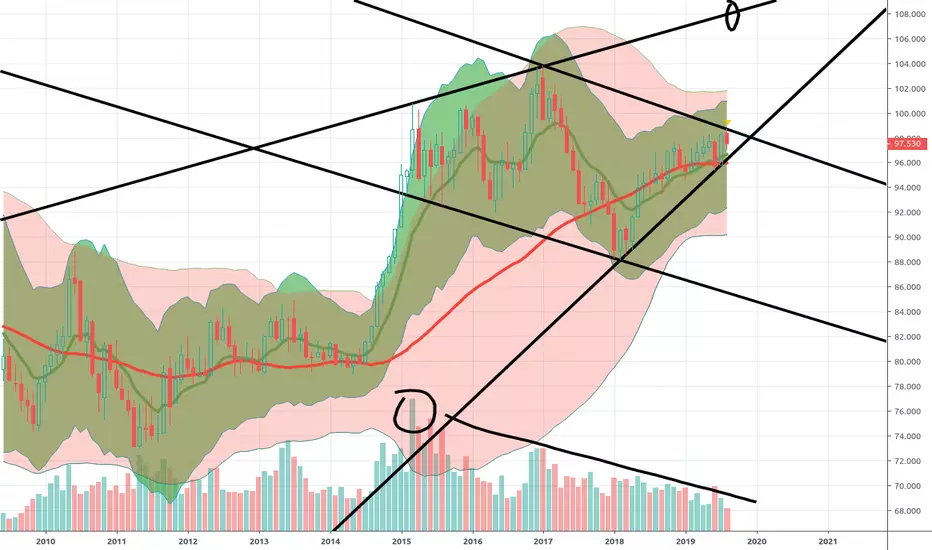

this diamond pattern most assume would be a top, but in some circumstances, it can be a continuation. based on past instances of deflation my best guess would say this is a continuation. during periods of deflation currency/buying power increases due to falling prices and the incentive to hold for further falling prices. with global currencies weakening in response to lowering bond yields and a potential wait and see fed the dollar may get a nice kicker to unimagined heights. i firmly stand with the deflationary scenario similar to the 1980's pre-plaza accord. basically the japanese and US were competiting very similarly to the US and China today. the dollar got out of control until the plaza accord when global finance ministers/central bankers all met up and agreed upon a dollar devaluation (global reset). this is the scenario i'd look for and similarly to then i would look to Chinese stocks/back then thats when the Japanese bubble went crazy insane.

so

1) let the deflation narrative/dollar run high

2) global reset via finance ministers/CB's devaluing the dollar

3) buy chinese stocks and let the bubble (hyperinflation in china) go beyond what's sustainable

so

1) let the deflation narrative/dollar run high

2) global reset via finance ministers/CB's devaluing the dollar

3) buy chinese stocks and let the bubble (hyperinflation in china) go beyond what's sustainable

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.