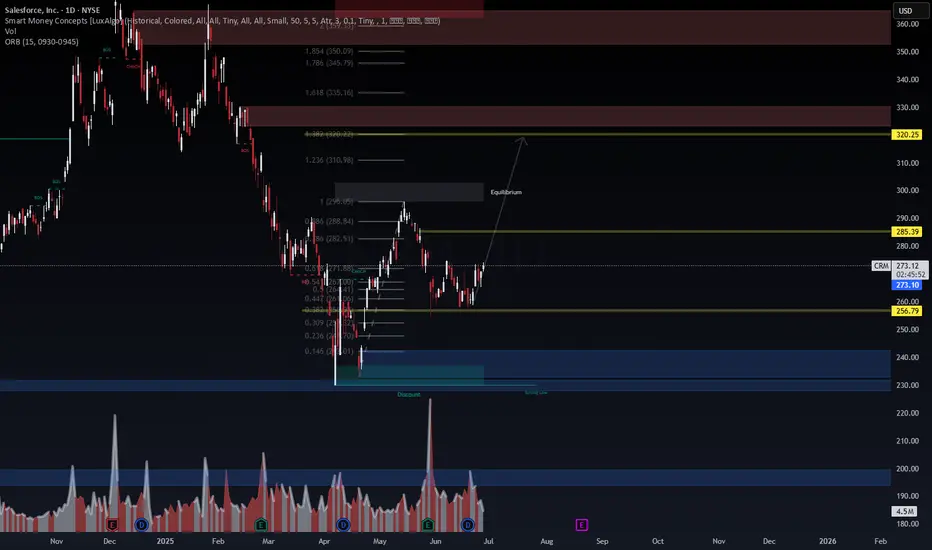

🧠 Salesforce (CRM) shows a clean price reaction from the 61.8–66% retracement zone after bullish CHoCH and internal BOS confirmations. Our Smart Money model detects a re-accumulation beneath prior imbalance zones, with a potential run toward the equilibrium range at ~296–320.

📍 WaverVanir Trade Plan

Type: Swing Position

Entry Zone: 272–276 (current zone showing absorption)

SL: Below 256.79 (prior SMC demand/discount invalidation)

TP1: 285.39 (inefficiency gap fill)

TP2: 296.05 (equilibrium)

TP3 (Extended): 320.25 (liquidity sweep above SMC block)

Risk-Reward Estimate: ~1:2.5+

Holding Time: 5–15 trading sessions

🔥 Catalysts to Watch

📈 Q2 Earnings Preview (Est. August 2025): Market is pricing in AI efficiency gains and subscription retention

🤖 AI & Automation Momentum: Salesforce expanding Einstein GPT and vertical-specific AI tools

🤝 M&A Rumors: Speculation around strategic acquisitions in marketing automation

🛠️ Cost Optimization Plans: Continues to offload non-core operations; potential margin upside

🌍 Macro Tailwinds

🏛️ Fed Policy Easing Bias: Lower rates may support tech multiples in H2 2025

💼 Enterprise Spending Rotation: CIO budgets increasingly favor CRM, AI, and cloud spend

💵 Liquidity Reallocation: Risk-on flows post-NFP and CPI trends benefiting high-multiple software names

💬 Sentiment Score (Aggregated)

StockTwits/Options Flow/Buzz: +72/100

– Bullish bias forming, but room for late-stage participants to enter.

📌 Final Note from WaverVanir:

This setup reflects institutional structure alignment and volume pocket efficiency. We’re actively tracking CRM for a potential full move toward macro equilibrium under stable macro risk regimes.

📍 WaverVanir Trade Plan

Type: Swing Position

Entry Zone: 272–276 (current zone showing absorption)

SL: Below 256.79 (prior SMC demand/discount invalidation)

TP1: 285.39 (inefficiency gap fill)

TP2: 296.05 (equilibrium)

TP3 (Extended): 320.25 (liquidity sweep above SMC block)

Risk-Reward Estimate: ~1:2.5+

Holding Time: 5–15 trading sessions

🔥 Catalysts to Watch

📈 Q2 Earnings Preview (Est. August 2025): Market is pricing in AI efficiency gains and subscription retention

🤖 AI & Automation Momentum: Salesforce expanding Einstein GPT and vertical-specific AI tools

🤝 M&A Rumors: Speculation around strategic acquisitions in marketing automation

🛠️ Cost Optimization Plans: Continues to offload non-core operations; potential margin upside

🌍 Macro Tailwinds

🏛️ Fed Policy Easing Bias: Lower rates may support tech multiples in H2 2025

💼 Enterprise Spending Rotation: CIO budgets increasingly favor CRM, AI, and cloud spend

💵 Liquidity Reallocation: Risk-on flows post-NFP and CPI trends benefiting high-multiple software names

💬 Sentiment Score (Aggregated)

StockTwits/Options Flow/Buzz: +72/100

– Bullish bias forming, but room for late-stage participants to enter.

📌 Final Note from WaverVanir:

This setup reflects institutional structure alignment and volume pocket efficiency. We’re actively tracking CRM for a potential full move toward macro equilibrium under stable macro risk regimes.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.