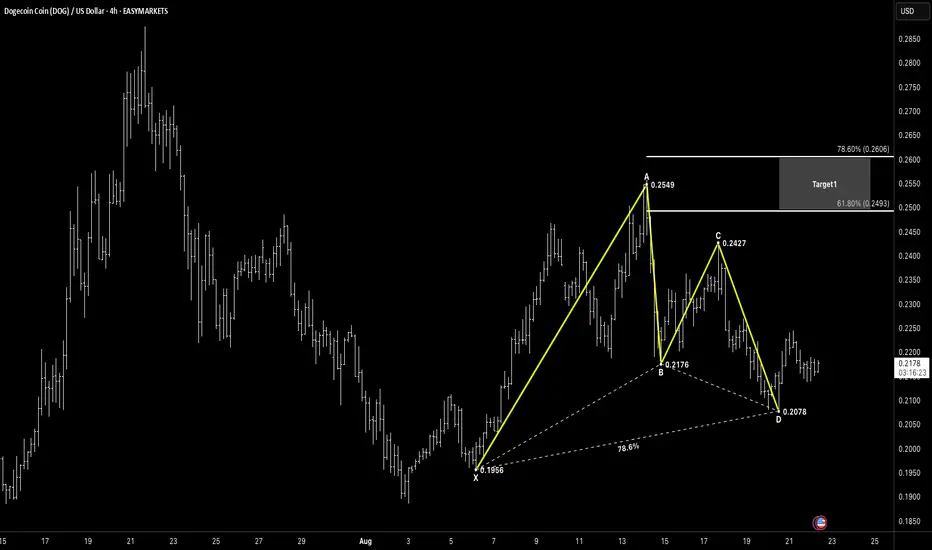

DOGE/USD (4H) – Bullish Gartley at D (Reversal → T1/T2)

Quick summer check-in while I sneak some downtime: DOGE just printed a clean Gartley-style completion and buyers are reacting at D.

📌 Pattern Overview

Pattern: Gartley (Bullish)

Asset: Dogecoin / USD

Timeframe: 4H

Bias: Long from D/PRZ on confirmation and structure reclaim

🔑 Key Levels

X: 0.1956

A: 0.2549

B: 0.2176 (shallow retrace of XA)

C: 0.2427

D (PRZ): 0.2078 (confluence with XA fib + AB=CD symmetry)

Target 1: 0.2493 – 0.2606 (≈ 61.8%–78.6% of AD)

Target 2: 0.2933 – 0.3165 (≈ 127.2%–161.8% extension)

📐 Technical Confirmation

BC retrace ≈ 67% of AB, CD ≈ 1.27–1.41 × BC into D.

Confluence at 0.207–0.210 forms the PRZ; first bullish reaction printed.

Structure pivot to watch: 0.224–0.226 (break/hold confirms momentum).

⚡️ Price Action & Trade Setup

Plan A (confirmation): Wait for a close above 0.224–0.226, buy the retest → T1, trail remainder toward T2.

Plan B (PRZ fade): Scale in small on holds within 0.208–0.212 with a tight stop; add on higher-low + pivot reclaim.

🧠 Market Sentiment

Choppy, but dip-buyers active near structure lows; holding above D keeps the recovery path open.

📊 Next Potential Movements

Upside path: 0.226 → 0.235 → 0.249–0.261 (T1), extension toward 0.293–0.317 (T2) if momentum broadens.

Pullbacks: 0.214 / 0.210 are spots to defend for higher-low continuation.

🛡 Risk Management

Invalidation: clean close below 0.2078 (D); conservative invalidation below 0.1956 (X).

Stops: just under 0.205 (aggressive) or < 0.195 (structure).

TP: scale at T1, trail to T2; move stop to BE after ~1R.

🚀 Conclusion

Gartley completion at D is holding. A firm 0.224–0.226 reclaim unlocks T1 (0.249–0.261), with room toward T2 (0.293–0.317) if buyers keep control.

“Patterns set the map — discipline drives the journey.”

@TRADECHARTPATTERNSLIKETHEPROS.

Quick summer check-in while I sneak some downtime: DOGE just printed a clean Gartley-style completion and buyers are reacting at D.

📌 Pattern Overview

Pattern: Gartley (Bullish)

Asset: Dogecoin / USD

Timeframe: 4H

Bias: Long from D/PRZ on confirmation and structure reclaim

🔑 Key Levels

X: 0.1956

A: 0.2549

B: 0.2176 (shallow retrace of XA)

C: 0.2427

D (PRZ): 0.2078 (confluence with XA fib + AB=CD symmetry)

Target 1: 0.2493 – 0.2606 (≈ 61.8%–78.6% of AD)

Target 2: 0.2933 – 0.3165 (≈ 127.2%–161.8% extension)

📐 Technical Confirmation

BC retrace ≈ 67% of AB, CD ≈ 1.27–1.41 × BC into D.

Confluence at 0.207–0.210 forms the PRZ; first bullish reaction printed.

Structure pivot to watch: 0.224–0.226 (break/hold confirms momentum).

⚡️ Price Action & Trade Setup

Plan A (confirmation): Wait for a close above 0.224–0.226, buy the retest → T1, trail remainder toward T2.

Plan B (PRZ fade): Scale in small on holds within 0.208–0.212 with a tight stop; add on higher-low + pivot reclaim.

🧠 Market Sentiment

Choppy, but dip-buyers active near structure lows; holding above D keeps the recovery path open.

📊 Next Potential Movements

Upside path: 0.226 → 0.235 → 0.249–0.261 (T1), extension toward 0.293–0.317 (T2) if momentum broadens.

Pullbacks: 0.214 / 0.210 are spots to defend for higher-low continuation.

🛡 Risk Management

Invalidation: clean close below 0.2078 (D); conservative invalidation below 0.1956 (X).

Stops: just under 0.205 (aggressive) or < 0.195 (structure).

TP: scale at T1, trail to T2; move stop to BE after ~1R.

🚀 Conclusion

Gartley completion at D is holding. A firm 0.224–0.226 reclaim unlocks T1 (0.249–0.261), with room toward T2 (0.293–0.317) if buyers keep control.

“Patterns set the map — discipline drives the journey.”

@TRADECHARTPATTERNSLIKETHEPROS.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.