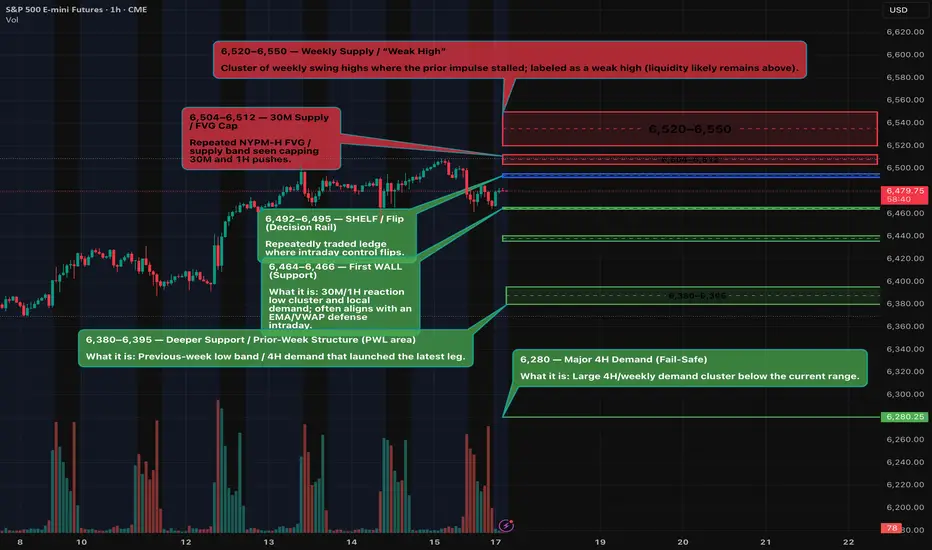

Context (W/D/4H/1H/30M): ES is consolidating just under 6,500. Price is boxed roughly 6,466 ↔ 6,504/12 with a cluster of highs above and recurring demand tests below.

Key Levels (zones, not single ticks):

Resistance: 6,504–6,512 (near-term lid). Above that: 6,520–6,550 (weekly supply/“weak high”).

Decision level: 6,492–6,495 (where control often flips intraday).

Supports: 6,464–6,466 (first support) → 6,436–6,440 → 6,380–6,395 (deeper support).

How to read it:

Bull path: A firm break and hold above 6,504 favors a push toward 6,520 → 6,535 → 6,550.

Bear path: Failure at 6,495 or a clean break below 6,464 opens 6,440 → 6,390.

If price stays between 6,466 and 6,504, expect range behavior until a catalyst pushes it out.

Scenarios (next week):

Range continues: Chop between 6,466–6,512 until mid-week events.

Upside break: Hold above 6,504 → test 6,520–6,550 (watch for reaction there).

Downside break: Lose 6,464 with momentum → 6,440, then 6,390 if pressure persists.

Key events (ET):

Wed: Federal Reserve meeting minutes (afternoon).

Thu: Weekly claims; flash PMIs; existing home sales (morning block).

Thu–Sat: Jackson Hole economic symposium (watch for policy remarks).

Notes: Levels are zones and may see initial reactions before acceptance or rejection. This post is for market commentary/education only.

Key Levels (zones, not single ticks):

Resistance: 6,504–6,512 (near-term lid). Above that: 6,520–6,550 (weekly supply/“weak high”).

Decision level: 6,492–6,495 (where control often flips intraday).

Supports: 6,464–6,466 (first support) → 6,436–6,440 → 6,380–6,395 (deeper support).

How to read it:

Bull path: A firm break and hold above 6,504 favors a push toward 6,520 → 6,535 → 6,550.

Bear path: Failure at 6,495 or a clean break below 6,464 opens 6,440 → 6,390.

If price stays between 6,466 and 6,504, expect range behavior until a catalyst pushes it out.

Scenarios (next week):

Range continues: Chop between 6,466–6,512 until mid-week events.

Upside break: Hold above 6,504 → test 6,520–6,550 (watch for reaction there).

Downside break: Lose 6,464 with momentum → 6,440, then 6,390 if pressure persists.

Key events (ET):

Wed: Federal Reserve meeting minutes (afternoon).

Thu: Weekly claims; flash PMIs; existing home sales (morning block).

Thu–Sat: Jackson Hole economic symposium (watch for policy remarks).

Notes: Levels are zones and may see initial reactions before acceptance or rejection. This post is for market commentary/education only.

If you want to contact me here is my Discord channel discord.gg/wPHfYgv892

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

If you want to contact me here is my Discord channel discord.gg/wPHfYgv892

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.