The North American online gambling sector is experiencing a surge, with companies like DraftKings and Evolution emerging as standout performers. In the past month, Evolution’s stock rose an impressive 15%, while DraftKings continues to show strong potential in the sports betting arena. As legal licenses expand across U.S. states, this industry is poised for significant growth, outpacing traditional benchmarks like the S&P 500.

Market Momentum and Company Highlights

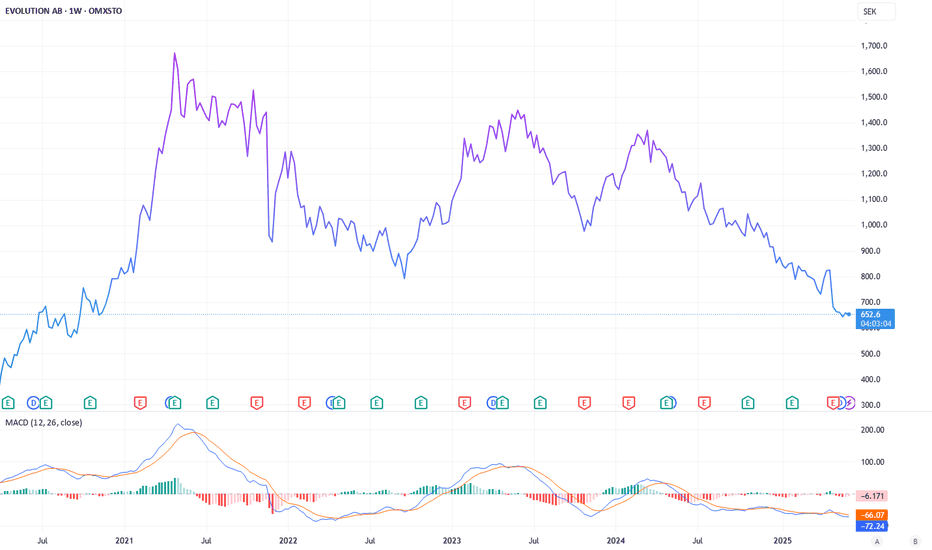

The online gambling market in North America is in a growth phase, largely due to the legalization of sports betting and casino operations. Evolution, a leader in online casino services, saw its stock climb to $41 as of June, with a market capitalization of $20.5 billion. Evolution's growth reflects the sector’s broader upward trend, bolstered by both stock appreciation and dividend payouts. DraftKings, meanwhile, dominates the sports betting space and is positioned as a future industry leader, capitalizing on the increasing availability of legal betting licenses.

The sector’s potential is fueled by untapped markets. Not all U.S. states have legalized gambling, meaning new licenses could significantly expand the user base. Analysts project a compound annual growth rate (CAGR) of 16.7% over the next 10–15 years, far exceeding the S&P 500’s historical average of 9.8% (or 6% adjusted for inflation since 1926). So, according to this growth trajectory, both companies could outperform broader market indices in the long term (by the way, we talked a lot about Evolution here):

Financial Performance and SBC Challenges

Despite their promise, both companies face financial challenges that investors should consider. DraftKings is currently unprofitable, with a net loss of $151 million over the last 12 months. The company is impacted by a substantial share-based compensation (SBC) expense of $550 million. SBC involves offering employees stock options or shares instead of cash to boost motivation. Such expense is recorded in profit and loss (P&L) statements as a "paper expense" without actual cash outflow. CrowdStrike is a similar case; excluding SBC would have turned a $400 million loss into a profit.

For DraftKings, this SBC-related drag has contributed to a recent dip in earnings per share. But the company is narrowing its losses, with accelerating revenue growth. Analysts anticipate a shift to positive net profit by late 2025 or early 2026, thanks to market share expansion. Evolution is also affected by SBC but benefits from a more established position, which supports its recent 15% stock gain and dividend payments.

Investment Appeal and Sector Dynamics

The growth potential of DraftKings and Evolution hinges on the evolving acceptance of gambling in North America. DraftKings is poised to lead in sports betting, while Evolution is set to dominate online casinos. The specialization reflects a market where younger generations are embracing regulated betting as a social activity. Let’s take as a little example two friends placing $2–3 bets on a game while watching at a bar. This cultural shift, coupled with legal expansions, underpins the sector’s robust outlook.

However, gambling’s stigma remains a consideration. Critics liken it to vices like alcohol or tobacco, but the industry counters that it targets controlled, recreational use rather than fostering addiction. With modern education and awareness—parents discussing gambling with children—the market is adapting to promote responsible engagement too, which may support long-term investment potential well.

Risks and Opportunities

Investing in DraftKings and Evolution carries risks, particularly the high SBC costs that inflate reported losses. Yet, this is offset by rapid revenue growth and a shrinking loss margin. The sector’s exclusion from major indices like the S&P 500

Over the next decade, the 16.7% CAGR suggests significant upside. DraftKings’ leadership in sports betting and Evolution’s casino dominance position them to outpace the S&P 500. For investors willing to navigate SBC-related volatility and societal perceptions, these stocks offer a compelling long-term bet.

A Niche Opportunity Worth Watching

DraftKings and Evolution represent a dynamic corner of the North American market, with growth rates that dwarf traditional indices. While SBC challenges and limited institutional backing pose hurdles, their revenue momentum and expanding legal landscape signal strong potential. As of Evolution and DraftKings showing similar promise, these stocks are worth considering for those seeking high-growth, niche investments. Proceed with due diligence, as the sector’s evolution will continue to shape its financial story.

CEO Mind-Money.eu

🌐 mind-money.eu

Personal website of Julia Khandoshko:

🌐 iuliia-khandoshko.com/

🌐 mind-money.eu

Personal website of Julia Khandoshko:

🌐 iuliia-khandoshko.com/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

CEO Mind-Money.eu

🌐 mind-money.eu

Personal website of Julia Khandoshko:

🌐 iuliia-khandoshko.com/

🌐 mind-money.eu

Personal website of Julia Khandoshko:

🌐 iuliia-khandoshko.com/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.