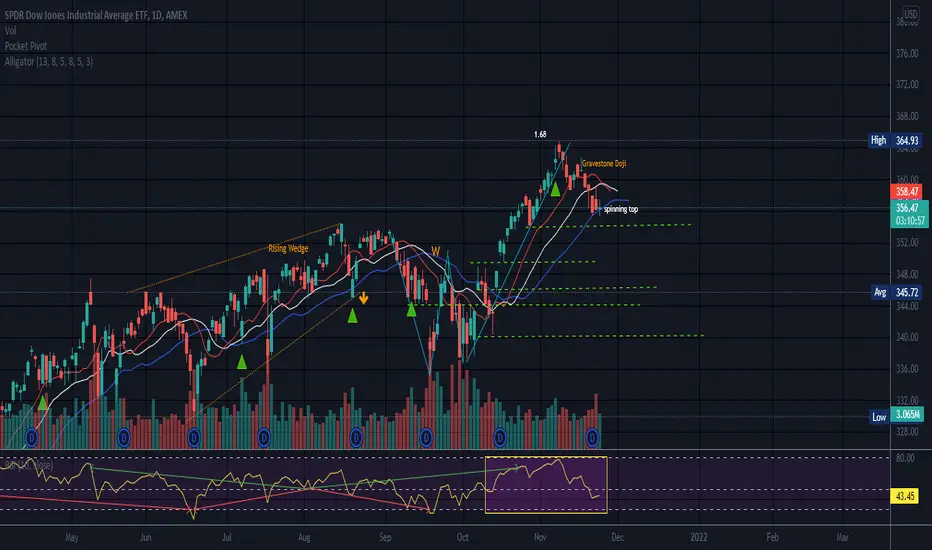

This looks like a crooked W, and seems most of the time Ws are bearish, but not always. The second leg of the W pushed up to the .786 and the last leg of the W ends at the 1.618. Quite a run up on that last leg up but price turned back down at almost exactly the 1.618, so this does line up as a bearish crab. A level of support can help DIA out.

There is also a bullish crab and it appears as a crooked M. If one is familiar with harmonic patterns, it is possible to go long or short on the different legs of the pattern, be it a bearish harmonic pattern or a bullish one.

Gravestone Doji noted close to the top. The Gravestone Doji is very similar to the Shooting Star pattern and both reversal candlesticks appear at the top of uptrends and have longer upper shadows. The main difference is Shooting Star has a visible body whose close price should be ideally below the open. The gravestone doji has no true candle body and the open is virtually at the close. The top wick on both of these candles is much longer than the body. The candle today keeps changing from a Doji to a spinning top. Both are candles of indecision.

No recommendation

There is also a bullish crab and it appears as a crooked M. If one is familiar with harmonic patterns, it is possible to go long or short on the different legs of the pattern, be it a bearish harmonic pattern or a bullish one.

Gravestone Doji noted close to the top. The Gravestone Doji is very similar to the Shooting Star pattern and both reversal candlesticks appear at the top of uptrends and have longer upper shadows. The main difference is Shooting Star has a visible body whose close price should be ideally below the open. The gravestone doji has no true candle body and the open is virtually at the close. The top wick on both of these candles is much longer than the body. The candle today keeps changing from a Doji to a spinning top. Both are candles of indecision.

No recommendation

Note

11/26 Ouch! Some look to the next support level when price passes one level and wait for the next, then reassess the situation when it gets there. If it passes that one, then they find the next one. Setting alerts can help.Note

The fib level reached by the bearish Crab should read 1.618 on the chart and this was a Bearish, not a bullish crab pattern. See the W pattern inside. Sometimes I am in outer space when I type (o:Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.