🚀 Dogecoin (DOGE) Market Update & Catalysts

🐋 Whale Accumulation & Trading Activity

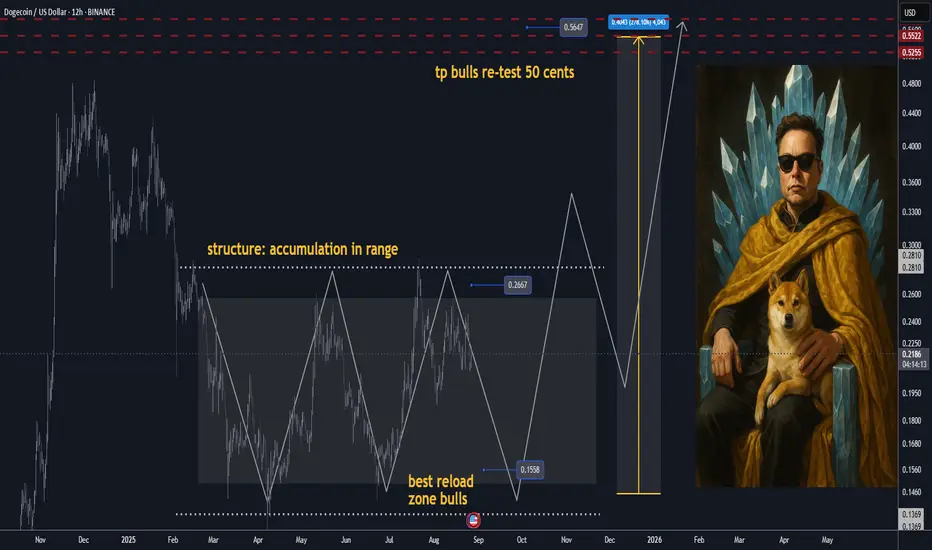

Large players (“whales”) have been steadily absorbing DOGE, fueling upward momentum. Recent market structure shows that bulls defended the $0.22 zone, while primary support and reload range sits at $0.15–$0.16 — the bottom of the accumulation range. A breakout above $0.25 could spark a run toward $0.40, especially if short positions get squeezed.

🏦 ETF Prospects & Institutional Tailwinds

Optimism is building around a potential Dogecoin Spot ETF, with growing speculation that approval could arrive in the next cycle. An ETF would open the doors for institutional capital, mirroring what happened with Bitcoin’s rally.

🔗 Expanding Utility (DogeOS & DeFi)

The development of DogeOS, which allows DOGE to interact with Ethereum DeFi ecosystems, could give the coin a major utility boost beyond its meme status. This evolution may help sustain higher valuations long-term.

📈 Technical Signals & Price Forecasts

Chart patterns are turning favorable:

Golden cross (50-day MA crossing the 200-day) shows momentum strength.

Oversold RSI signals suggest a potential reversal upward.

If support at $0.15–$0.16 holds and bulls reclaim $0.25, upside targets expand to $0.34–$0.40.

🔮 Bullish Scenarios & Analyst Sentiment

Mid-term projections highlight possible price zones:

Conservative path: $0.30–$0.33 into 2025.

Aggressive path: Retesting all-time highs near $1 if institutional demand + ETF + DeFi traction align.

🌟 Key Positive Catalysts

🔑 Catalyst 🚀 Impact

🐋 Whale absorption & accumulation Strengthens base; short squeezes possible.

🏦 Spot ETF approval potential Brings institutional demand.

📊 Technical bullish patterns Golden cross + RSI suggest uptrend.

🔗 DogeOS & DeFi integration Expands DOGE’s real-world use cases.

💬 Strong community + hype Keeps DOGE in the spotlight.

✅ Summary

Dogecoin is holding its accumulation base at $0.15–$0.16, with strong whale support and growing catalysts like ETFs and DeFi integration. If bulls can reclaim the $0.25–$0.26 zone, momentum could build toward $0.40 in the mid-term — with long-term upside scenarios eyeing $1+ if institutional and utility drivers align.

🐋 Whale Accumulation & Trading Activity

Large players (“whales”) have been steadily absorbing DOGE, fueling upward momentum. Recent market structure shows that bulls defended the $0.22 zone, while primary support and reload range sits at $0.15–$0.16 — the bottom of the accumulation range. A breakout above $0.25 could spark a run toward $0.40, especially if short positions get squeezed.

🏦 ETF Prospects & Institutional Tailwinds

Optimism is building around a potential Dogecoin Spot ETF, with growing speculation that approval could arrive in the next cycle. An ETF would open the doors for institutional capital, mirroring what happened with Bitcoin’s rally.

🔗 Expanding Utility (DogeOS & DeFi)

The development of DogeOS, which allows DOGE to interact with Ethereum DeFi ecosystems, could give the coin a major utility boost beyond its meme status. This evolution may help sustain higher valuations long-term.

📈 Technical Signals & Price Forecasts

Chart patterns are turning favorable:

Golden cross (50-day MA crossing the 200-day) shows momentum strength.

Oversold RSI signals suggest a potential reversal upward.

If support at $0.15–$0.16 holds and bulls reclaim $0.25, upside targets expand to $0.34–$0.40.

🔮 Bullish Scenarios & Analyst Sentiment

Mid-term projections highlight possible price zones:

Conservative path: $0.30–$0.33 into 2025.

Aggressive path: Retesting all-time highs near $1 if institutional demand + ETF + DeFi traction align.

🌟 Key Positive Catalysts

🔑 Catalyst 🚀 Impact

🐋 Whale absorption & accumulation Strengthens base; short squeezes possible.

🏦 Spot ETF approval potential Brings institutional demand.

📊 Technical bullish patterns Golden cross + RSI suggest uptrend.

🔗 DogeOS & DeFi integration Expands DOGE’s real-world use cases.

💬 Strong community + hype Keeps DOGE in the spotlight.

✅ Summary

Dogecoin is holding its accumulation base at $0.15–$0.16, with strong whale support and growing catalysts like ETFs and DeFi integration. If bulls can reclaim the $0.25–$0.26 zone, momentum could build toward $0.40 in the mid-term — with long-term upside scenarios eyeing $1+ if institutional and utility drivers align.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.