Long

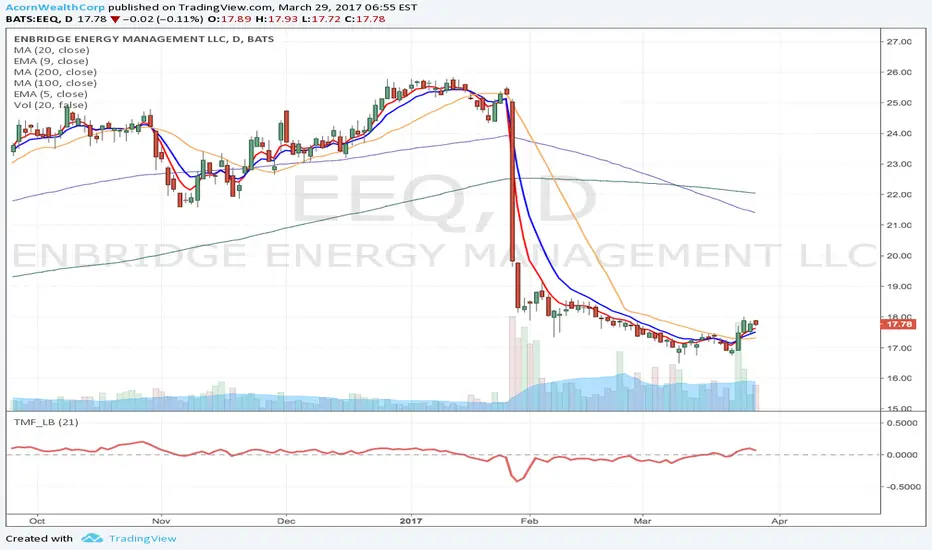

EEQ - Fallen angel type Momentum Long at the break of $18

EEQ is an energy stock that seems forming a fallen angel pattern recently. On the other side Energy sector seems breaking out of a downward channel & getting ready for a short term rally. Along with the Sectorial strength, EEQ seems an interesting Long set up.

* Trade Criteria *

Date First Found- March , 2017

Pattern/Why- Fallen angel

Entry Target Criteria- Break of $18 (Further update coming)

Exit Target Criteria- Momentum

Stop Loss Criteria- (Further update coming)

Please check back for Trade updates. (Note: Trade update is little delayed here.)

* Trade Criteria *

Date First Found- March , 2017

Pattern/Why- Fallen angel

Entry Target Criteria- Break of $18 (Further update coming)

Exit Target Criteria- Momentum

Stop Loss Criteria- (Further update coming)

Please check back for Trade updates. (Note: Trade update is little delayed here.)

Trade active

March 30th - Went upward & hit our entry criteria. Now wait & see.Note

April 4th - closed above its 50 day SMA and it appears skies are clear. Looking good.Note

April 11th- Seems rolling over, however still holding above Entry criteria. Updating stop loss criteria to $17.41.Like what you see? Get full access to our 3X daily members only video/txt alerts & live trading room at smartmoneytrading.com/now

Check out some of our free video examples @ smartmoneytrading.com/insights/

Check out some of our free video examples @ smartmoneytrading.com/insights/

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Like what you see? Get full access to our 3X daily members only video/txt alerts & live trading room at smartmoneytrading.com/now

Check out some of our free video examples @ smartmoneytrading.com/insights/

Check out some of our free video examples @ smartmoneytrading.com/insights/

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.