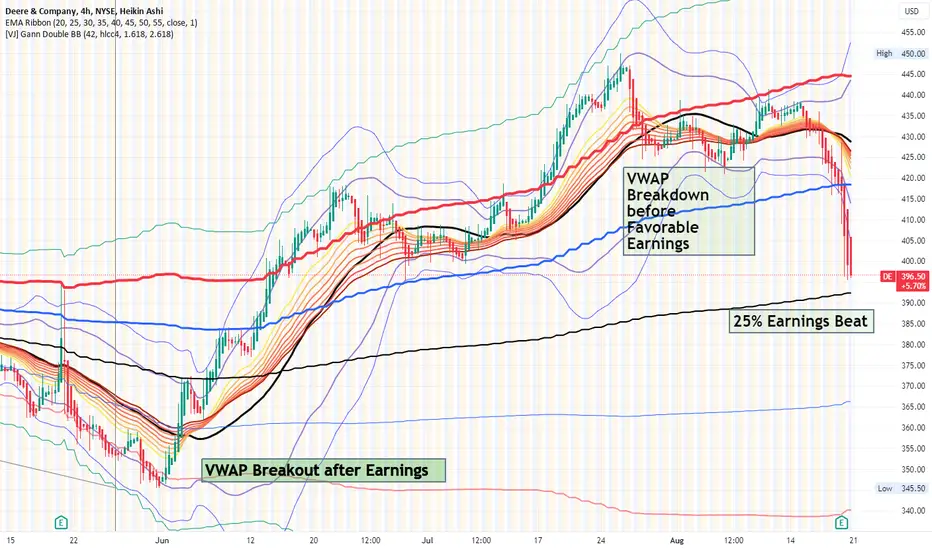

DE on the 4H chart is now setup for a long trade. It is now positioned just above a long term

anchored VWAP to which a stop loss can be set just below @ 390. DE was falling before

favorable earnings and has not yet reversed. I see this as an opportunity to trade an

industrial blue chip taking entry well below fair value and so a bargain.

I will get a mixture of a handfulof stock shares and a single option 4 months to expiration. The

target is selected to be 445 at the upper Bollinger bands confluent with the second deviation

line of the anchored VWAP. This is about 13% upside- while the option's profit potential is

substantially higher. If you would like to know the details of the call option leave a comment. (

if this idea is of interest considering liking and following :)

anchored VWAP to which a stop loss can be set just below @ 390. DE was falling before

favorable earnings and has not yet reversed. I see this as an opportunity to trade an

industrial blue chip taking entry well below fair value and so a bargain.

I will get a mixture of a handfulof stock shares and a single option 4 months to expiration. The

target is selected to be 445 at the upper Bollinger bands confluent with the second deviation

line of the anchored VWAP. This is about 13% upside- while the option's profit potential is

substantially higher. If you would like to know the details of the call option leave a comment. (

if this idea is of interest considering liking and following :)

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.