📉 DOCU Earnings Setup – IV Heavy, Bearish Skew, Max Pain Below 👇

🗓️ Earnings: June 5, 2025 (AMC) | ⏳ Expiry: June 6, 2025 (1D)

🎯 Strategy: Low-cost short-dated put targeting downside surprise

🔍 Multi-Model Consensus Summary

Model View Strike Premium Confidence Notes

Grok/xAI Moderately Bearish 93P 4.15 70% BE $88.85, high IV

Claude Moderately Bearish 91P 3.20 65% Max pain $89

Gemini Moderately Bearish 87P 1.77 65% BE $85.23, value setup

Llama Neutral / No Trade – – <60% Elevated IV, no edge

DeepSeek Bearish / No Trade – – <60% IV crush concern

⚙️ Setup Breakdown

Historical Move Range: ±8–12%

Implied Move: ±9.17% (~$8.60)

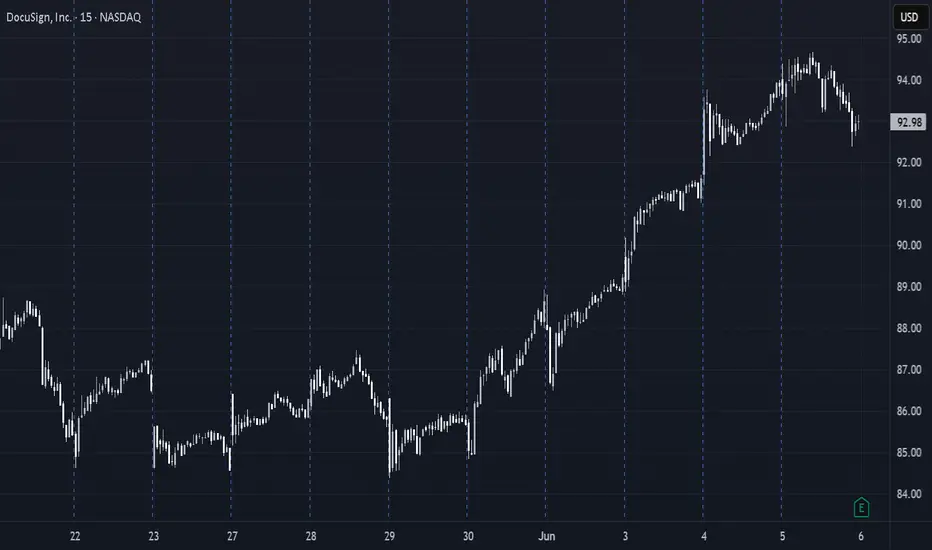

Price Position: $93.84, extended above 20MA

Volume: 1.64× average

IV Rank: 75th percentile → expect 40% IV crush post-earnings

Max Pain: $89 → downside magnet

Put/Call Skew: Bearish tilt (1.37), high flow at $84/$105

📈 Trade Setup (Short-Term Swing Put)

Parameter Value

Instrument DOCU

Direction PUT (SHORT)

Strike $87.00

Expiry 2025-06-06

Entry Price $1.77 (ask)

Breakeven $85.23

Profit Target $3.10 (75% gain)

Stop Loss $0.89 (50% loss)

Confidence 65%

Position Size 1 contract (~3% capital)

Entry Timing Before earnings close (6/5)

Exit Timing Next-day open (6/6)

⚠️ Key Risks

🟢 Strong beat or guidance → upside gap

⚫ IV Crush → premium collapse despite small drop

🟠 Broader tech strength could override stock-specific weakness

🔵 Put spread resistance near $84–$85 could slow downside

🧠 Final Take

DOCU is overextended into earnings, with elevated volatility and max pain $5 below spot. Most models lean moderately bearish, and the $87 put at $1.77 offers a favorable mix of premium, liquidity, and setup alignment. Risk/reward justifies taking the shot here—tight risk, high upside potential.

🗓️ Earnings: June 5, 2025 (AMC) | ⏳ Expiry: June 6, 2025 (1D)

🎯 Strategy: Low-cost short-dated put targeting downside surprise

🔍 Multi-Model Consensus Summary

Model View Strike Premium Confidence Notes

Grok/xAI Moderately Bearish 93P 4.15 70% BE $88.85, high IV

Claude Moderately Bearish 91P 3.20 65% Max pain $89

Gemini Moderately Bearish 87P 1.77 65% BE $85.23, value setup

Llama Neutral / No Trade – – <60% Elevated IV, no edge

DeepSeek Bearish / No Trade – – <60% IV crush concern

⚙️ Setup Breakdown

Historical Move Range: ±8–12%

Implied Move: ±9.17% (~$8.60)

Price Position: $93.84, extended above 20MA

Volume: 1.64× average

IV Rank: 75th percentile → expect 40% IV crush post-earnings

Max Pain: $89 → downside magnet

Put/Call Skew: Bearish tilt (1.37), high flow at $84/$105

📈 Trade Setup (Short-Term Swing Put)

Parameter Value

Instrument DOCU

Direction PUT (SHORT)

Strike $87.00

Expiry 2025-06-06

Entry Price $1.77 (ask)

Breakeven $85.23

Profit Target $3.10 (75% gain)

Stop Loss $0.89 (50% loss)

Confidence 65%

Position Size 1 contract (~3% capital)

Entry Timing Before earnings close (6/5)

Exit Timing Next-day open (6/6)

⚠️ Key Risks

🟢 Strong beat or guidance → upside gap

⚫ IV Crush → premium collapse despite small drop

🟠 Broader tech strength could override stock-specific weakness

🔵 Put spread resistance near $84–$85 could slow downside

🧠 Final Take

DOCU is overextended into earnings, with elevated volatility and max pain $5 below spot. Most models lean moderately bearish, and the $87 put at $1.77 offers a favorable mix of premium, liquidity, and setup alignment. Risk/reward justifies taking the shot here—tight risk, high upside potential.

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.