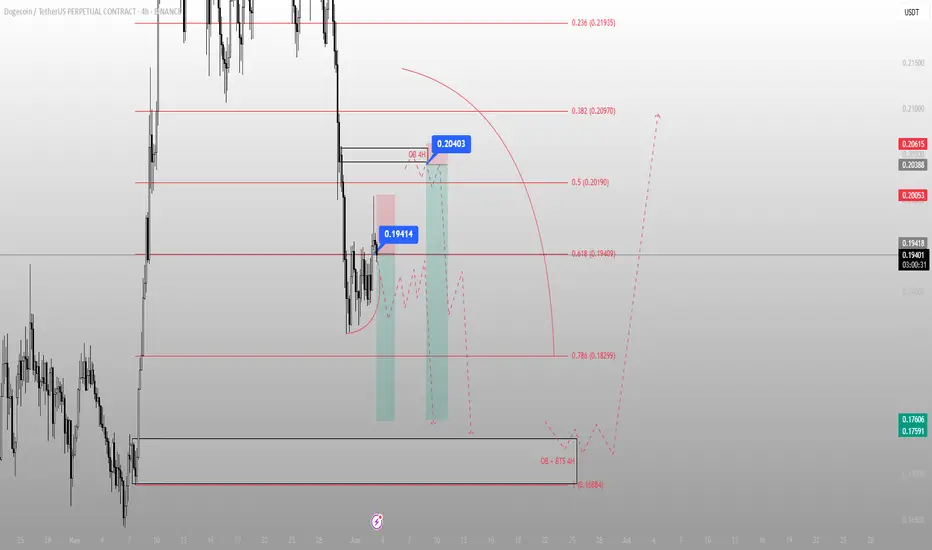

Here’s the setup:

Price tapped into the 4H discount zone — a structural STB

We’re now reacting from the 0.618 (0.1940) and pushing up toward the 4H OB at 0.20403

That OB is perfectly nested just above the 0.5 fib (0.20190), and below the 0.382 (0.20970) — prime for internal liquidity collection

If price fails to break structure above that 4H OB, the move is complete. This isn’t bullish continuation — it’s cleanup. From there, I’m watching closely for signs of rejection and displacement back toward the OB + BTS zone near 0.16884.

This is where real risk is priced in — and where Smart Money actually loads up.

Execution mindset:

Let price reach into 0.204–0.209

Watch for rejection — that’s the trigger

Downside target: 0.18299 → 0.16884

If we impulsively break 0.2097 and reclaim it, the bearish thesis is invalidated and I’ll re-evaluate

This isn’t trading a bounce. It’s reading the cleanup.

You want real entries, real invalidations, real structure? Check the profile description. The trades speak louder than the noise.

Smart Money signals. Hourly trades. More Signals here

📍Telegram: t.me/smartflowblog

📍Telegram: t.me/smartflowblog

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Smart Money signals. Hourly trades. More Signals here

📍Telegram: t.me/smartflowblog

📍Telegram: t.me/smartflowblog

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.