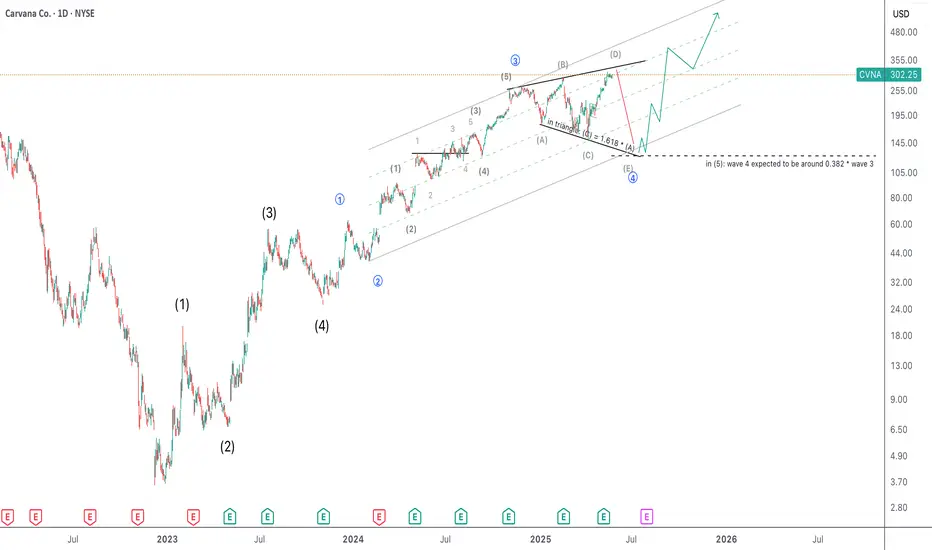

I believe CVNA is printing expanding triangle as wave 4 in larger 5.

If this count is correct, currently wave D of triangle is close to its end and soon, around $325-340, the trend should reverse and go down to complete the triangle with wave E which will erase >60% of market cap.

After this move the stock is expected to climb up again.

If this count is correct, currently wave D of triangle is close to its end and soon, around $325-340, the trend should reverse and go down to complete the triangle with wave E which will erase >60% of market cap.

After this move the stock is expected to climb up again.

Note

Despite price came quite close to from where it expected to drop, currently I don't see signs to fall.Candlesticks on daily and weekly frames look quite bullish.

Will see how price develops this week.

Trade active

CVNA sets up at -3% pre-market now and this is right at the upper triangle edge (black). Entering short here with the target at $274 as 38.2% retracement on linear scale of wave D.There is also a chance that wave D is actually a new impulse wave but I very doubt it and stick to the triangle option.

Order cancelled

I don't like price action here, specifically, daily candlesticks, and it will be no surprise if CVNA goes up more. I believe I was wrong here with drawing expanding triangle too early. It was an expanding flat instead. This guess has not played out, so I cancel the idea.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.