst

• Q2 FY26 earnings on August 27 2025 after market close (TipRanks, 2025)

• Dreamforce conference mid September 2025

🔹 Macro Environment

• Fed likely to hold rates at July 30 meeting (Binance News, 2025)

• Enterprise IT budgets remain resilient amid cost pressure

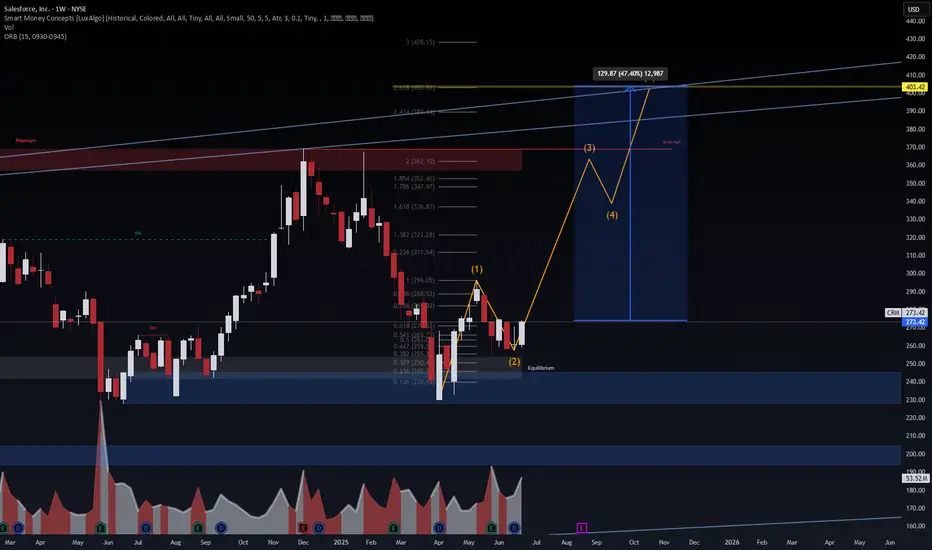

🔹 Technical Setup

• Weekly ORB demand zone at 239 supports price

• Wave 1 high at 296 and corrective wave 2 near 260–270 signals wave 3 start

• Resistance clusters at 336 (1.618 Fibonacci), 362 (2.0 Fibonacci), and extended target near 403

🔹 Trade Plan & Risk

1. Entry: Long near 274–276 on pullback

2. Stop: Below 265 to limit drawdown

3. Targets:

1. Scale out at 336

2. Add or trim at 362

3. Full exit near 403

4. Position size: Risk ≤ 1.5 percent of portfolio

5. Trail: Move stop to breakeven once 336 is taken, then trail beneath higher lows

🔹 Options Play

• Strategy: Sep 2025 bull call spread

– Buy 280 call

– Sell 320 call

• Defined risk equals net debit, breakeven ~ 283, max gain if CRM ≥ 320

#CRM #Salesforce #Stocks #TradingPlan #Options

References

Binance News. (2025, June 27). Federal Reserve’s July rate decision likely to remain unchanged. Retrieved June 28 2025 from binancenews.com

TipRanks. (2025). Salesforce CRM earnings dates, call summary & reports. Retrieved June 28 2025 from tipranks.com

Ticker: CRM | Chart: Weekly

🔹 Catalyst

• Q2 FY26 earnings on August 27 2025 after market close (TipRanks, 2025)

• Dreamforce conference mid September 2025

🔹 Macro Environment

• Fed likely to hold rates at July 30 meeting (Binance News, 2025)

• Enterprise IT budgets remain resilient amid cost pressure

🔹 Technical Setup

• Weekly ORB demand zone at 239 supports price

• Wave 1 high at 296 and corrective wave 2 near 260–270 signals wave 3 start

• Resistance clusters at 336 (1.618 Fibonacci), 362 (2.0 Fibonacci), and extended target near 403

🔹 Trade Plan & Risk

1. Entry: Long near 274–276 on pullback

2. Stop: Below 265 to limit drawdown

3. Targets:

1. Scale out at 336

2. Add or trim at 362

3. Full exit near 403

4. Position size: Risk ≤ 1.5 percent of portfolio

5. Trail: Move stop to breakeven once 336 is taken, then trail beneath higher lows

🔹 Options Play

• Strategy: Sep 2025 bull call spread

– Buy 280 call

– Sell 320 call

• Defined risk equals net debit, breakeven ~ 283, max gain if CRM ≥ 320

#CRM #Salesforce #Stocks #TradingPlan #Options

References

Binance News. (2025, June 27). Federal Reserve’s July rate decision likely to remain unchanged. Retrieved June 28 2025 from binancenews.com

TipRanks. (2025). Salesforce CRM earnings dates, call summary & reports. Retrieved June 28 2025 from tipranks.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.