📉

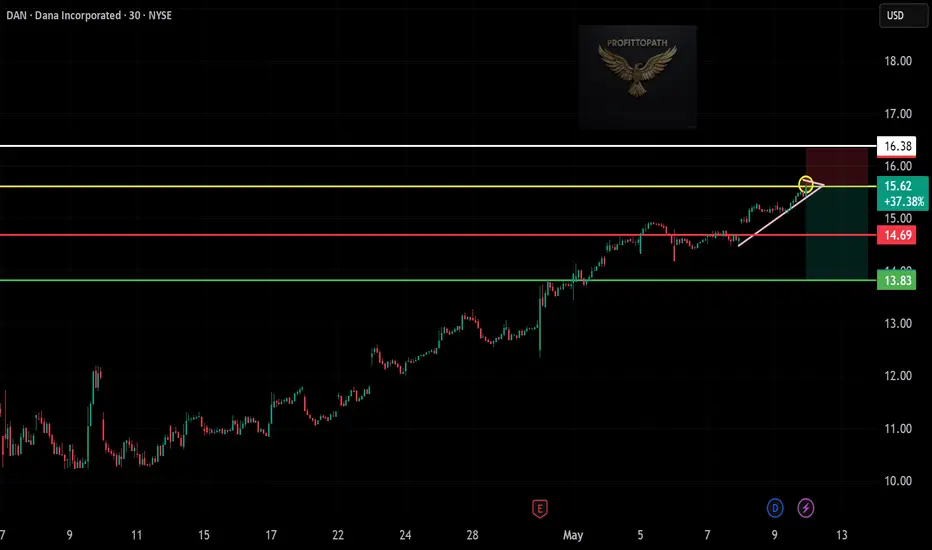

🔹 Asset: Dana Incorporated (NYSE: DAN)

🔹 Timeframe: 30-Minute Chart

🔹 Setup Type: Rising Wedge Breakdown (Trend Reversal)

📌 Trade Plan (Short Position)

✅ Entry Zone: Around $15.62 (Breakdown confirmation near wedge support)

✅ Stop-Loss (SL): Above $16.38 (Wedge invalidation / prior resistance)

🎯 Take Profit Targets

📌 TP1: $14.69 – Previous minor support

📌 TP2: $13.83 – Key support and breakout base

📊 Risk-Reward Calculation

📉 Risk: $16.38 - $15.62 = $0.76

📈 Reward to TP1: $15.62 - $14.69 = $0.93 → R/R = 1:1.22

📈 Reward to TP2: $15.62 - $13.83 = $1.79 → R/R = 1:2.35 ✅

🔍 Technical Highlights

📌 Rising wedge pattern nearing breakdown

📌 Slowing momentum with lower breakout volume

📌 Price testing yellow resistance with rejection

📌 Sharp trendline support—key for breakdown watch

📈 Execution Strategy

📊 Enter near $15.62 if breakdown confirms

📉 SL above $16.38 to protect from breakout trap

💰 TP1 at $14.69, TP2 near $13.83 for deeper move

🚨 Invalidation Risk

❌ Bullish close above $16.38 breaks bearish thesis

❌ Strong volume reversal = cancel trade

🚀 Final Take

✔ Reversal opportunity with favorable R:R

✔ Clean wedge breakdown setup

✔ Stay alert, manage risk — let trade prove itself

🔹 Asset: Dana Incorporated (NYSE: DAN)

🔹 Timeframe: 30-Minute Chart

🔹 Setup Type: Rising Wedge Breakdown (Trend Reversal)

📌 Trade Plan (Short Position)

✅ Entry Zone: Around $15.62 (Breakdown confirmation near wedge support)

✅ Stop-Loss (SL): Above $16.38 (Wedge invalidation / prior resistance)

🎯 Take Profit Targets

📌 TP1: $14.69 – Previous minor support

📌 TP2: $13.83 – Key support and breakout base

📊 Risk-Reward Calculation

📉 Risk: $16.38 - $15.62 = $0.76

📈 Reward to TP1: $15.62 - $14.69 = $0.93 → R/R = 1:1.22

📈 Reward to TP2: $15.62 - $13.83 = $1.79 → R/R = 1:2.35 ✅

🔍 Technical Highlights

📌 Rising wedge pattern nearing breakdown

📌 Slowing momentum with lower breakout volume

📌 Price testing yellow resistance with rejection

📌 Sharp trendline support—key for breakdown watch

📈 Execution Strategy

📊 Enter near $15.62 if breakdown confirms

📉 SL above $16.38 to protect from breakout trap

💰 TP1 at $14.69, TP2 near $13.83 for deeper move

🚨 Invalidation Risk

❌ Bullish close above $16.38 breaks bearish thesis

❌ Strong volume reversal = cancel trade

🚀 Final Take

✔ Reversal opportunity with favorable R:R

✔ Clean wedge breakdown setup

✔ Stay alert, manage risk — let trade prove itself

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.