This was a textbook setup. Clean structure, high-probability narrative, and the kind of zone that doesn’t ask for your belief — it commands it.

Breakdown:

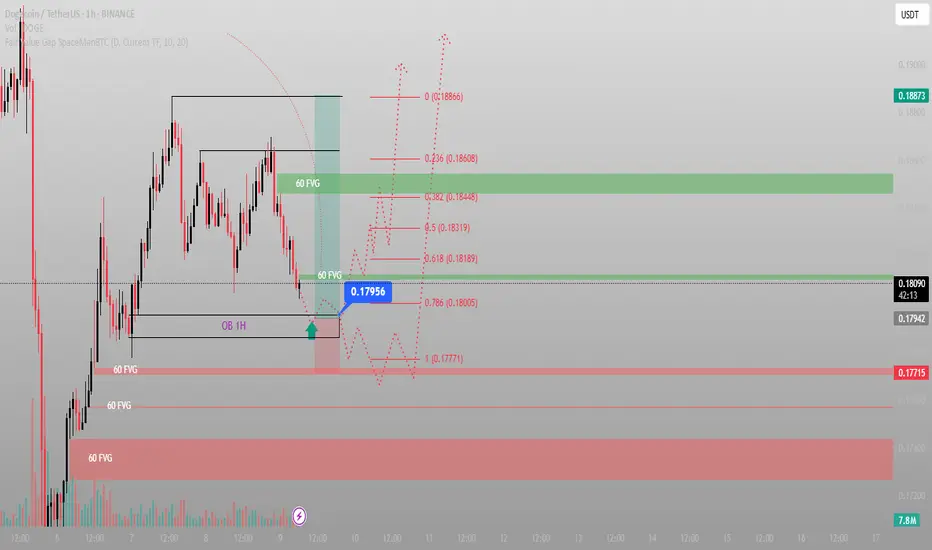

Price delivered a sharp move into a 1H OB confluence with an untouched 60min FVG sitting just below. That OB wasn’t noise — it was a true origin point, the last down candle before a major rally.

As price retraced, it swept short-term liquidity and tapped into that OB with precision. I watched volume spike on the drop — not retail fear, but Smart Money engineering the entry.

The 0.1795 zone wasn’t random. It was deliberate. A key equilibrium between displacement and rebalancing. And if this holds, the next logical draw is above 0.1860 — into the unmitigated FVG and resting buy-side liquidity.

Expectation:

From this 1H OB / FVG stack, I’m looking for:

Entry: ~0.1795

SL: Just under the 1.0 fib — under 0.1777

TP1: Mid FVG at 0.1831 (0.5)

TP2: Full inefficiency fill at 0.1887

I’m not forcing anything. If the market wants lower, there’s another FVG just below to absorb it — but structure still favors premium re-pricing.

Final note:

I don’t chase breakouts. I trap Smart Money setups, wait in silence — and strike when the chart gives me the story.

“The market doesn’t move by chance. It moves by design. And I design my trades the same way.”

Breakdown:

Price delivered a sharp move into a 1H OB confluence with an untouched 60min FVG sitting just below. That OB wasn’t noise — it was a true origin point, the last down candle before a major rally.

As price retraced, it swept short-term liquidity and tapped into that OB with precision. I watched volume spike on the drop — not retail fear, but Smart Money engineering the entry.

The 0.1795 zone wasn’t random. It was deliberate. A key equilibrium between displacement and rebalancing. And if this holds, the next logical draw is above 0.1860 — into the unmitigated FVG and resting buy-side liquidity.

Expectation:

From this 1H OB / FVG stack, I’m looking for:

Entry: ~0.1795

SL: Just under the 1.0 fib — under 0.1777

TP1: Mid FVG at 0.1831 (0.5)

TP2: Full inefficiency fill at 0.1887

I’m not forcing anything. If the market wants lower, there’s another FVG just below to absorb it — but structure still favors premium re-pricing.

Final note:

I don’t chase breakouts. I trap Smart Money setups, wait in silence — and strike when the chart gives me the story.

“The market doesn’t move by chance. It moves by design. And I design my trades the same way.”

Smart Money signals. Hourly trades.

📍Telegram: t.me/smartflowblog

📍Telegram: t.me/smartflowblog

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Smart Money signals. Hourly trades.

📍Telegram: t.me/smartflowblog

📍Telegram: t.me/smartflowblog

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.