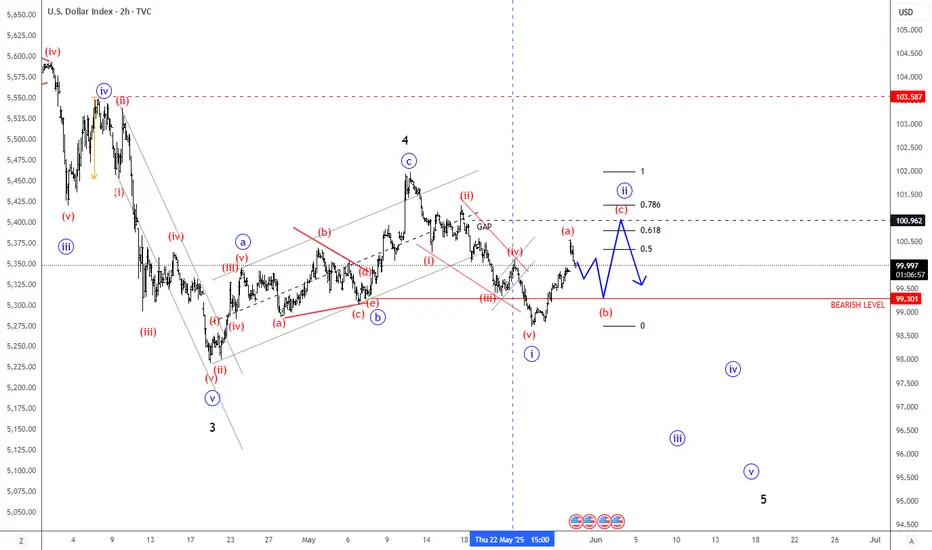

Good morning traders! Stocks keep pushing higher along with yields, so it looks like 10Y US Notes could still see lower support levels, and that’s why USdollar is in a bigger intraday correction. What we want to say is that while the 10Y US Notes are still searching for support, the DXY can stay in recovery mode or at least sideways. In the meantime, stocks can easily see even higher levels after NVIDIA surpassed earnings.

Looking at the intraday USDollar Index – DXY chart, we see a leading diagonal formation, so we are tracking now an intraday abc correction before a bearish continuation, thus keep an eye on GAP from May 18 around 101 level that can be filled and may act as a resistance before a bearish continuation.

Looking at the intraday USDollar Index – DXY chart, we see a leading diagonal formation, so we are tracking now an intraday abc correction before a bearish continuation, thus keep an eye on GAP from May 18 around 101 level that can be filled and may act as a resistance before a bearish continuation.

US Single STOCKS (FREE Access), FX, Crypto

👉Explore Our Services @ wavetraders.com/elliott-wave-plans/

Learn Elliott Waves

👉 wavetraders.com/academy/

Newsletter Sign up

👉 bit.ly/3FVPVzO

👉Explore Our Services @ wavetraders.com/elliott-wave-plans/

Learn Elliott Waves

👉 wavetraders.com/academy/

Newsletter Sign up

👉 bit.ly/3FVPVzO

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

US Single STOCKS (FREE Access), FX, Crypto

👉Explore Our Services @ wavetraders.com/elliott-wave-plans/

Learn Elliott Waves

👉 wavetraders.com/academy/

Newsletter Sign up

👉 bit.ly/3FVPVzO

👉Explore Our Services @ wavetraders.com/elliott-wave-plans/

Learn Elliott Waves

👉 wavetraders.com/academy/

Newsletter Sign up

👉 bit.ly/3FVPVzO

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.