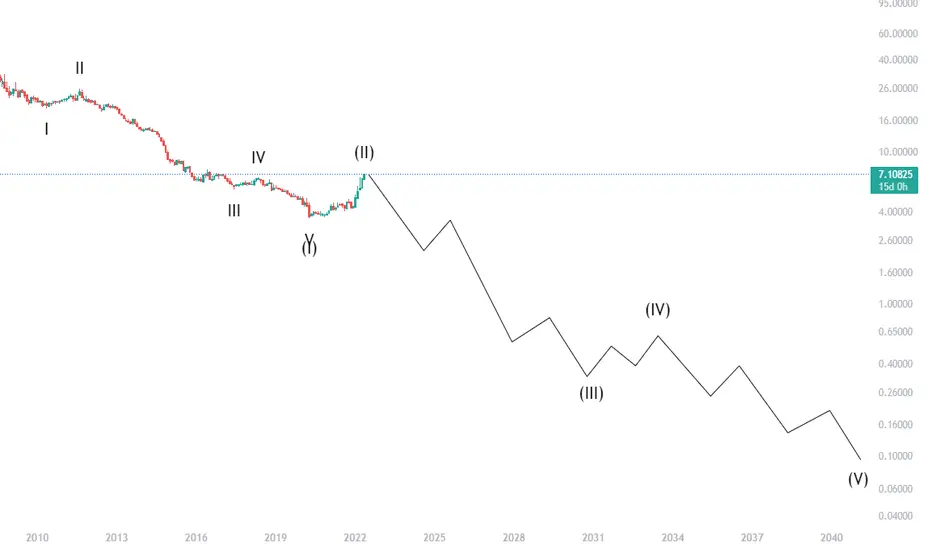

I have long said that commodities always go down over the long term. This chart shows that perfectly, and also adds on another component which is the well-known fact that stocks always go up over the long term. As a result, what we see is an index that only ever is in one of 2 states:

1) Pullback to the upside

2) Trending to the downside

Currently, we are in the first state, which is much rarer and provides far more opportunity. It allows us to actually short this chart! All you need to to is sell/short commodities, and buy stocks. This is the chance of a lifetime to short commodity markets at these bubble prices!

As the fed chokes the life out of risk assets and beats inflation to death, commodity prices will fall. As we discover new and amazing technology at an ever-increasing rate, commodity prices will fall and innovative stock will rise. When we finally reach a superintelligent AI which can help us find ways beyond our knowledge to make commodities, commodity prices will fall and innovative stock will rise. When we gain the ability to harvest the nearly infinite amount of precious metals such as gold from outer space, commodity prices will fall and innovative stock will rise.

Think of it as The Infinity Trade. Oil going to negative was just the start.

1) Pullback to the upside

2) Trending to the downside

Currently, we are in the first state, which is much rarer and provides far more opportunity. It allows us to actually short this chart! All you need to to is sell/short commodities, and buy stocks. This is the chance of a lifetime to short commodity markets at these bubble prices!

As the fed chokes the life out of risk assets and beats inflation to death, commodity prices will fall. As we discover new and amazing technology at an ever-increasing rate, commodity prices will fall and innovative stock will rise. When we finally reach a superintelligent AI which can help us find ways beyond our knowledge to make commodities, commodity prices will fall and innovative stock will rise. When we gain the ability to harvest the nearly infinite amount of precious metals such as gold from outer space, commodity prices will fall and innovative stock will rise.

Think of it as The Infinity Trade. Oil going to negative was just the start.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.