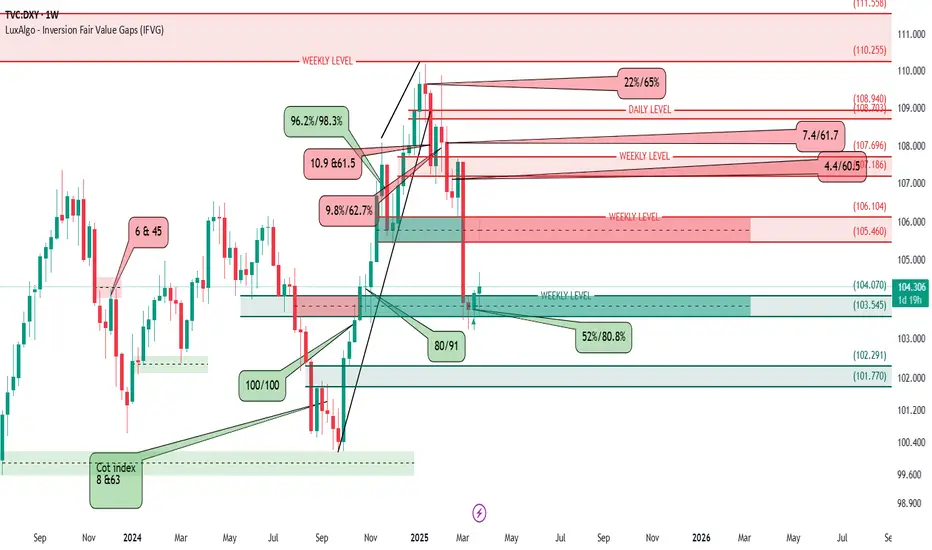

The DOllar has been in a decline over the last couple of months, We can see from tracking how the COT INDEX

COT Index in Forex for 6 months and 36 months

The 6-month and 36-month time frames typically refer to the historical analysis of COT data for specific currency pairs, providing insights into:

6-month COT Index:

This reflects the trading positions over the past 6 months.

It shows the trends in how market participants (e.g., hedge funds or commercial traders) have been positioned recently.

Traders typically use this shorter time frame to gauge recent trends and near-term sentiment.

A higher COT Index value indicates that speculators have a larger net long position, suggesting potential bullish sentiment, and vice versa for a lower COT Index.

36-month COT Index:

This reflects the trading positions over the past 3 years.

It provides a longer-term view of trader positioning, helping to identify historical trends and market cycles.

A higher 36-month COT Index suggests persistent bullish positioning over the longer term,

we can see the Dollar has been bought up at WEEKLY Demand, we will start looking for a shift to buy the Dollar on a daily chart.

COT Index in Forex for 6 months and 36 months

The 6-month and 36-month time frames typically refer to the historical analysis of COT data for specific currency pairs, providing insights into:

6-month COT Index:

This reflects the trading positions over the past 6 months.

It shows the trends in how market participants (e.g., hedge funds or commercial traders) have been positioned recently.

Traders typically use this shorter time frame to gauge recent trends and near-term sentiment.

A higher COT Index value indicates that speculators have a larger net long position, suggesting potential bullish sentiment, and vice versa for a lower COT Index.

36-month COT Index:

This reflects the trading positions over the past 3 years.

It provides a longer-term view of trader positioning, helping to identify historical trends and market cycles.

A higher 36-month COT Index suggests persistent bullish positioning over the longer term,

we can see the Dollar has been bought up at WEEKLY Demand, we will start looking for a shift to buy the Dollar on a daily chart.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.