EOS Education: Range Trading

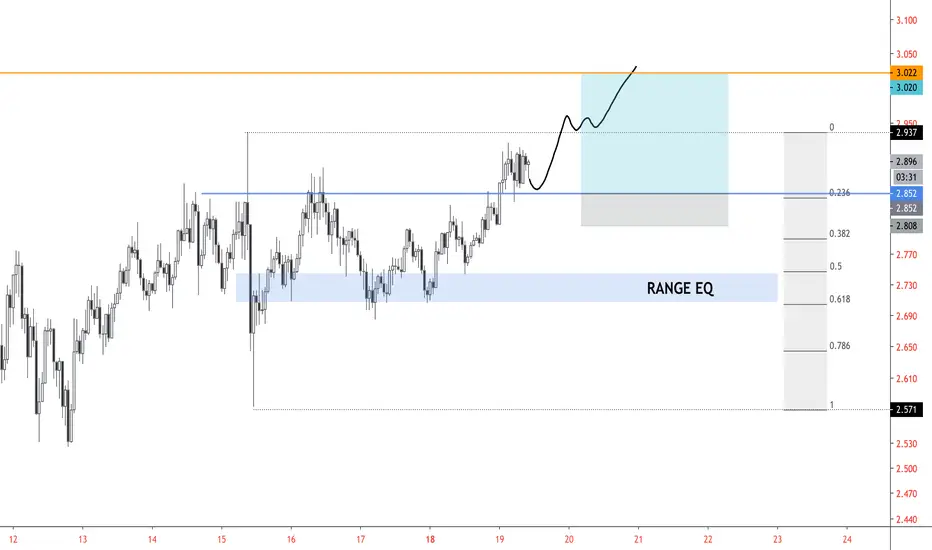

Extreme wicks in quick succession, such as a blow-off top and a quick dump, establish a range.

1. Identify range extremes (high/low) at the ends of the candle wicks

2. Plot the Fibonacci levels

3. Important levels to mark are around the 0.25, 0.5, 0.75

- 0.75 tends to be the first Higher Low (HL)

- 0.5-0.618 is the Range Equilibrium (Range EQ) and price tends to test it as support/resistance numerous times.

- 0.25 tends to be the first rejection after dumping from range high

HOW OT PLAY RANGE:

- after dump from range high to range low (range established), look to long after reclaiming the 0.75 as support.

- If price rejects Range EQ with a sharp bearish engulfing candle, short.

- If price breaks Range EQ and retests as support, long

- If price bounced from Range EQ, look to take profits at 0.25

- If price rejects 0.25 with bearish engulfing candle, short

RANGE BREAKOUTS:

- Often ranges will exhibit "fakeouts" to either side. After establishing the range low, price could bounce and make a Lower High around Range EQ. Typically price will then return to range low, wick slightly below and then immediately snap back into the range. This is a "false breakdown"

- The inverse is true as well. Price could hold range EQ as support and then pump hard and breakout of the range high, wick beyond it and fail to hold range high as support. The price will then return to the range, thus creating a "false breakout"

- This is important as fakeouts tend to shake out the weak hands. When it breaks range low, stop losses at range low are often hit thus creating a liquidation dump.

- Upon breaking range high, many novice traders experience FOMO and market long. They get liquidated because they're stop losses are oftetn placed at range high at this point, so when price fails to hold range high as support they get liquidated causing a massive dump back into the range.

SUMMARY:

- Watch Fibonacci levels

- Don't FOMO the breakouts. Wait for clear retests of range extremes as support/resistance before entering a trade.

- In EOS right now, a quick scalp could be made if we hold 0.25 as support.

- Otherwise, look to long a successful retest of range high as support before longing.

1. Identify range extremes (high/low) at the ends of the candle wicks

2. Plot the Fibonacci levels

3. Important levels to mark are around the 0.25, 0.5, 0.75

- 0.75 tends to be the first Higher Low (HL)

- 0.5-0.618 is the Range Equilibrium (Range EQ) and price tends to test it as support/resistance numerous times.

- 0.25 tends to be the first rejection after dumping from range high

HOW OT PLAY RANGE:

- after dump from range high to range low (range established), look to long after reclaiming the 0.75 as support.

- If price rejects Range EQ with a sharp bearish engulfing candle, short.

- If price breaks Range EQ and retests as support, long

- If price bounced from Range EQ, look to take profits at 0.25

- If price rejects 0.25 with bearish engulfing candle, short

RANGE BREAKOUTS:

- Often ranges will exhibit "fakeouts" to either side. After establishing the range low, price could bounce and make a Lower High around Range EQ. Typically price will then return to range low, wick slightly below and then immediately snap back into the range. This is a "false breakdown"

- The inverse is true as well. Price could hold range EQ as support and then pump hard and breakout of the range high, wick beyond it and fail to hold range high as support. The price will then return to the range, thus creating a "false breakout"

- This is important as fakeouts tend to shake out the weak hands. When it breaks range low, stop losses at range low are often hit thus creating a liquidation dump.

- Upon breaking range high, many novice traders experience FOMO and market long. They get liquidated because they're stop losses are oftetn placed at range high at this point, so when price fails to hold range high as support they get liquidated causing a massive dump back into the range.

SUMMARY:

- Watch Fibonacci levels

- Don't FOMO the breakouts. Wait for clear retests of range extremes as support/resistance before entering a trade.

- In EOS right now, a quick scalp could be made if we hold 0.25 as support.

- Otherwise, look to long a successful retest of range high as support before longing.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.