-states have different rules,

-80% of premiums had to go towards care,

-thin profit margins due to High Medical Loss Ratios of 87%,

-Low Enrollment

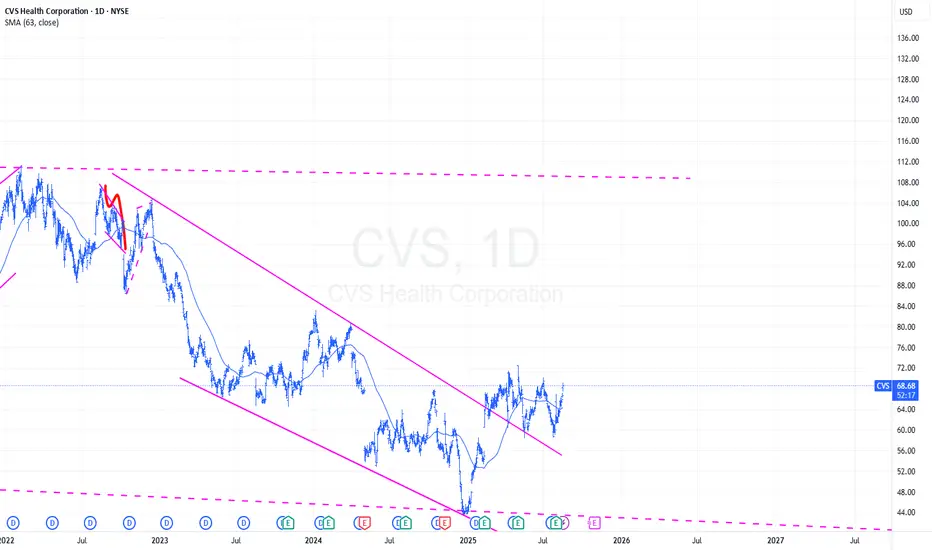

Since late 2024 CVS has made strong strides trending up. Q1 2025 earnings were good as well with net income totaling $1.8 Billion. Couple this with recent rise in healthcare stocks thanks to news that Warren Buffet of Berkshire Hathaway purchased 5 Million shares of

With all things being constant in current market conditions

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.