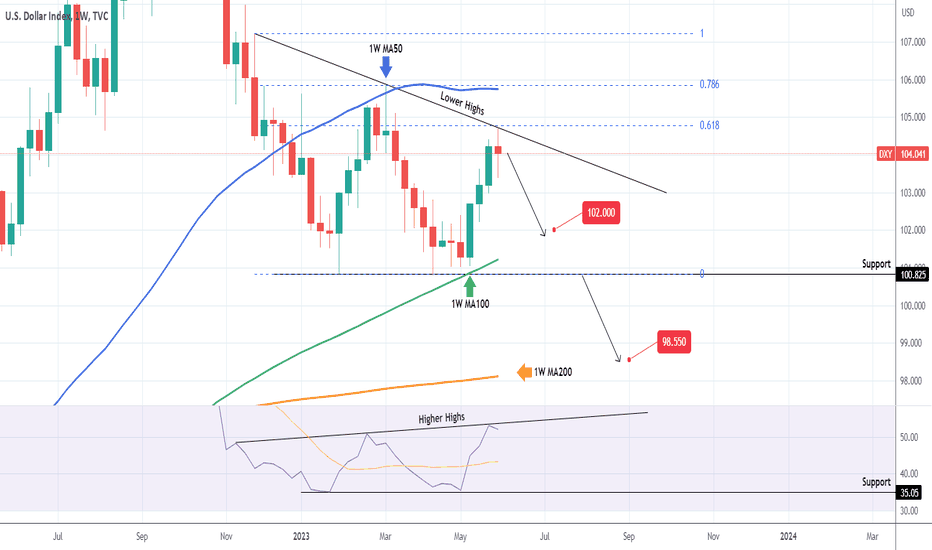

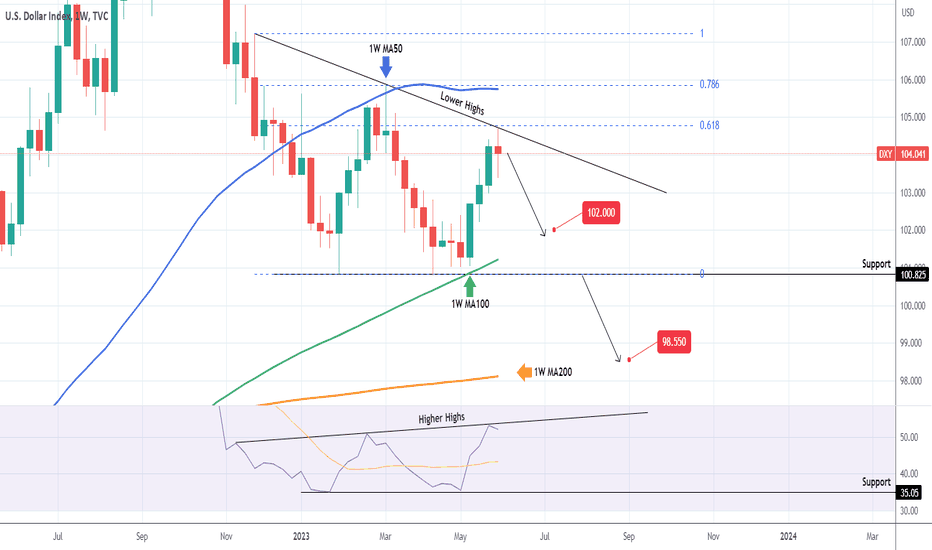

Last time we looked at the U.S. Dollar Index (DXY) we gave a sell signal on the exact top, the Lower Highs trend-line (chart below):

Our first target (102.000) got hit, which was basically the 1W MA100 (green trend-line) that supported on the May 08 bounce. This week, that trend-line broke emphatically (also the 100.825 Support) and that is a strong bearish break-out signal. Technically the 1W MA200 (orange trend-line) is next, which has been our second target (98.550) since our June 04 analysis.

Notice also that even the 1W RSI broke below its 35.05 Support, a clear indication that the long-term strength has shifted to bearish.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Our first target (102.000) got hit, which was basically the 1W MA100 (green trend-line) that supported on the May 08 bounce. This week, that trend-line broke emphatically (also the 100.825 Support) and that is a strong bearish break-out signal. Technically the 1W MA200 (orange trend-line) is next, which has been our second target (98.550) since our June 04 analysis.

Notice also that even the 1W RSI broke below its 35.05 Support, a clear indication that the long-term strength has shifted to bearish.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.