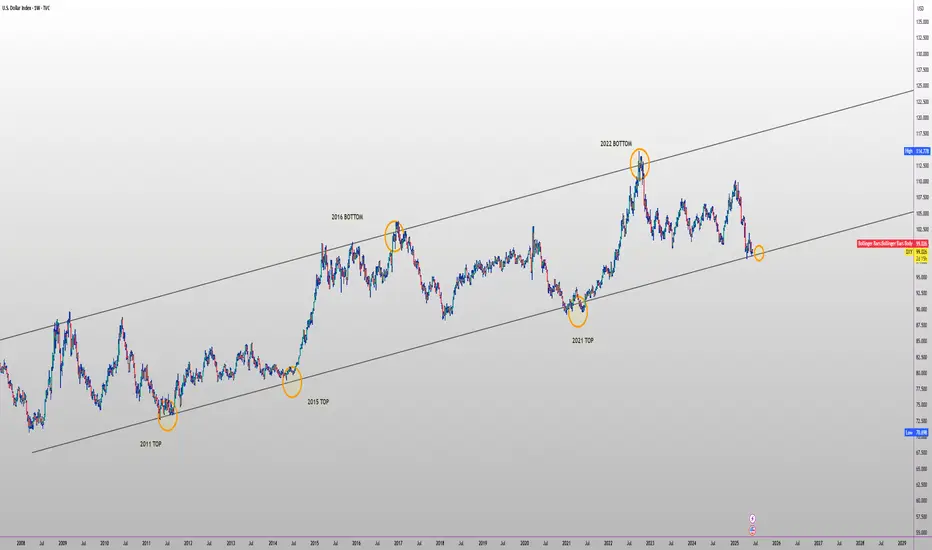

The U.S. Dollar Index (DXY) is probing 99-100—the same lower-rail support of its 14-year ascending channel that caught the 2011, 2015 and 2021 inflection points and launched the 2016 and 2022 dollar surges

macrotrends.net

forex.com

. History shows that when the dollar sinks beneath this zone (April 2017 and June 2020) Bitcoin has ripped 10-fold or more within months

cointelegraph.com

, whereas a sharp bounce from here (September 2022 above 110) coincided with BTC’s plunge to the cycle low near $16 k

forex.com

coindesk.com

. The macro backdrop currently favours at least a reflex rally: the Fed’s latest survey and dot-plot point to “higher-for-longer” policy with only two cuts pencilled in for 2025

reuters.com

finance.yahoo.com

, 10-year Treasuries still yield about 4.7 %—a near-cycle high that supports dollar carry demand

wsj.com

, and U.S. growth has just been revised up to 2.7 % for 2025 while euro-area PMIs languish in contraction and the ECB is already easing

mdm.com

ecb.europa.eu

. Add in lingering negative BTC-DXY correlation metrics

coindesk.com

and the structural importance of the psychologically charged 100 level, and this pivot becomes a practical timing gauge: a sustained break below 99 would clear the way for the next broad crypto bull-phase, whereas a confirmed dollar rebound warns that any exuberance in digital assets could mark a cyclical top.

macrotrends.net

forex.com

. History shows that when the dollar sinks beneath this zone (April 2017 and June 2020) Bitcoin has ripped 10-fold or more within months

cointelegraph.com

, whereas a sharp bounce from here (September 2022 above 110) coincided with BTC’s plunge to the cycle low near $16 k

forex.com

coindesk.com

. The macro backdrop currently favours at least a reflex rally: the Fed’s latest survey and dot-plot point to “higher-for-longer” policy with only two cuts pencilled in for 2025

reuters.com

finance.yahoo.com

, 10-year Treasuries still yield about 4.7 %—a near-cycle high that supports dollar carry demand

wsj.com

, and U.S. growth has just been revised up to 2.7 % for 2025 while euro-area PMIs languish in contraction and the ECB is already easing

mdm.com

ecb.europa.eu

. Add in lingering negative BTC-DXY correlation metrics

coindesk.com

and the structural importance of the psychologically charged 100 level, and this pivot becomes a practical timing gauge: a sustained break below 99 would clear the way for the next broad crypto bull-phase, whereas a confirmed dollar rebound warns that any exuberance in digital assets could mark a cyclical top.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.