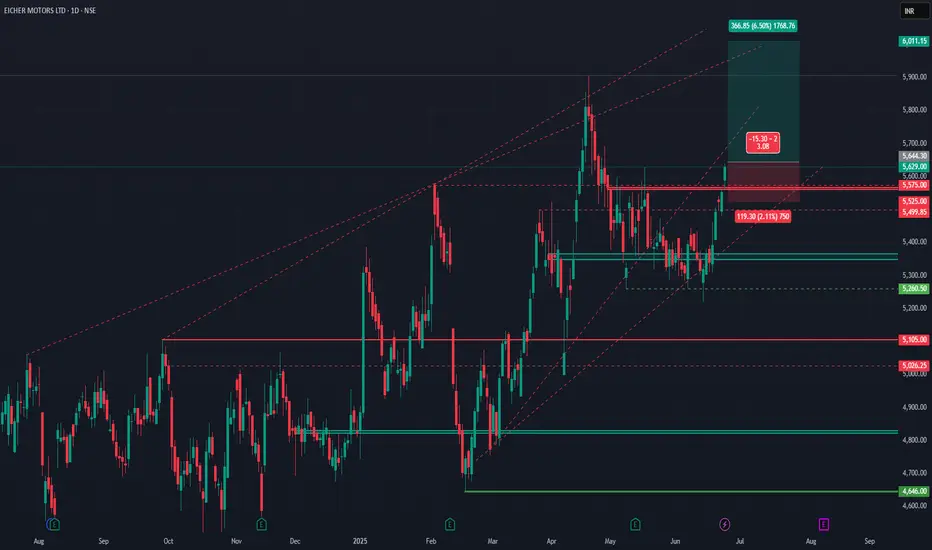

Eicher Motors breaks out of resistance with volume eyes set on the upper trendline near 6011.

After weeks of consolidation between 5250 and 5575, Eicher Motors has finally broken out of its sideways zone with strong follow-through and bullish intent.

Price not only cleared horizontal resistance but also pushed above the red supply zone around 5645, confirming buyer dominance.

This breakout aligns with the broader ascending channel that has been intact since March. The structure now hints at a potential continuation toward the upper channel line, projected near 6011 level highlighted risk-reward 1:3,

From a fundamental lens, Eicher has seen improved export numbers and rising traction in the premium segment, especially with Royal Enfield's increasing demand in overseas markets. If macro sentiment remains supportive, this technical breakout could be backed by earnings momentum in the upcoming quarters.

On the flip side, a failure to sustain above ₹5575 may drag the price back to test the breakout zone around ₹5430–₹5250.

Like, comment your thoughts, and share this post

Explore more stock ideas on the right hand side your feedback means a lot to me!

Disclaimer: This post is for educational purposes only and should not be considered a buy/sell recommendation.

After weeks of consolidation between 5250 and 5575, Eicher Motors has finally broken out of its sideways zone with strong follow-through and bullish intent.

Price not only cleared horizontal resistance but also pushed above the red supply zone around 5645, confirming buyer dominance.

This breakout aligns with the broader ascending channel that has been intact since March. The structure now hints at a potential continuation toward the upper channel line, projected near 6011 level highlighted risk-reward 1:3,

From a fundamental lens, Eicher has seen improved export numbers and rising traction in the premium segment, especially with Royal Enfield's increasing demand in overseas markets. If macro sentiment remains supportive, this technical breakout could be backed by earnings momentum in the upcoming quarters.

On the flip side, a failure to sustain above ₹5575 may drag the price back to test the breakout zone around ₹5430–₹5250.

Like, comment your thoughts, and share this post

Explore more stock ideas on the right hand side your feedback means a lot to me!

Disclaimer: This post is for educational purposes only and should not be considered a buy/sell recommendation.

Note

Re-entered with days low LOW RISK? PLAY HUGE!

Follow for latest updates and valuable financial content

✆ t.me/iVishalPal

Yt: t.ly/frb4G

LinkedIn: t.ly/g_SjB

WhatsApp: t.ly/_6T9j

TradingView: t.ly/-UGgZ

Telegram: t.me/traderpulseyt

Follow for latest updates and valuable financial content

✆ t.me/iVishalPal

Yt: t.ly/frb4G

LinkedIn: t.ly/g_SjB

WhatsApp: t.ly/_6T9j

TradingView: t.ly/-UGgZ

Telegram: t.me/traderpulseyt

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

LOW RISK? PLAY HUGE!

Follow for latest updates and valuable financial content

✆ t.me/iVishalPal

Yt: t.ly/frb4G

LinkedIn: t.ly/g_SjB

WhatsApp: t.ly/_6T9j

TradingView: t.ly/-UGgZ

Telegram: t.me/traderpulseyt

Follow for latest updates and valuable financial content

✆ t.me/iVishalPal

Yt: t.ly/frb4G

LinkedIn: t.ly/g_SjB

WhatsApp: t.ly/_6T9j

TradingView: t.ly/-UGgZ

Telegram: t.me/traderpulseyt

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.