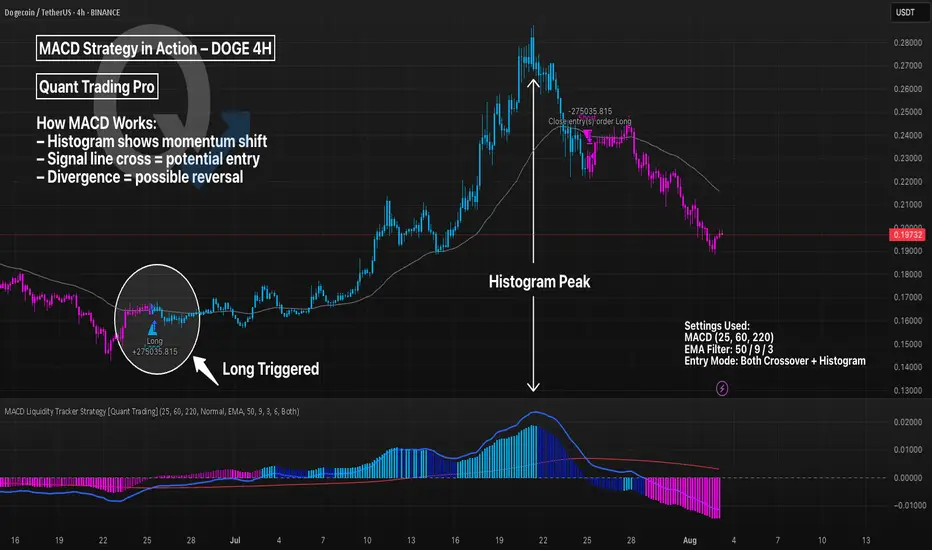

The MACD (Moving Average Convergence Divergence) is a trend-following momentum indicator. It uses two EMAs to generate signals via crossovers and histogram shifts.

This chart shows DOGE 4H with a long-only MACD Liquidity Tracker Strategy, using:

Fast EMA: 25

Slow EMA: 60

Signal Line: 220

These longer settings reduce noise and provide higher-conviction swing entries, though at the cost of late signals.

💡 Tweak Tip:

Lower values (e.g. 12/26/9) = more signals, better for scalping

Higher values (e.g. 25/60/220) = fewer signals, better trend filtering

Adjust the EMA filter (50/9/3 here) to match asset volatility

📊 Use MACD for:

Trend continuation confirmation

Exit timing via histogram fading

Divergence spotting (momentum vs price)

This chart shows DOGE 4H with a long-only MACD Liquidity Tracker Strategy, using:

Fast EMA: 25

Slow EMA: 60

Signal Line: 220

These longer settings reduce noise and provide higher-conviction swing entries, though at the cost of late signals.

💡 Tweak Tip:

Lower values (e.g. 12/26/9) = more signals, better for scalping

Higher values (e.g. 25/60/220) = fewer signals, better trend filtering

Adjust the EMA filter (50/9/3 here) to match asset volatility

📊 Use MACD for:

Trend continuation confirmation

Exit timing via histogram fading

Divergence spotting (momentum vs price)

Try our strategy optimizer at quanttradingpro.com

Developing free strategies weekly stay tuned...

Join our discord discord.gg/2systG9frc

We provide education & tools.

Developing free strategies weekly stay tuned...

Join our discord discord.gg/2systG9frc

We provide education & tools.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Try our strategy optimizer at quanttradingpro.com

Developing free strategies weekly stay tuned...

Join our discord discord.gg/2systG9frc

We provide education & tools.

Developing free strategies weekly stay tuned...

Join our discord discord.gg/2systG9frc

We provide education & tools.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.