A shale specialist with big dividends, when the price is right.

Devon Energy is a U.S.-based oil and gas company focused on domestic shale production, particularly in the Delaware Basin, one of the most cost-efficient regions. It’s known for paying a “variable dividend”, meaning payouts rise when profits rise, and shrink when oil prices fall.

With its smaller size, Devon is more volatile than oil giants, but also more agile when prices are strong.

✅ Key Strengths:

- High dividends when oil prices are elevated.

- Efficient, low-cost production in the Delaware Basin.

- Strong upside when Brent crude rises.

⚠️ Potential Risks:

- Dividends decrease sharply if oil prices fall.

- More price swings due to smaller market cap and higher sensitivity.

📈 Technical View

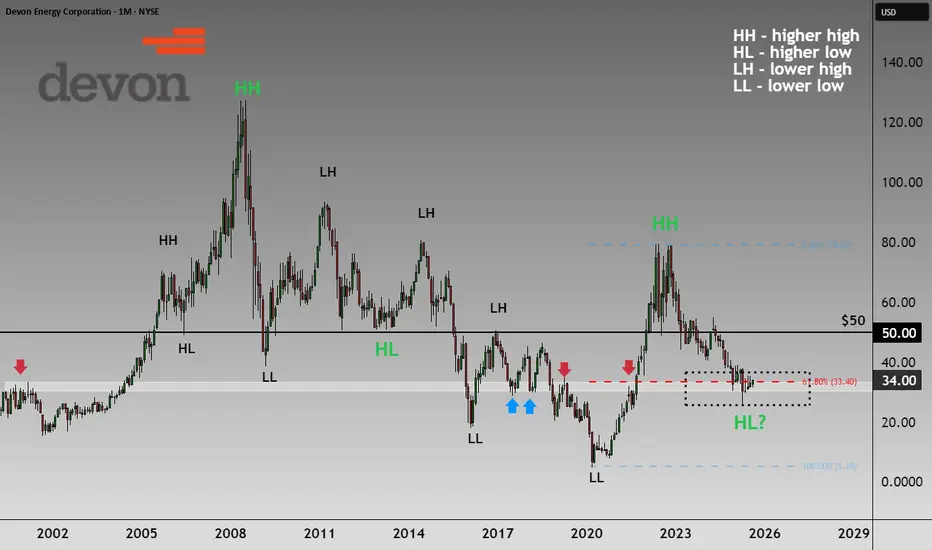

As someone who appreciates structure in technical analysis, I have to say: this chart is a gem. Clean movements, clear tops and visually logical price behaviors.

Let me break it down:

From its all-time high in 2008, DVN went through a long downtrend — making a series of lower highs (LH) and lower lows (LL). For over a decade, buyers couldn’t gain control, even for short-term higher highs.

But that changed in 2020.

That rally brought a long-awaited structural shift: a higher high (HH), meaning buyers finally pushed the price above a previous high. The trend reversed, and the sentiment flipped.

Now what?

The stock has done a textbook pullback, a normal retracement after a strong move.

It currently sits at a critical technical confluence zone:

- The 61.8% Fibonacci retracement (often referred to as the “golden ratio”)

- A well-defined horizontal support level

- Structurally healthy trend

- Clear prior breakout

👉 Technically, this is a sound setup: structure + support + healthy trend. If buyers defend here, upside potential is strong.

Regards,

Vaido

This post is for educational purposes only and reflects my personal opinion, not investment advice.

Devon Energy is a U.S.-based oil and gas company focused on domestic shale production, particularly in the Delaware Basin, one of the most cost-efficient regions. It’s known for paying a “variable dividend”, meaning payouts rise when profits rise, and shrink when oil prices fall.

With its smaller size, Devon is more volatile than oil giants, but also more agile when prices are strong.

✅ Key Strengths:

- High dividends when oil prices are elevated.

- Efficient, low-cost production in the Delaware Basin.

- Strong upside when Brent crude rises.

⚠️ Potential Risks:

- Dividends decrease sharply if oil prices fall.

- More price swings due to smaller market cap and higher sensitivity.

📈 Technical View

As someone who appreciates structure in technical analysis, I have to say: this chart is a gem. Clean movements, clear tops and visually logical price behaviors.

Let me break it down:

From its all-time high in 2008, DVN went through a long downtrend — making a series of lower highs (LH) and lower lows (LL). For over a decade, buyers couldn’t gain control, even for short-term higher highs.

But that changed in 2020.

That rally brought a long-awaited structural shift: a higher high (HH), meaning buyers finally pushed the price above a previous high. The trend reversed, and the sentiment flipped.

Now what?

The stock has done a textbook pullback, a normal retracement after a strong move.

It currently sits at a critical technical confluence zone:

- The 61.8% Fibonacci retracement (often referred to as the “golden ratio”)

- A well-defined horizontal support level

- Structurally healthy trend

- Clear prior breakout

👉 Technically, this is a sound setup: structure + support + healthy trend. If buyers defend here, upside potential is strong.

Regards,

Vaido

This post is for educational purposes only and reflects my personal opinion, not investment advice.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.