📊  DJI – Market Outlook Ahead of Inflation Data

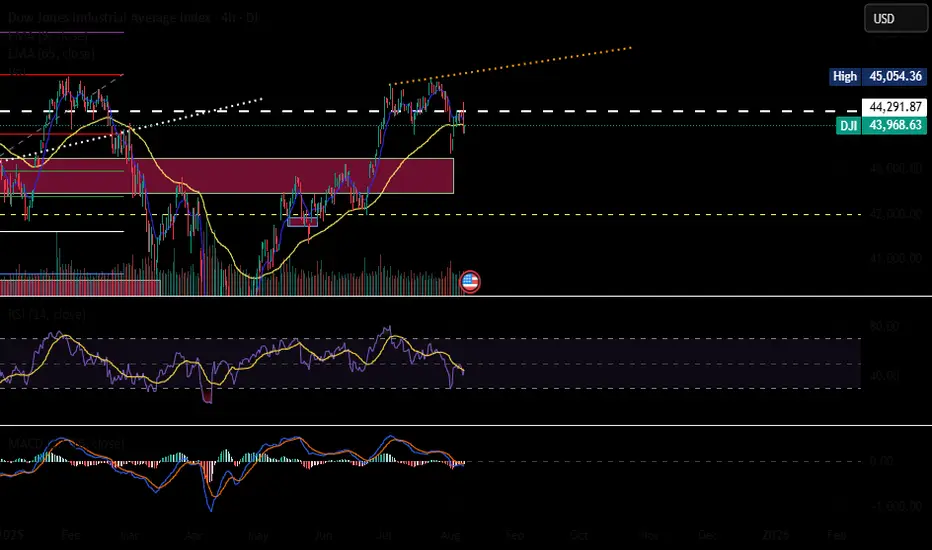

DJI – Market Outlook Ahead of Inflation Data

As we head into next week’s inflation report, market sentiment is showing signs of cautious optimism. Recent signals from China suggest a slowing in money supply growth, which could be part of an effort to stabilize domestic markets and control capital flows.

At the same time, the possibility of a 90-day truce in U.S.–China tensions may give investors some breathing room, especially around trade and supply chain concerns. If such a pause materializes, it could help maintain a temporary balance in global supply chains, reducing immediate inflationary pressures.

For the Dow Jones, this combination of monetary restraint in China and geopolitical stability—even if short-lived—may support a steadier market tone in the near term. However, the upcoming inflation data will be the key driver to confirm whether this calm can extend or if volatility will return.

As we head into next week’s inflation report, market sentiment is showing signs of cautious optimism. Recent signals from China suggest a slowing in money supply growth, which could be part of an effort to stabilize domestic markets and control capital flows.

At the same time, the possibility of a 90-day truce in U.S.–China tensions may give investors some breathing room, especially around trade and supply chain concerns. If such a pause materializes, it could help maintain a temporary balance in global supply chains, reducing immediate inflationary pressures.

For the Dow Jones, this combination of monetary restraint in China and geopolitical stability—even if short-lived—may support a steadier market tone in the near term. However, the upcoming inflation data will be the key driver to confirm whether this calm can extend or if volatility will return.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.