Since the start of 2025, the US dollar has established itself as the weakest major currency on the Forex market, falling by over 11% against a basket of major currencies. If we extend the reference period to include Donald Trump's return to the presidency, the slide even reaches 12%. This spectacular decline is no accident, but the fruit of a strategy deliberately implemented by the Trump administration. The stated aim is clear: to restore the commercial competitiveness of American companies, boost exports and restore the price advantage of products made in the USA. In this respect, the fall of the US dollar on the FX has fulfilled its mission. Can we now envisage a low point for the US dollar on the FX?

1) US dollar: the battle for currency competitiveness has been won for US companies, and this should have a positive impact on the second-quarter results of S&P 500 companies published this July

Indeed, the fall in the dollar translates directly into a much more favorable environment for exporting groups, particularly those which generate the bulk of their sales in Europe or Asia. The conversion of foreign currencies into dollars mechanically boosts revenues and margins. For many multinationals, this factor is likely to contribute to strong earnings releases in the second quarter, as the reporting period takes place this summer. Beyond the immediate impact on corporate accounts, the greenback's depreciation is also encouraging a more structural trend towards reindustrialization and support for domestic production. The effects of this dynamic can already be seen in certain manufacturing segments, which are regaining international market share. Nevertheless, this scenario is not without its downsides: a weak dollar makes imports more expensive, especially raw materials, and weighs on companies dependent on foreign inputs. On the whole, however, the exchange rate policy implemented since January represents a successful gamble by Donald Trump to boost American competitiveness.

2) Technical analysis: can we anticipate a low point for the US dollar?

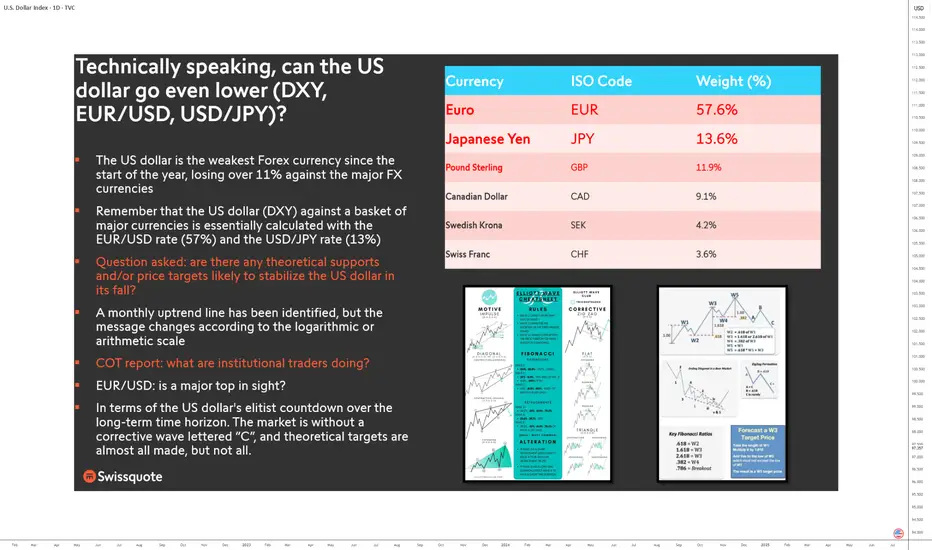

The crucial question today is whether the US dollar can pull back further, or whether a technical and fundamental bottom is emerging. From a technical analysis point of view, the DXY index, which measures the value of the dollar against a basket of currencies weighted 57% by the euro and 13% by the yen, remains anchored in a bearish trend. Some of the theoretical targets evoked by Elliottist analysis have been reached, but not all. However, long-term supports are visible on monthly charts: an uptrend line, particularly visible on the arithmetic scale, could act as a short-term stabilizer. Note that a potential bullish divergence is also possible on the weekly timeframe. But a bullish reversal pattern is still lacking to speak of a major low point, so let's not put the cart before the horse.

3) Scenarios and stakes for the rest of the year for the US dollar on FX

Beyond technical considerations, the persistent weakness of the US dollar acts as a revealing indicator of the tensions between trade policy and financial stability. On the one hand, a dollar under pressure is a powerful lever for supporting exports and consolidating US growth in an uncertain global context. On the other, a prolonged fall in the greenback fuels concerns about international confidence in dollar-denominated assets, and makes imports more expensive, which could rekindle inflationary pressures. This dilemma lies at the heart of the forthcoming trade-offs between the White House and the Federal Reserve.

For investors and companies exposed to Forex, several scenarios are conceivable. If the U.S. political agenda leads to a trade compromise, and if second-quarter publications confirm the robustness of the U.S. economy, the dollar is likely to find a technical floor around the supports identified on the DXY. In this scenario, a stabilization phase, or even a moderate rebound, could set in during the second half of the year. Conversely, if the trade stimulus policy is accompanied by a hardening of relations with Europe and China, or if the Fed is slow to react, the downward momentum could be prolonged.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

1) US dollar: the battle for currency competitiveness has been won for US companies, and this should have a positive impact on the second-quarter results of S&P 500 companies published this July

Indeed, the fall in the dollar translates directly into a much more favorable environment for exporting groups, particularly those which generate the bulk of their sales in Europe or Asia. The conversion of foreign currencies into dollars mechanically boosts revenues and margins. For many multinationals, this factor is likely to contribute to strong earnings releases in the second quarter, as the reporting period takes place this summer. Beyond the immediate impact on corporate accounts, the greenback's depreciation is also encouraging a more structural trend towards reindustrialization and support for domestic production. The effects of this dynamic can already be seen in certain manufacturing segments, which are regaining international market share. Nevertheless, this scenario is not without its downsides: a weak dollar makes imports more expensive, especially raw materials, and weighs on companies dependent on foreign inputs. On the whole, however, the exchange rate policy implemented since January represents a successful gamble by Donald Trump to boost American competitiveness.

2) Technical analysis: can we anticipate a low point for the US dollar?

The crucial question today is whether the US dollar can pull back further, or whether a technical and fundamental bottom is emerging. From a technical analysis point of view, the DXY index, which measures the value of the dollar against a basket of currencies weighted 57% by the euro and 13% by the yen, remains anchored in a bearish trend. Some of the theoretical targets evoked by Elliottist analysis have been reached, but not all. However, long-term supports are visible on monthly charts: an uptrend line, particularly visible on the arithmetic scale, could act as a short-term stabilizer. Note that a potential bullish divergence is also possible on the weekly timeframe. But a bullish reversal pattern is still lacking to speak of a major low point, so let's not put the cart before the horse.

3) Scenarios and stakes for the rest of the year for the US dollar on FX

Beyond technical considerations, the persistent weakness of the US dollar acts as a revealing indicator of the tensions between trade policy and financial stability. On the one hand, a dollar under pressure is a powerful lever for supporting exports and consolidating US growth in an uncertain global context. On the other, a prolonged fall in the greenback fuels concerns about international confidence in dollar-denominated assets, and makes imports more expensive, which could rekindle inflationary pressures. This dilemma lies at the heart of the forthcoming trade-offs between the White House and the Federal Reserve.

For investors and companies exposed to Forex, several scenarios are conceivable. If the U.S. political agenda leads to a trade compromise, and if second-quarter publications confirm the robustness of the U.S. economy, the dollar is likely to find a technical floor around the supports identified on the DXY. In this scenario, a stabilization phase, or even a moderate rebound, could set in during the second half of the year. Conversely, if the trade stimulus policy is accompanied by a hardening of relations with Europe and China, or if the Fed is slow to react, the downward momentum could be prolonged.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

This content is written by Vincent Ganne for Swissquote.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

This content is written by Vincent Ganne for Swissquote.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.