I’ve been actively trading

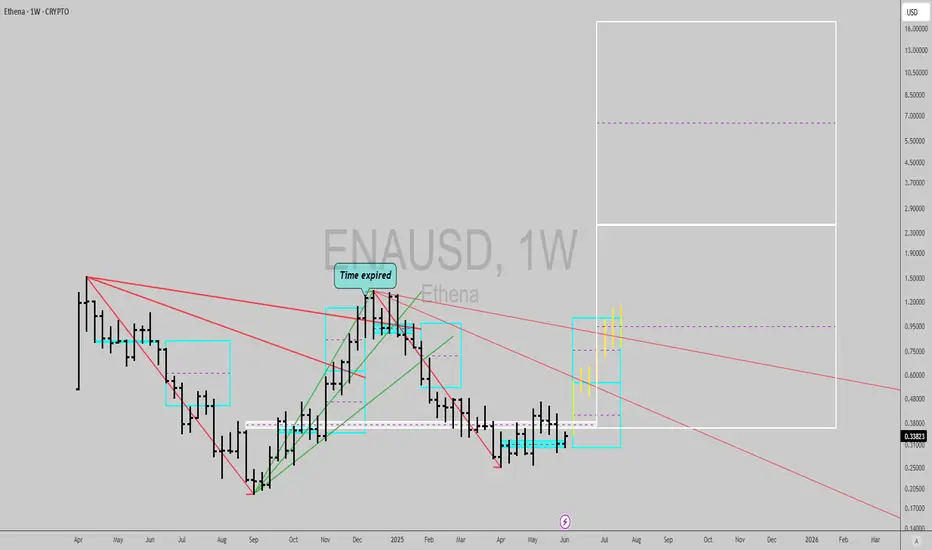

Now, a larger weekly signal might be on the horizon, which matches

Why

A Quick Technical Overview of Ethena

Ethena is a synthetic dollar protocol on Ethereum, offering USDe and USDtb, crypto and treasury-bond backed stablecoin alternatives to fiat-based stablecoins like USDT or USDC.

USDe maintains its dollar peg through crypto assets paired with short futures to hedge volatility and earn the future funding rate (when positive) as revenue for the protocol, providing a decentralized, globally accessible savings tool called the "Internet Bond."

USDtb is backed by high quality short duration treasury assets including BlackRock's BUIDL fund exposure.

The

Bullish Catalysts and News

*Airdrop farming for holders of

*On November 15, 2024, Ethena agreed to share a portion of its approximately $200 million in protocol revenues with tokenholders, which includes buying back its native ENA tokens. This initiative is part of a broader trend among DeFi protocols to enhance token value through revenue-sharing mechanisms like buybacks and fee switches. Ethena’s revenue, primarily from minting, redemption, and yield-generating mechanisms tied to its USDe stablecoin, supports this program, with the protocol recently achieving a daily revenue of $3.28 million. Additionally, Ethena plans to enable a fee switch to share revenue directly with ENA stakers once certain conditions are met, further aligning tokenholder incentives with protocol growth.

Best of luck!

Cheers,

Ivan Labrie.

🔒Want to dive deeper? Check out my paid services below🔒

linktr.ee/ivanlabrie

linktr.ee/ivanlabrie

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔒Want to dive deeper? Check out my paid services below🔒

linktr.ee/ivanlabrie

linktr.ee/ivanlabrie

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.