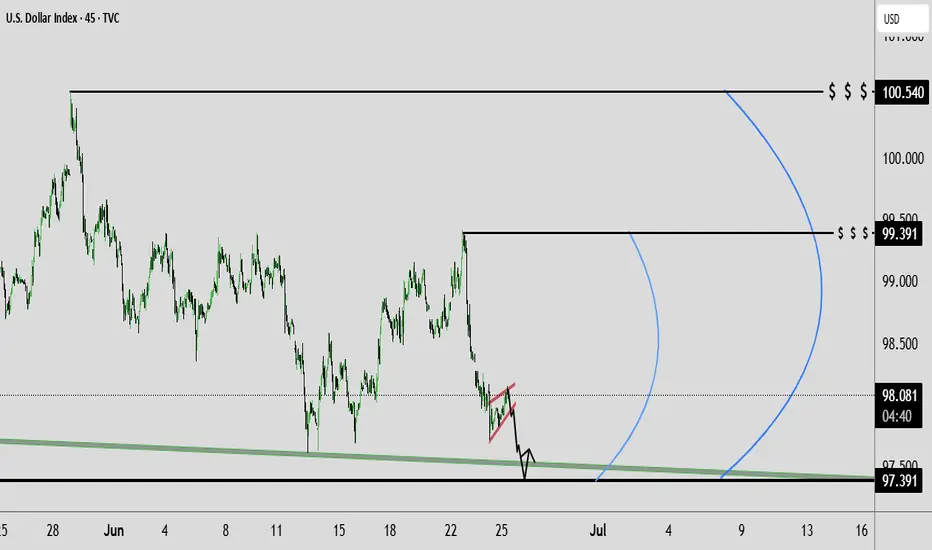

📉 Technical Outlook: Bearish Rising Wedge + Liquidity Sweep Setup

DXY The Dollar Index (DXY) is currently trading within a rising wedge pattern, typically a bearish structure. We're anticipating a fake breakdown, potential sweep of the key demand zone, followed by a reversal move targeting key highs.

DXY The Dollar Index (DXY) is currently trading within a rising wedge pattern, typically a bearish structure. We're anticipating a fake breakdown, potential sweep of the key demand zone, followed by a reversal move targeting key highs.

🔍 Key Technical Zones

📥 Demand Zone (Buy Area):

🔵 97.50 – 97.20 = Institutional accumulation + unfilled orders

🚫 Invalidation Level (Stop-Loss):

❌ 96.70 = Clean break below confirms full bearish continuation

🎯 Target Projections (Upside Levels):

🧠 Summary Setup:

🏛️ Fundamental Analysis – Powell’s Testimony Insights

Fed Chair Powell highlighted the following during his recent testimony:

🔄 “We’re not there yet on inflation” — Core services remain sticky

🛑 No immediate rate cuts — Growth is slowing but not crashing

🕰 Rate cuts likely postponed to Q4 2025

🔐 “Real rates are restrictive enough” = No more hikes expected

💡 Implication for DXY:

✅ Short-term bullish bias as higher U.S. yields remain attractive if rate cuts are delayed.

🌍 Macro Context Snapshot (as of June 25, 2025)

🇺🇸 US Disinflation: CPI & PCE easing, but not collapsing

🇪🇺 ECB Cut in June: Euro may weaken further

🇯🇵 BOJ Policy Unclear: USD/JPY likely volatile

🌐 Global Risk Appetite High: Volatility may return with geopolitical events

🔥 Watch This: Trade Tariff Narrative Heating Up

🚨 New U.S. Tariff Signals on Chinese tech and EU autos are resurfacing. This could:

Push inflation risk higher

Delay Fed’s easing timeline

Add support to USD short term as markets price in geopolitical tension and uncertainty

📌 Trading Strategy Recap:

Pine Script®

🔍 Key Technical Zones

📥 Demand Zone (Buy Area):

🔵 97.50 – 97.20 = Institutional accumulation + unfilled orders

🚫 Invalidation Level (Stop-Loss):

❌ 96.70 = Clean break below confirms full bearish continuation

🎯 Target Projections (Upside Levels):

- TP1: 99.00

- TP2: 100.00

- TP3: 101.04 (HTF swing high liquidity cleanout)

🧠 Summary Setup:

- Downtrend

- Rising wedge formation

- Sweep of 97.20 possible

- Watch for fakeout & reversal play toward 101.04

🏛️ Fundamental Analysis – Powell’s Testimony Insights

Fed Chair Powell highlighted the following during his recent testimony:

🔄 “We’re not there yet on inflation” — Core services remain sticky

🛑 No immediate rate cuts — Growth is slowing but not crashing

🕰 Rate cuts likely postponed to Q4 2025

🔐 “Real rates are restrictive enough” = No more hikes expected

💡 Implication for DXY:

✅ Short-term bullish bias as higher U.S. yields remain attractive if rate cuts are delayed.

🌍 Macro Context Snapshot (as of June 25, 2025)

🇺🇸 US Disinflation: CPI & PCE easing, but not collapsing

🇪🇺 ECB Cut in June: Euro may weaken further

🇯🇵 BOJ Policy Unclear: USD/JPY likely volatile

🌐 Global Risk Appetite High: Volatility may return with geopolitical events

🔥 Watch This: Trade Tariff Narrative Heating Up

🚨 New U.S. Tariff Signals on Chinese tech and EU autos are resurfacing. This could:

Push inflation risk higher

Delay Fed’s easing timeline

Add support to USD short term as markets price in geopolitical tension and uncertainty

📌 Trading Strategy Recap:

- Monitor wedge support near 97.20

- Look for fakeout/sweep and bullish reversal

- Target 99–101 zone on rebound

- Stay alert to Powell/Fed rhetoric + tariff news

If you find this analysis helpful, Like, Comment, and Follow for more DXY, gold, and macro trades!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.