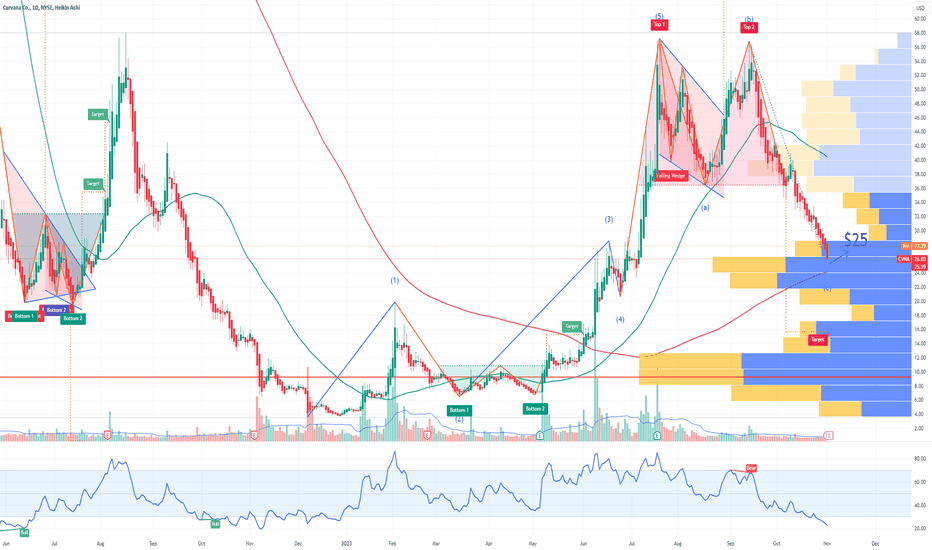

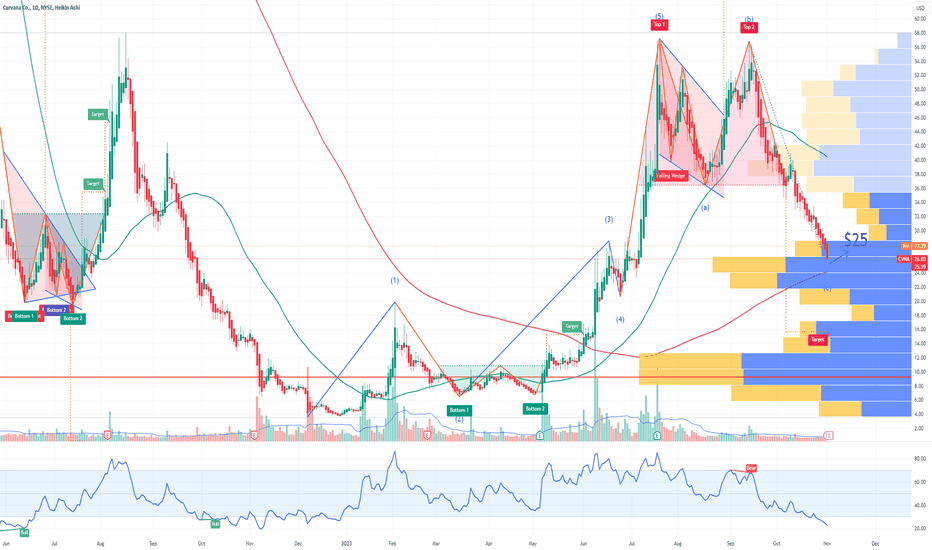

If you haven`t bought CVNA at $25:

Carvana Stock Now Faces Major Risks: A Price Target of $127

Carvana Co. (CVNA), currently trading at $199, faces mounting scrutiny after allegations from Hindenburg Research. The short-seller’s report, titled “Carvana: A Father-Son Accounting Grift for the Ages,” accuses the company of unsustainable growth fueled by lax underwriting standards and questionable insider dealings.

Key Concerns:

Insider Selling: CEO Ernest Garcia III and his father, Ernie Garcia II, sold $3.6 billion in stock between 2020-2021, with an additional $1.4 billion sold last year after a 284% stock surge.

Loan Portfolio Risks: Claims suggest Carvana approves nearly all loan applicants, increasing exposure to subprime defaults as economic conditions tighten.

DriveTime Transactions: Allegations of inflated revenues through sales to DriveTime, owned by Garcia II, raise conflict-of-interest concerns.

Manipulated Results: Extensions on subprime loans reportedly delay delinquencies, misrepresenting financial health.

Outlook:

While the stock has shown resilience, we believe these risks significantly outweigh the rewards. With questionable accounting practices and a vulnerable loan portfolio, our price target is $127.

Carvana Stock Now Faces Major Risks: A Price Target of $127

Carvana Co. (CVNA), currently trading at $199, faces mounting scrutiny after allegations from Hindenburg Research. The short-seller’s report, titled “Carvana: A Father-Son Accounting Grift for the Ages,” accuses the company of unsustainable growth fueled by lax underwriting standards and questionable insider dealings.

Key Concerns:

Insider Selling: CEO Ernest Garcia III and his father, Ernie Garcia II, sold $3.6 billion in stock between 2020-2021, with an additional $1.4 billion sold last year after a 284% stock surge.

Loan Portfolio Risks: Claims suggest Carvana approves nearly all loan applicants, increasing exposure to subprime defaults as economic conditions tighten.

DriveTime Transactions: Allegations of inflated revenues through sales to DriveTime, owned by Garcia II, raise conflict-of-interest concerns.

Manipulated Results: Extensions on subprime loans reportedly delay delinquencies, misrepresenting financial health.

Outlook:

While the stock has shown resilience, we believe these risks significantly outweigh the rewards. With questionable accounting practices and a vulnerable loan portfolio, our price target is $127.

Private SIGNALS patreon.com/PremiumOptionsSignals

Trading COURSE bit.ly/tradex

RESULTS bit.ly/TG10x

TradeNation bit.ly/t10X

CRYPTO partner.bybit.com/b/37880

BUY-SELL INDICATORS tradingindicators.store/

Trading COURSE bit.ly/tradex

RESULTS bit.ly/TG10x

TradeNation bit.ly/t10X

CRYPTO partner.bybit.com/b/37880

BUY-SELL INDICATORS tradingindicators.store/

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Private SIGNALS patreon.com/PremiumOptionsSignals

Trading COURSE bit.ly/tradex

RESULTS bit.ly/TG10x

TradeNation bit.ly/t10X

CRYPTO partner.bybit.com/b/37880

BUY-SELL INDICATORS tradingindicators.store/

Trading COURSE bit.ly/tradex

RESULTS bit.ly/TG10x

TradeNation bit.ly/t10X

CRYPTO partner.bybit.com/b/37880

BUY-SELL INDICATORS tradingindicators.store/

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.