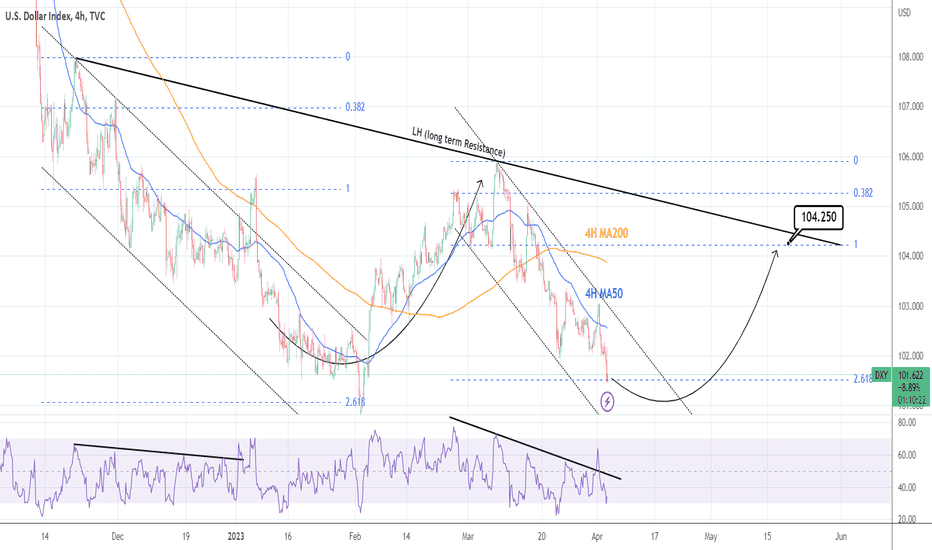

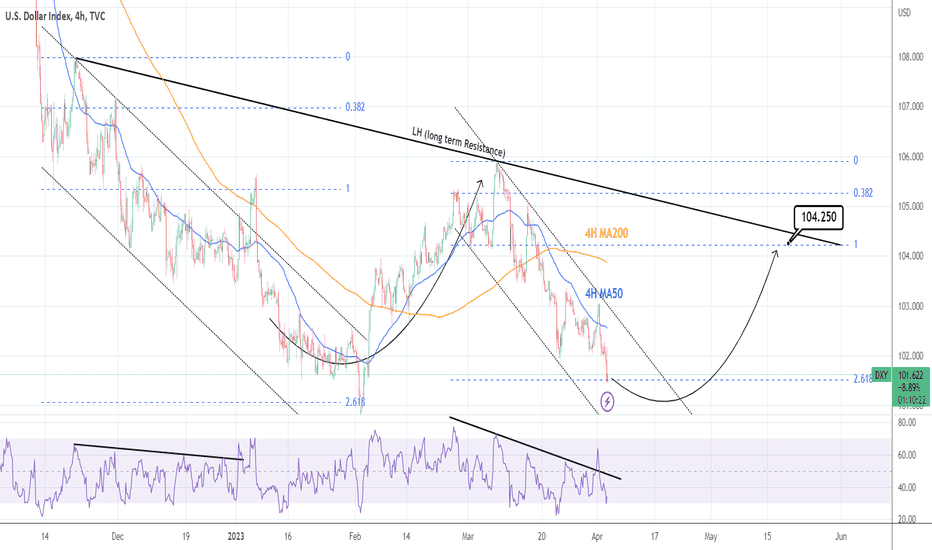

The U.S. Dollar Index is rising on an almost overbought 1D technical timeframe (RSI = 69.699, MACD = 0.650, ADX = 30.040) supported by a HL trendline. Following the 1D Golden Cross (first since July 26th 2021), it is now facing the most important Resistance for the long term, R1 at 105.900.

We will go long if a 1D candle closes over it and target the R2 level (TP = 108.000) and sell if rejected and target the 0.382 Fibonacci level (TP = 103.500). It has to be said that the 1D RSI has turned sideways since August 25th. This is a potential sign that the bullish trend is losing strength.

Prior idea:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

We will go long if a 1D candle closes over it and target the R2 level (TP = 108.000) and sell if rejected and target the 0.382 Fibonacci level (TP = 103.500). It has to be said that the 1D RSI has turned sideways since August 25th. This is a potential sign that the bullish trend is losing strength.

Prior idea:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Telegram: t.me/investingscope

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Telegram: t.me/investingscope

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.