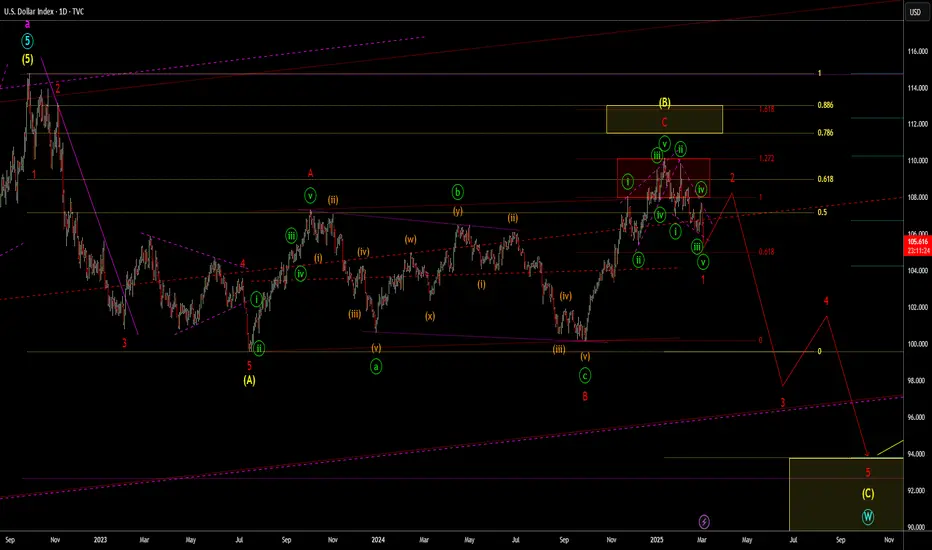

This is my current Elliott Wave count for the DXY Dollar index. I have a couple of variations which I will share but this one sees a decline starting with a leading diagonal in red wave 1 which is close to completion. May see a pull back in red 2 before a strong move lower in 3. The alternative is a nesting 1,2,1,2. If that's the case then a strong decline could continue from here.

Note

20/03/2025 DXY UpdateSince the last outlook DXY has continued lower and is currently potentially consolidating in wave iv in green. Im currently viewing the correction as a (w)(x)(y) in orange, it has made a measured move target and im looking for price to break down in a continuation in wave v in green, the lower of the two green target zones would be nice 😊.

If price doesn’t head lower from here then wave count invalidation is 106.126, but in fairness if it goes much higher than 105 I would start to question whether the chart is currently making green wave iv.

Note

21/03/2025 DXY UpdateSince the last outlook DXY has continued lower and is currently potentially consolidating in wave iv in green. I've adjusted the current correction to an (a)(b)(c) in orange due to the final wave progressing in 5 sub waves. The chart has pushed slightly past the measured move target and made an expanded flat correction. I’m looking for price to break down in a continuation in wave v in green, the lower of the two green target zones would be nice 😊.

If price doesn’t head lower from here then wave count invalidation is 106.126, but in fairness if it goes much higher than 105 I would start to question whether the chart is currently making green wave iv.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.