Check out the video for a complete walk through of the daily market analysis of S&P 500 futures (ES) for 7 May 2020 trading session. In this video, I am going to show you the market recap on yesterday's session on Tuesday including trade review in M3, the bias going forward, the key levels to pay attention to, and the potential setup for the US session later.

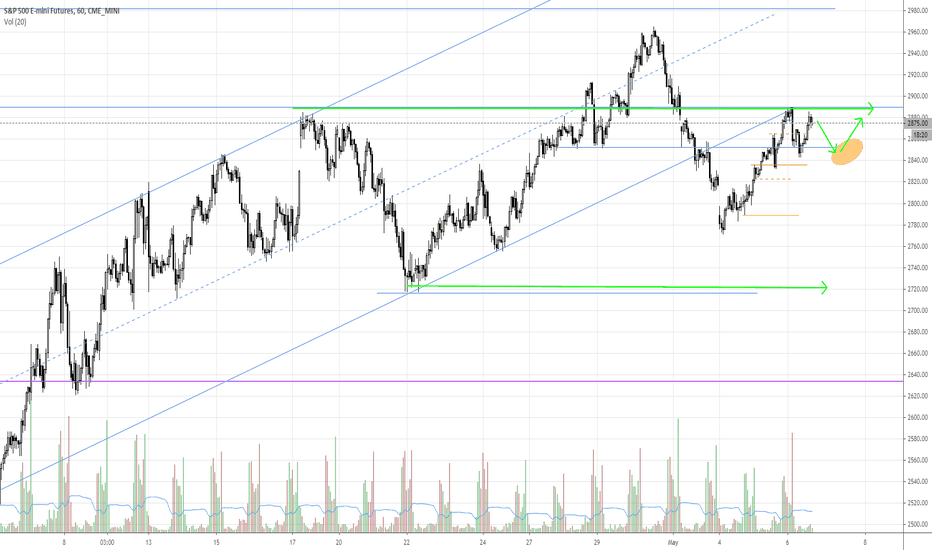

6 May 2020 recap - S&P 500 tested the high near 2890 and started a reaction towards the support level at 2850, which was mentioned in my video yesterday. The rally off the support was mediocre. There was no strength for the subsequent lifts from the support level at 2850, which lead to a sell off below the level. Watch my market analysis video from yesterday if you haven't so that you can relate to the trade review presented in today's video:

So far, S&P 500 still trading within a range between 2825-2890. Commitment above 2890 should see a test of 2960, which is the swing high. A broke below 2830 could see S&P 500 to test the lower levels at 2770–2800.

Bias - neutral (day trading); Up (swing trading)

Key levels - Resistance 2880–2900, 2960 (Swing high); Support: 2840-2850, 2820

Potential setup - a test and reversal from 2880–2900 could present a short entry. Else a bounce from 2840-2850 could be a entry for long. The targets for take profit are based on the key levels (plus day high, low from previous day, non-RTH high, low, etc…).

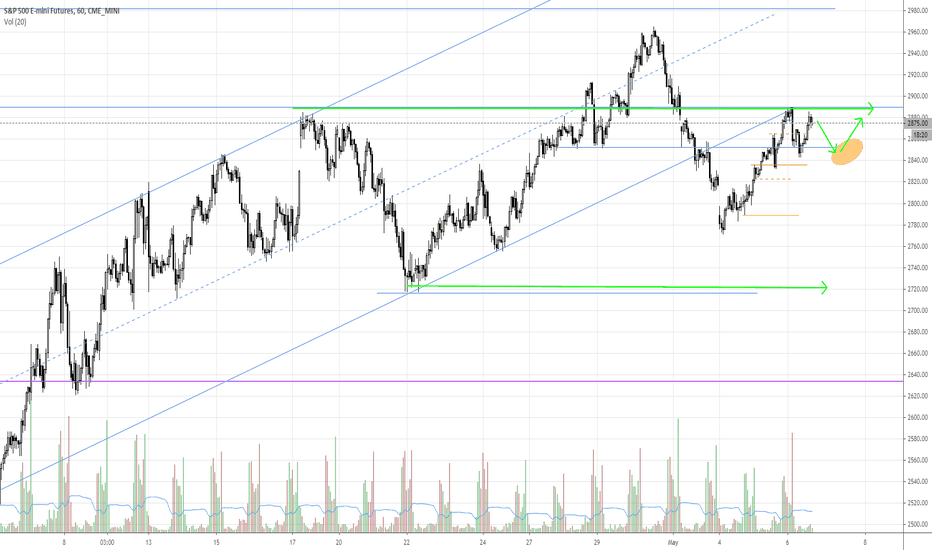

6 May 2020 recap - S&P 500 tested the high near 2890 and started a reaction towards the support level at 2850, which was mentioned in my video yesterday. The rally off the support was mediocre. There was no strength for the subsequent lifts from the support level at 2850, which lead to a sell off below the level. Watch my market analysis video from yesterday if you haven't so that you can relate to the trade review presented in today's video:

So far, S&P 500 still trading within a range between 2825-2890. Commitment above 2890 should see a test of 2960, which is the swing high. A broke below 2830 could see S&P 500 to test the lower levels at 2770–2800.

Bias - neutral (day trading); Up (swing trading)

Key levels - Resistance 2880–2900, 2960 (Swing high); Support: 2840-2850, 2820

Potential setup - a test and reversal from 2880–2900 could present a short entry. Else a bounce from 2840-2850 could be a entry for long. The targets for take profit are based on the key levels (plus day high, low from previous day, non-RTH high, low, etc…).

Find Out the Top 3 Unknown Stocks Ready to Soar: Click my website below

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Find Out the Top 3 Unknown Stocks Ready to Soar: Click my website below

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.