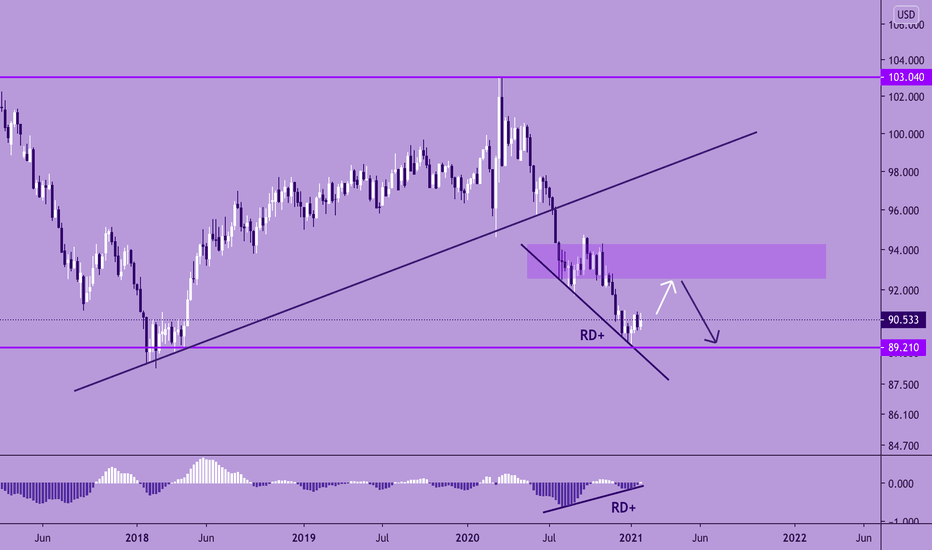

We have seen a big growth on dollar index for the last few weeks. In Weekly time frame, there is a downtrend which is in the correction phase. Price has approached to the supply zone and has retraced more than 50% of the downside move. There is also a negative hidden divergence between MACD and price peaks. In Daily chart, price has approached to the two resistance levels. There is a negative regular divergence between MACD and price peaks. As you see, although price has made a higher high, MACD made a lower high which means the downside pressure is coming soon. I expect a rejection from the resistance levels and a downside push around the marked areas. What do you think about US dollar?

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.