$D #DominionEnergy — Dominion Energy Inc. (NYSE:D) Insider Activity Report | Utilities | Utilities - Regulated Electric | USA | NYSE | September 02, 2025.

Overview: This report evaluates the recent open-market purchase of Dominion Energy (D) shares by its Chair, President, and CEO on August 27, 2025. Dominion, a leading regulated utility with a focus on transitioning to clean energy, is well-positioned amid surging electricity demand from data centers and renewable initiatives.

The insider activity, against a backdrop of solid Q2 earnings and strategic investments, suggests executive confidence in near-term value creation. This analysis is tailored for institutional investors seeking exposure to resilient utility plays with growth catalysts.

1. Insider Trading

On Aug 27, 2025, Dominion’s boss Robert Blue (Chair, President & CEO) bought 4,331 shares @ $60.35.

Ticket size: ~$250k. (SEC Form 4)

sec.gov/Archives/edgar/data/715957/000122520825007493/xslF345X05/doc4.xml

Not huge for a $50B utility, but it’s his first open-market buy since Mar ‘24. No insider sales on record. That’s a confidence move.

2. Fundamentals

• Q2 EPS: $0.75 (beat by 8.7%). Revenues $3.5B (+3% vs est).

• FY25 EPS guidance reaffirmed at $3.28–$3.52.

• Dividend yield ~4.5% — not bad while you wait.

• $50B capex plan (2025–2029) focused on data centers + renewables.

• Offshore wind project facing cost bumps, but still on track.

3. Big Picture

• Utilities usually move slow, but AI/data-center demand is a real tailwind.

• Dominion already hooked up 15 centers (1,000 MW) in 2024, another 15 on deck this year.

• SCC hearings Sept 2 on rate adjustments — could unlock recovery on those heavy investments.

Charts:

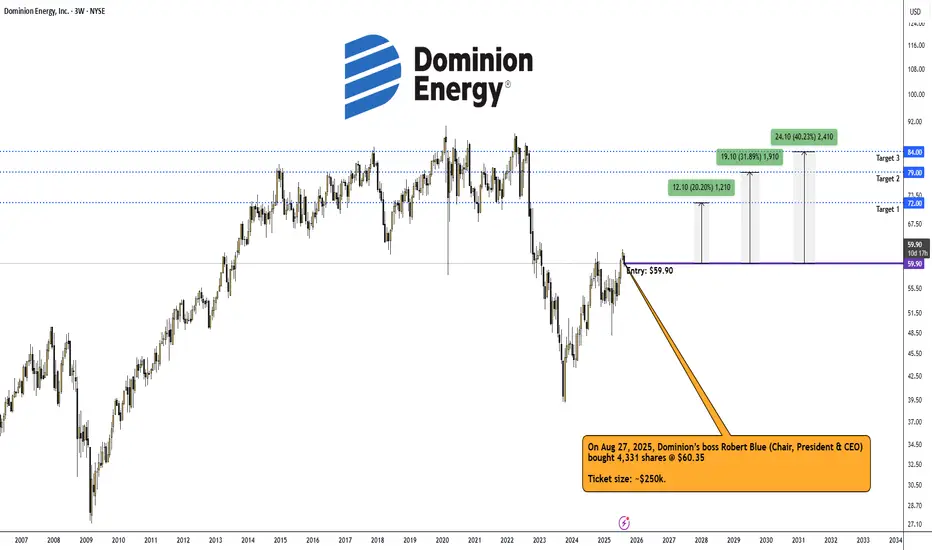

• (3W)

Insider Trades:

D Ownership:

4. Trade Setup

Entry: $59.90–$60.35 (right around CEO’s buy).

Targets:

➡️ Short-term: $72.00

➡️ Mid-term: $79.00

➡️ Long-term: $84.00

Takeaway

CEO’s dipping into his own pocket right after an earnings beat + with data-center growth at his back? That’s not charity. That’s conviction.

For me, $D looks like a buy/accumulate here with 20–40% upside over 6–12 months. Worst case you clip the dividend while waiting — not the worst seat in the house.

Overview: This report evaluates the recent open-market purchase of Dominion Energy (D) shares by its Chair, President, and CEO on August 27, 2025. Dominion, a leading regulated utility with a focus on transitioning to clean energy, is well-positioned amid surging electricity demand from data centers and renewable initiatives.

The insider activity, against a backdrop of solid Q2 earnings and strategic investments, suggests executive confidence in near-term value creation. This analysis is tailored for institutional investors seeking exposure to resilient utility plays with growth catalysts.

1. Insider Trading

On Aug 27, 2025, Dominion’s boss Robert Blue (Chair, President & CEO) bought 4,331 shares @ $60.35.

Ticket size: ~$250k. (SEC Form 4)

sec.gov/Archives/edgar/data/715957/000122520825007493/xslF345X05/doc4.xml

Not huge for a $50B utility, but it’s his first open-market buy since Mar ‘24. No insider sales on record. That’s a confidence move.

2. Fundamentals

• Q2 EPS: $0.75 (beat by 8.7%). Revenues $3.5B (+3% vs est).

• FY25 EPS guidance reaffirmed at $3.28–$3.52.

• Dividend yield ~4.5% — not bad while you wait.

• $50B capex plan (2025–2029) focused on data centers + renewables.

• Offshore wind project facing cost bumps, but still on track.

3. Big Picture

• Utilities usually move slow, but AI/data-center demand is a real tailwind.

• Dominion already hooked up 15 centers (1,000 MW) in 2024, another 15 on deck this year.

• SCC hearings Sept 2 on rate adjustments — could unlock recovery on those heavy investments.

Charts:

• (3W)

Insider Trades:

D Ownership:

4. Trade Setup

Entry: $59.90–$60.35 (right around CEO’s buy).

Targets:

➡️ Short-term: $72.00

➡️ Mid-term: $79.00

➡️ Long-term: $84.00

Takeaway

CEO’s dipping into his own pocket right after an earnings beat + with data-center growth at his back? That’s not charity. That’s conviction.

For me, $D looks like a buy/accumulate here with 20–40% upside over 6–12 months. Worst case you clip the dividend while waiting — not the worst seat in the house.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.