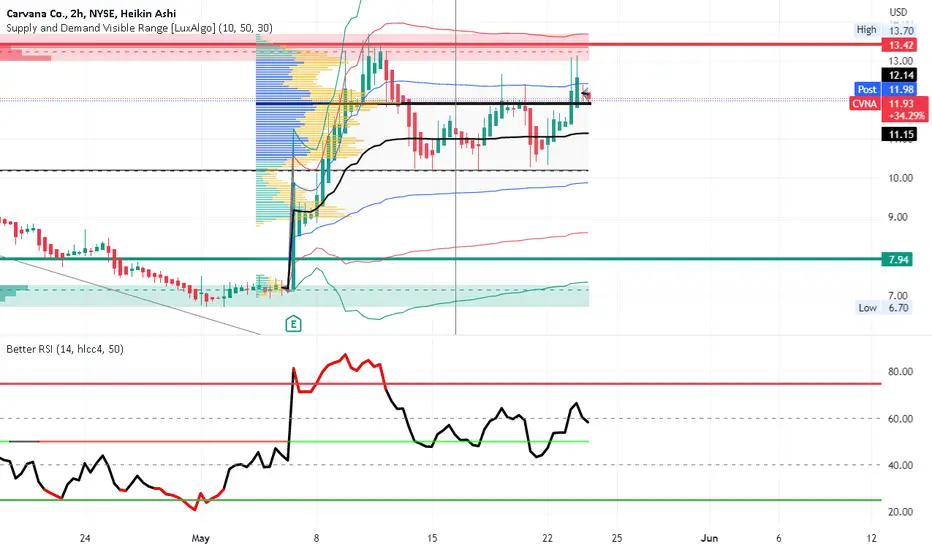

CVNA in the past couple of trading sessions had a 20 % move and then reversed downward.

As shown on the 1 hour chart, price is below the demand/ resistance zone and sitting on the

POC line of the multisession volume profile where volatility is often at its highest. The

anchored VWAP indicator shows the bands are nearly flat. Price is in the fair value zone and

falling towards VWAP. RSI is near 60 and dropping.

I see this as a decent short setup.

The first target is before the VWAP at 11.20 while the second target is at 10, the confluence

of the bottom of the high volume area and the first VWAP band below the mean. the stop

loss is near to the first VWAP band above the mean at 12.55.

Fundamentally, CVNA has a decent earnings report but is subject

to an impending recession where consumers may be not inclined to make big purchases such

as cars.

As shown on the 1 hour chart, price is below the demand/ resistance zone and sitting on the

POC line of the multisession volume profile where volatility is often at its highest. The

anchored VWAP indicator shows the bands are nearly flat. Price is in the fair value zone and

falling towards VWAP. RSI is near 60 and dropping.

I see this as a decent short setup.

The first target is before the VWAP at 11.20 while the second target is at 10, the confluence

of the bottom of the high volume area and the first VWAP band below the mean. the stop

loss is near to the first VWAP band above the mean at 12.55.

Fundamentally, CVNA has a decent earnings report but is subject

to an impending recession where consumers may be not inclined to make big purchases such

as cars.

Trade active

Put options doing well with 2 DTE. General market down helping CVNA slide further.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.